Chevron 2004 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

44

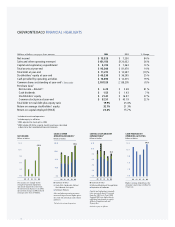

Millionsofdollars,exceptper-shareamounts 2003 % Change

Net income1 $ 7,230 84 %

Sales and other operating revenues1 $ 120,032 26 %

Capital and exploratory expenditures2 $ 7,363 13 %

Total assets at year-end $ 81,470 14 %

Total debt at year-end $ 12,597 (11)%

Stockholders’ equity at year-end $ 36,295 25 %

Cash provided by operating activities $ 12,315 19 %

Common shares outstanding at year-end3(Thousands) 2,138,295 (1) %

Per-share data3

Net income – diluted1,4 $ 3.48 81 %

Cash dividends $ 1.43 7 %

Stockholders’ equity $ 16.97 27 %

Common stock price at year-end $ 43.19 22 %

Total debt to total debt-plus-equity ratio 25.8%

Return on average stockholders’ equity 21.3%

Return on capital employed (ROCE) 15.7%

1 Includes discontinued operations

2 Includes equity in affi liates

3 2003 adjusted for stock split in 2004

4 2003 includes $0.08 for a capital stock transaction as described

in Note 26 to the Consolidated Financial Statements

CHEVRONTEXACO FINANCIAL HIGHLIGHTS

0.0

160.0

120.0

80.0

40.0

0100 02 03

Billions of dollars

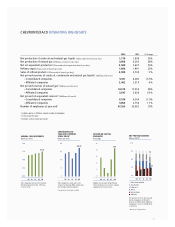

Salesandotheroperatingrevenues

increased26percentonhigherprices

forcrudeoil,naturalgasandrefined

products.

�Includesdiscontinuedoperations

Chemicals & Other

Crude Oil & Condensate, Natural

Gas & Natural Gas Liquids

Petroleum Products

0.0

12.0

10.0

8.0

6.0

4.0

2.0

0100 02 03

Billions of dollars

Capitalandexploratoryexpendi-

turesincreasedabout13percent

fromthe2003level.Years2000

through2002werehigherdueto

additionalinvestmentsinequity

affiliatesTengizchevroiland

DynegyInc.

�Includesequityinaffiliates

Chemicals & Other

Refining, Marketing & Transportation

Exploration & Production

0.0

15.0

12.0

9.0

6.0

3.0

0100 02 03

Billions of dollars

Higherearningshelpedboostthe

company’soperatingcashflowby

19percent.

0.0

15.0

12.0

9.0

3.0

6.0

0100 02 03

Billions of dollars

Netincomerosesharplyonthe

strengthofupstreamoperations

andmuch-improvedresultsfrom

thedownstreambusinessesin2004.

Special-itemchargesin2002reduced

earningsmorethan$3billion.