Chevron 2004 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHEVRONTEXACO CORPORATION 2004 ANNUAL REPORT 75

tainedaperformanceelementthathadtobesatisfiedinorderfor

alloraspecifiedportionofthesharestovest.Uponthemerger,

allrestrictedsharesbecamevestedandconvertedtoChevron-

Texacosharesatthemergerexchangeratioof0.77.Apartfrom

therestoredoptions,nofurtherawardsmaybegrantedunderthe

formerTexacoplans.Noamountfortheseplanswaschargedto

compensationexpensein2004,2003or2002.

Thefairmarketvalueofeachstockoptiongrantedis

estimatedonthedateofgrantunderFASNo.123usingthe

Black-Scholesoption-pricingmodelwiththefollowingweighted-

averageassumptions:

2003 2002

ChevronTexaco plans:

Expected life in years 7 7

Risk-free interest rate 3.1% 4.6%

Volatility 19.3% 21.6%

Dividend yield 3.5% 3.0%

Texaco plans:

Expected life in years 2 2

Risk-free interest rate 1.7% 1.6%

Volatility 22.0% 24.1%

Dividend yield 3.9% 3.1%

TheBlack-Scholesweighted-averagefairvalueoftheChevron-

Texacooptionsgrantedduring2004,2003and2002was$7.14,

$5.51and$9.30pershare,respectively,andtheweighted-average

fairvalueoftheSIPrestoredoptionsgrantedduring2004,2003

and2002was$4.00,$4.03and$5.15pershare,respectively.

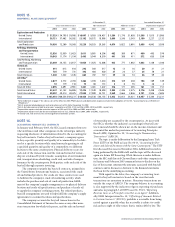

Asummaryofthestatusofstockoptionsawardedunder

thecompany’sLTIP,aswellastheformerTexacoplans,for2004,

2003and2002follows:

Options Weighted-Average

(thousands) Exercise Price

Outstanding at December 31, 2001 45,240 $ 40.57

Granted 6,582 43.07

Exercised (3,636) 36.51

Restored 2,548 44.69

Forfeited (1,490) 44.05

Outstanding at December 31, 2002 49,244 $ 41.33

Granted 9,320 36.70

Exercised (1,458) 25.07

Restored 120 41.35

Forfeited (1,966) 42.70

Outstanding at December 31, 2003 55,260 $ 40.93

Granted 9,164 47.06

Exercised (14,308) 39.87

Restored 4,814 48.84

Forfeited (578) 43.94

Outstanding at December 31, 2004 54,352 $ 42.90

Exercisable at December 31

2002 42,890 $ 41.07

2003 42,554 $ 41.62

2004 35,547 $ 42.15

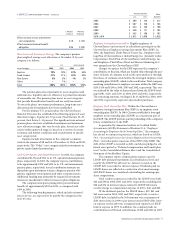

Thefollowingtablesummarizesinformationaboutstock

optionsoutstanding,includingthosefromformerTexacoplans,

atDecember31,2004:

Options Outstanding Options Exercisable

Weighted-

Average Weighted- Weighted-

Number Remaining Average Number Average

Range of Outstanding Contractual Exercise Exercisable Exercise

Exercise Prices (thousands) Life (years) Price (thousands) Price

$ 15 to $ 25 513 0.55 $ 24.09 513 $ 24.09

25 to 35 875 1.86 32.94 875 32.94

35 to 45 33,061 6.13 40.97 26,031 41.71

45 to 55 19,846 6.54 47.02 8,128 45.69

55 to 65 57 2.41 55.21 – –

$ 15 to $ 65 54,352 6.15 $ 42.90 35,547 $ 42.15

IncomeTaxes Thecompanyestimatesitsincometaxexpense

andliabilitiesannually.Theseliabilitiesgenerallyarenotfinal-

izedwiththeindividualtaxingauthoritiesuntilseveralyears

aftertheendoftheannualperiodforwhichincometaxeshave

beenestimated.TheU.S.federalincometaxliabilitieshavebeen

settledthrough1996forChevronTexaco(formerlyChevron

Corporation),1997forChevronTexacoGlobalEnergyInc.(for-

merlyCaltex)and1991forTexacoInc.Californiafranchisetax

liabilitieshavebeensettledthrough1991forChevronand1987

forTexaco.Settlementofopentaxyears,aswellastaxissuesin

othercountrieswherethecompanyconductsitsbusinesses,is

notexpectedtohaveamaterialeffectontheconsolidatedfinan-

cialpositionorliquidityofthecompany,andintheopinion

ofmanagement,adequateprovisionhasbeenmadeforincome

andfranchisetaxesforallyearsunderexaminationorsubjectto

futureexamination.

Guarantees AtDecember31,2004,thecompanyanditssubsid-

iariesprovided,eitherdirectlyorindirectly,guaranteesof$963

fornotesandothercontractualobligationsofaffiliatedcompa-

niesand$130forthirdparties,asdescribedbymajorcategory

below.Therearenoamountsbeingcarriedasliabilitiesforthe

company’sobligationsundertheseguarantees.

Ofthe$963guaranteesprovidedtoaffiliates,$774relateto

borrowingsforcapitalprojectsorgeneralcorporatepurposes.

Theseguaranteeswereundertakentoachievelowerinterest

ratesandgenerallycovertheconstructionperiodofthecapital

projects.Approximately90percentoftheamountsguaranteed

willexpireby2009,withtheremainingguaranteesexpiringby

theendof2015.Underthetermsoftheguarantees,thecompany

wouldberequiredtofulfilltheguaranteeshouldanaffiliatebein

defaultofitsloanterms,generallyforthefullamountsdisclosed.

Therearenorecourseprovisions,andnoassetsareheldascollat-

eralfortheseguarantees.The$189balanceofthe$963represents

obligationsinconnectionwithpricingofpowerpurchaseagree-

mentsforcertainofthecompany’scogenerationaffiliates.Under

thetermsoftheseguarantees,thecompanymayberequired

tomakepaymentsundercertainconditionsiftheaffiliatesdo

notperformundertheagreements.Therearenoprovisionsfor

recoursetothirdparties,andnoassetsareheldascollateralfor

thesepricingguarantees.

Guaranteesof$130havebeenprovidedtothirdparties,

includingapproximately$40ofconstructionloanstohostgov-

ernmentsofcertainofthecompany’sinternationalupstream

operations.Theremainingguaranteesof$90wereprovided

STOCK OPTIONS – Continued