Chevron 2004 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHEVRONTEXACO CORPORATION 2004 ANNUAL REPORT 55

oneormoreofthefollowing:(1)decisionsonadditionalmajor

capitalexpenditures,(2)theresultsofadditionalexploratory

wellsthatareunderwayorfirmlyplanned,and(3)securingfinal

regulatoryapprovalsfordevelopment.Otherwise,wellcostsare

expensedifadeterminationastowhetherprovedreserveswere

foundcannotbemadewithinoneyearfollowingcompletionof

drilling.Allotherexploratorywellsandcostsareexpensed.Refer

toNote21onpage69foradditionaldiscussionofaccountingfor

suspendedexploratorywellcosts.

Long-livedassetstobeheldandused,includingproved

crudeoilandnaturalgasproperties,areassessedforpossible

impairmentbycomparingtheircarryingvalueswiththeirasso-

ciatedundiscountedfuturenetbefore-taxcashflows.Events

thatcantriggerassessmentsforpossibleimpairmentsinclude

write-downsofprovedreservesbasedonfieldperformance,

significantdecreasesinthemarketvalueofanasset,significant

changeintheextentormannerofuseoforaphysicalchangein

anasset,andamore-likely-than-notexpectationthatalong-lived

assetorassetgroupwillbesoldorotherwisedisposedofsignifi-

cantlysoonerthantheendofitspreviouslyestimatedusefullife.

Impairedassetsarewrittendowntotheirestimatedfairvalues,

generallytheirdiscountedfuturenetbefore-taxcashflows.For

provedcrudeoilandnaturalgaspropertiesintheUnitedStates,

thecompanygenerallyperformstheimpairmentreviewonan

individualfieldbasis.OutsidetheUnitedStates,reviewsareper-

formedonacountry,concessionorfieldbasis,asappropriate.

Globallyintherefining,marketing,transportationandchemical

areas,impairmentreviewsaregenerallydoneonarefinery,plant,

marketingareaormarketingassetsbycountrybasis.Impairment

amountsarerecordedasincremental“Depreciation,depletion

andamortization”expense.

Long-livedassetsthatareheldforsaleareevaluatedforpos-

sibleimpairmentbycomparingthecarryingvalueoftheassetwith

itsfairvaluelessthecosttosell.Ifthenetbookvalueexceedsthe

fairvaluelesscosttosell,theassetisconsideredimpairedand

adjustedtothelowervalue.

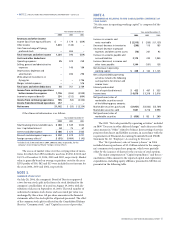

EffectiveJanuary1,2003,thecompanyimplementedFinan-

cialAccountingStandardsBoardStatementNo.143,“Accounting

forAssetRetirementObligations(FAS143),”inwhichthefair

valueofaliabilityforanassetretirementobligationisrecorded

asanassetandaliabilitywhenthereisalegalobligationassoci-

atedwiththeretirementofalong-livedassetandtheamountcan

bereasonablyestimated.ReferalsotoNote25onpage77relating

toassetretirementobligations,whichincludesadditionalinfor-

mationonthecompany’sadoptionofFAS143.Previously,for

crudeoil,naturalgasandcoalproducingproperties,aprovision

wasmadethroughdepreciationexpenseforanticipatedabandon-

mentandrestorationcostsattheendoftheproperty’susefullife.

Depreciationanddepletionofallcapitalizedcostsofproved

crudeoilandnaturalgasproducingproperties,exceptmineral

interests,areexpensedusingtheunit-of-productionmethodby

individualfieldastheproveddevelopedreservesareproduced.

Depletionexpensesforcapitalizedcostsofprovedmineralinter-

estsarerecognizedusingtheunit-of-productionmethodby

individualfieldastherelatedprovedreservesareproduced.Peri-

odicvaluationprovisionsforimpairmentofcapitalizedcostsof

unprovedmineralinterestsareexpensed.

Depreciationanddepletionexpensesforcoalassetsare

determinedusingtheunit-of-productionmethodastheproved

reservesareproduced.Thecapitalizedcostsofallotherplant

andequipmentaredepreciatedoramortizedovertheirestimated

usefullives.Ingeneral,thedeclining-balancemethodisusedto

depreciateplantandequipmentintheUnitedStates;thestraight-

linemethodgenerallyisusedtodepreciateinternationalplant

andequipmentandtoamortizeallcapitalizedleasedassets.

Gainsorlossesarenotrecognizedfornormalretirementsof

properties,plantandequipmentsubjecttocompositegroupamor-

tizationordepreciation.Gainsorlossesfromabnormalretirements

arerecordedasexpenses,andfromsalesas“Otherincome.”

Expendituresformaintenance,repairsandminorrenewalsto

maintainfacilitiesinoperatingconditionaregenerallyexpensed

asincurred.Majorreplacementsandrenewalsarecapitalized.

EnvironmentalExpenditures Environmentalexpendituresthat

relatetoongoingoperationsortoconditionscausedbypast

operationsareexpensed.Expendituresthatcreatefuturebenefits

orcontributetofuturerevenuegenerationarecapitalized.

Liabilitiesrelatedtofutureremediationcostsarerecorded

whenenvironmentalassessmentsorcleanupsorbothareprobable

andthecostscanbereasonablyestimated.Forthecompany’s

U.S.andCanadianmarketingfacilities,theaccrualisbasedin

partontheprobabilitythatafutureremediationcommitment

willberequired.Foroil,gasandcoalproducingproperties,a

liabilityforanassetretirementobligationismade,following

FAS143.Referto“Properties,PlantandEquipment”inthis

noteforadiscussionofFAS143.

ForfederalSuperfundsitesandanalogoussitesunderstate

laws,thecompanyrecordsaliabilityforitsdesignatedshareof

theprobableandestimablecostsandprobableamountsforother

potentiallyresponsiblepartieswhenmandatedbytheregula-

toryagenciesbecausetheotherpartiesarenotabletopaytheir

respectiveshares.

Thegrossamountofenvironmentalliabilitiesisbased

onthecompany’sbestestimateoffuturecostsusingcurrently

availabletechnologyandapplyingcurrentregulationsandthe

company’sowninternalenvironmentalpolicies.Futureamounts

arenotdiscounted.Recoveriesorreimbursementsarerecorded

asassetswhenreceiptisreasonablyassured.

CurrencyTranslation TheU.S.dollaristhefunctionalcurrency

forsubstantiallyallofthecompany’sconsolidatedoperations

andthoseofitsequityaffiliates.Forthoseoperations,allgains

andlossesfromcurrencytranslationsarecurrentlyincludedin

income.Thecumulativetranslationeffectsforthosefewentities,

bothconsolidatedandaffiliated,usingfunctionalcurrencies

otherthantheU.S.dollarareincludedinthecurrencytranslation

adjustmentin“Stockholders’equity.”

RevenueRecognition Revenuesassociatedwithsalesofcrudeoil,

naturalgas,coal,petroleumandchemicalsproducts,andallother

sourcesarerecordedwhentitlepassestothecustomer,netofroyal-

ties,discountsandallowances,asapplicable.Revenuesfromnatural

gasproductionfrompropertiesinwhichChevronTexacohasan

interestwithotherproducersaregenerallyrecognizedonthebasis

ofthecompany’snetworkinginterest(entitlementmethod).

RefertoNote16onpage65foradiscussionoftheaccounting

forbuy/sellarrangements.

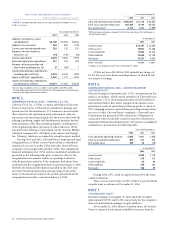

StockCompensation AtDecember31,2004,thecompanyhad

stock-basedemployeecompensationplans,whicharedescribed

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – Continued