Chevron 2004 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 CHEVRONTEXACO CORPORATION 2004 ANNUAL REPORT

ofnaturalgas,andthefractionation,storage,transportationand

marketingofnaturalgasliquids.Thecompanyalsoholdsinvest-

mentsinDynegypreferredstock.

Investment in Dynegy Common Stock AtDecember31,2004,

thecarryingvalueofthecompany’sinvestmentinDynegycom-

monstockwasapproximately$150.Thisamountwasabout

$365belowthecompany’sproportionateinterestinDynegy’s

underlyingnetassets.Thisdifferenceisprimarilytheresultof

write-downsoftheinvestmentin2002fordeclinesinthemarket

valueofthecommonsharesbelowthecompany’scarryingvalue

thatweredeemedtobeotherthantemporary.Thisdifference

hasbeenassignedtotheextentpracticabletospecificDynegy

assetsandliabilities,baseduponthecompany’sanalysisofthe

variousfactorscontributingtothedeclineinvalueoftheDynegy

shares.Thecompany’sequityshareofDynegy’sreportedearnings

isadjustedquarterlywhenappropriatetoreflectthedifference

betweentheseallocatedvaluesandDynegy’shistoricalbookval-

ues.Themarketvalueofthecompany’sinvestmentinDynegy’s

commonstockatDecember31,2004,wasapproximately$450.

Investments in Dynegy Notes and Preferred Stock Referto

Note8,page60,foradiscussionoftheseinvestments.

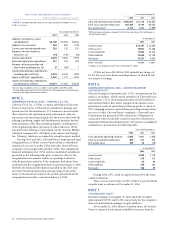

OtherInformation “Salesandotheroperatingrevenues”on

theConsolidatedStatementofIncomeincludes$7,933,$6,308

and$6,522withaffiliatedcompaniesfor2004,2003and2002,

respectively.“Purchasedcrudeoilandproducts”includes$2,548,

$1,740and$1,839withaffiliatedcompaniesfor2004,2003and

2002,respectively.

“Accountsandnotesreceivable”ontheConsolidatedBalance

Sheetincludes$1,188and$827duefromaffiliatedcompaniesat

December31,2004and2003,respectively.“Accountspayable”

includes$192and$118duetoaffiliatedcompaniesatDecember

31,2004and2003,respectively.

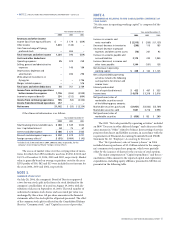

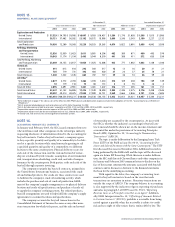

Thefollowingtableprovidessummarizedfinancialinfor-

mationona100percentbasisforallequityaffiliates,aswellas

ChevronTexaco’stotalshare.

maturity,andthe$1,800distributionwererecordedto“Invest-

mentsandAdvances.”

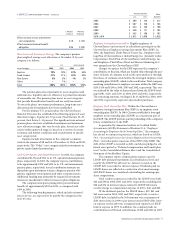

LG-CaltexOilCorporation ChevronTexacoowns50percentof

LG-Caltex,ajointventureformedin1967betweentheLGGroup

andCaltextoengageinimporting,refiningandmarketingof

petroleumproductsandpetrochemicalsinSouthKorea.

StarPetroleumRefiningCompanyLtd. ChevronTexacohasa

64percentequityownershipinterestinStarPetroleumRefining

CompanyLimited(SPRC),whichownstheStarRefineryat

MapTaPhut,Thailand.ThePetroleumAuthorityofThailand

ownstheremaining36percentofSPRC.

CaltexAustraliaLtd. ChevronTexacohasa50percentequity

ownershipinterestinCaltexAustraliaLimited(CAL).The

remaining50percentofCALispubliclyowned.During2002,

thecompanywrotedownitsinvestmentinCALby$136toits

estimatedfairvalueatSeptember30,2002.AtDecember31,

2004,thefairvalueofChevronTexaco’sshareofCALcommon

stockwas$1,130.Theaggregatecarryingvalueofthecompany’s

investmentinCALwasapproximately$80lowerthanthe

amountofunderlyingequityinCALnetassets.

ChevronPhillipsChemicalCompanyLLC ChevronTexacoowns

50percentofCPChem,formedin2000whenChevronmerged

mostofitspetrochemicalsbusinesseswiththoseofPhillipsPetro-

leumCompany.AtDecember31,2004,thecompany’scarrying

valueofitsinvestmentinCPChemwasapproximately$130lower

thantheamountofunderlyingequityinCPChem’snetassets.

DynegyInc. ChevronTexacoownsanapproximate25percent

equityinterestinthecommonstockofDynegy,anenergypro-

viderengagedinpowergeneration,thegatheringandprocessing

Notes to the Consolidated Financial Statements

Millionsofdollars,exceptper-shareamounts

INVESTMENTS AND ADVANCES – Continued

Affiliates ChevronTexaco Share*

YearendedDecember31 2003 2002 2003 2002

Total revenues $ 42,323 $ 31,877 $ 19,467 $ 15,049

Income (loss) before

income tax expense 1,657 (1,517) 1,211 70

Net income (loss) 1,508 (1,540) 1,029 (25)

Current assets $ 12,204 $ 16,808 $ 5,180 $ 6,270

Noncurrent assets 39,422 40,884 15,765 15,219

Current liabilities 9,642 14,414 4,132 5,158

Noncurrent liabilities 22,738 24,129 5,002 5,668

$ 19,246 $ 19,149 $ 11,811 $ 10,663

*

The company’s share of income and underlying equity in the net assets of its investments includes the effects of write-downs of certain investments, largely related to Dynegy Inc.

and Caltex Australia Limited, as described in the preceding section.