Chevron 2004 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72 CHEVRONTEXACO CORPORATION 2004 ANNUAL REPORT

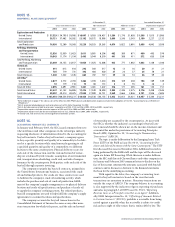

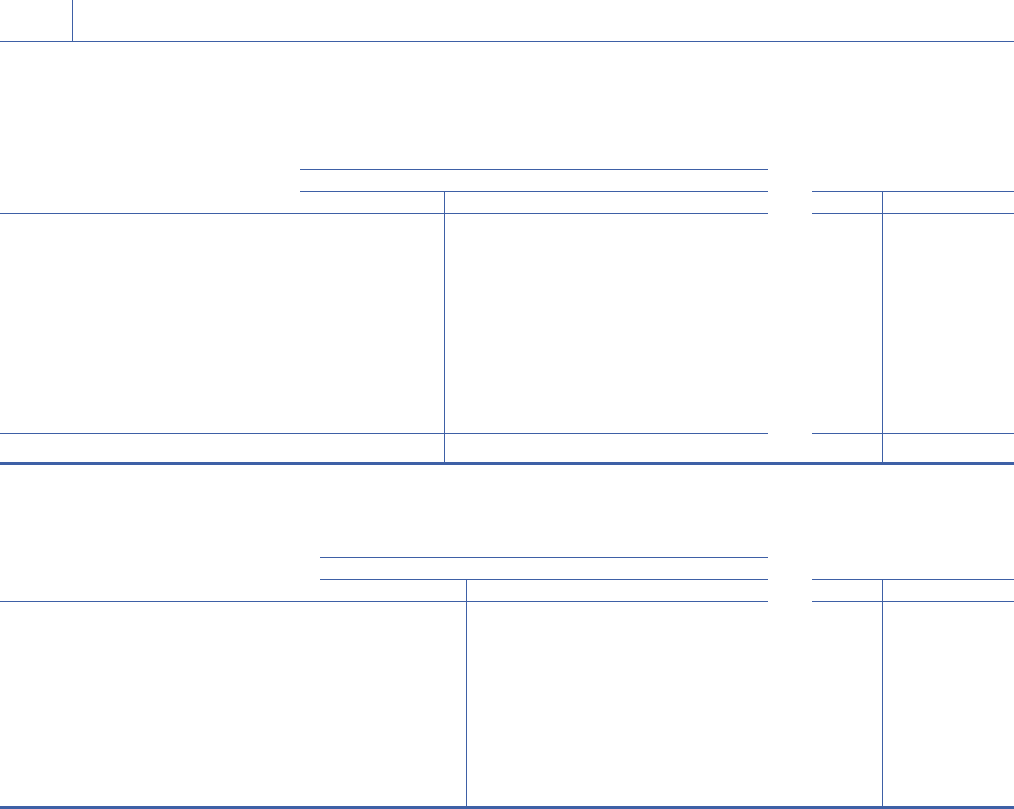

Thecomponentsofnetperiodicbenefitcostfor2004,2003and2002were:

Pension Benefits

2003 2002 Other Benefits

U.S. Int’l. U.S. Int’l. U.S. Int’l. 2003 2002

Service cost $ 144 $ 54 $ 112 $ 47 $ 28 $ 25

Interest cost 334 151 334 143 191 178

Expected return on plan assets (224) (132) (288) (138) – –

Amortization of transitional assets – (3) – (3) – –

Amortization of prior-service costs 45 14 32 12 (3) (3)

Recognized actuarial losses (gains) 133 42 32 27 12 (1)

Settlement losses 132 1 146 1 – –

Curtailment losses – 6 – – – – –

Special termination benefits

recognition – – – – – –

Net periodic benefit cost $ 564 $ 133 $ 368 $ 89 $ 228 $ 199

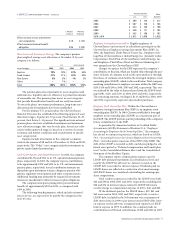

Assumptions Thefollowingweightedaverageassumptionswereusedtodeterminebenefitobligationsandnetperiodbenefitcostsforyears

endedDecember31:

Pension Benefits

2003 2002 Other Benefits

U.S. Int’l. U.S. Int’l. U.S. Int’l. 2003 2002

Assumptions used to determine

benefit obligations

Discount rate 6.0% 6.8% 6.8% 7.1% 6.1% 6.8%

Rate of compensation increase 4.0% 4.9% 4.0% 5.5% 4.1% 4.1%

Assumptions used to determine

net periodic benefit cost

Discount rate* 6.3% 7.1% 7.4% 7.7% 6.8% 7.3%

Expected return on plan assets* 7.8% 8.3% 8.3% 8.9% N/A N/A

Rate of compensation increase 4.0% 5.1% 4.0% 5.4% 4.1% 4.1%

* Discount rate and expected rate of return on plan assets were reviewed and updated as needed on a quarterly basis for the main U.S. pension plan.

ExpectedReturnonPlanAssets Thecompanyemploysarigorous

processtodeterminetheestimatesoflong-termrateofreturn

onpensionassets.Theseestimatesareprimarilydrivenbyactual

historicalasset-classreturns,anassessmentofexpectedfuture

performanceandadvicefromexternalactuarialfirmswhile

incorporatingspecificasset-classriskfactors.Assetallocationsare

regularlyupdatedusingpensionplanasset/liabilitystudies,and

thedeterminationofthecompany’sestimatesoflong-termrates

ofreturnareconsistentwiththesestudies.

Therehavebeennochangesintheexpectedlong-termrate

ofreturnonplanassetssince2002forU.S.plans,whichaccount

forabout70percentofthecompany’spensionplanassets.At

December31,2004,theestimatedlong-termrateofreturnon

U.S.pensionplanassetswas7.8percent.

Theyear-endmarket-relatedvalueofU.S.pensionplan

assetsusedinthedeterminationofpensionexpensewasbasedon

themarketvaluesintheprecedingthreemonths,asopposedto

themaximumallowableperiodoffiveyearsunderU.S.accounting

rules.Managementconsidersthethree-monthtimeperiodlong

enoughtominimizetheeffectsofdistortionsfromday-to-day

marketvolatilityandyetstillbecontemporaneoustotheendof

theyear.ForplansoutsidetheU.S.,marketvalueofassetsasof

themeasurementdateisusedincalculatingthepensionexpense.

Notes to the Consolidated Financial Statements

Millionsofdollars,exceptper-shareamounts

EMPLOYEE BENEFIT PLANS – Continued

OtherBenefitAssumptions EffectiveJanuary1,2005,thecom-

panyamendeditsmainU.S.postretirementmedicalplantolimit

futureincreasesinthecompanycontribution.Forcurrentretirees,

theincreaseincompanycontributioniscappedat4percenteach

year.Forfutureretirees,the4percentcapwillbeeffectiveat

retirement.Beforeretirement,theassumedhealthcarecosttrend

ratesstartwith10.6percentin2004andgraduallydropto4.8

percentfor2010andbeyond.Oncetheemployeeelectstoretire,

thetrendratesarecappedat4percent.

Forthemeasurementofaccumulatedpostretirementbenefit

obligationatDecember31,2003,theassumedheathcarecost

trendratesstartwith8.4percentin2003andgraduallydecline

to4.5percentfor2007andbeyond.

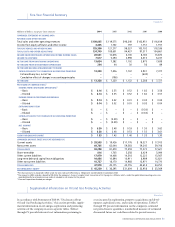

Assumedhealthcarecost-trendrateshaveasignificanteffect

ontheamountsreportedforretireehealthcarecosts.Achangeof

onepercentagepointintheassumedhealthcarecost-trendrates

wouldhavethefollowingeffects: