Chevron 2004 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 CHEVRONTEXACO CORPORATION 2004 ANNUAL REPORT

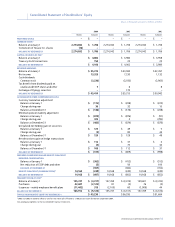

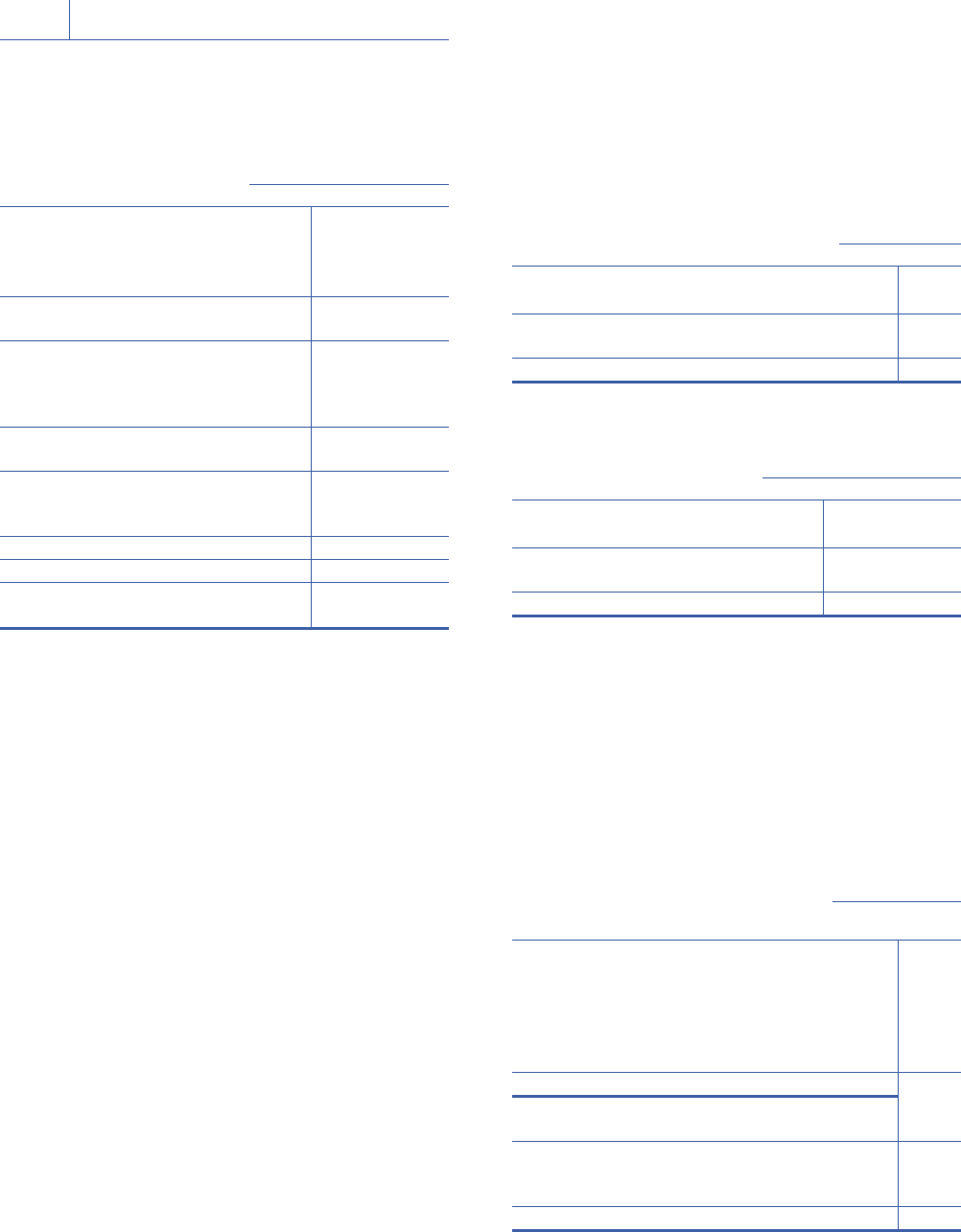

SegmentIncomeTaxes Segmentincometaxexpensesforthe

years2004,2003and2002areasfollows:

Year ended December 31

20031 2002

United States $ 1,853 $ 854

International 3,831 3,415

5,684 4,269

United States 300 (254)

International 275 138

575 (116)

United States (25) (17)

International 6 17

(19) –

(946) (1,155)

$ 5,294 $ 2,998

1 See Note 25 on page 77 for information concerning the cumulative effect of

changes in accounting principles due to the adoption of FAS 143, “Accounting for

Asset Retirement Obligations.”

2 Income tax expense of $100, $50 and $26 related to discontinued operations for

2004, 2003 and 2002, respectively, is not included.

OtherSegmentInformation Additionalinformationforthe

segmentationofmajorequityaffiliatesiscontainedinNote14

beginningonpage63.Informationrelatedtoproperties,plantand

equipmentbysegmentiscontainedinNote15onpage65.

Thecompanyandmanyothercompaniesinthepetroleum

industryhaveusedmethyltertiarybutylether(MTBE)asagaso-

lineadditive.

Thecompanyisapartytomorethan70lawsuitsandclaims,

themajorityofwhichinvolves

numerousotherpetroleummarketers

andrefiners,relatedtotheuseofMTBEincertainoxygenated

gasolinesandtheallegedseepageofMTBEintogroundwater.

Resolutionoftheseactionsmayultimatelyrequirethecompany

tocorrectoramelioratetheallegedeffectsontheenvironment

ofpriorreleaseofMTBEbythecompanyorotherparties.Addi-

tionallawsuitsandclaimsrelatedtotheuseofMTBE,including

personal-injuryclaims,maybefiledinthefuture.

Thecompany’sultimateexposurerelatedtotheselawsuits

andclaimsisnotcurrentlydeterminable,butcouldbematerial

tonetincomeinanyoneperiod.ThecompanydoesnotuseMTBE

inthemanufactureofgasolineintheUnitedStates,andthereare

nodetectablelevelsofMTBEinthatgasoline.

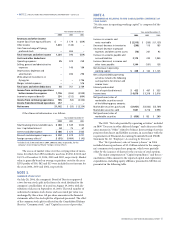

Certainnoncancelableleasesareclassifiedascapitalleases,and

theleasedassetsareincludedaspartof“Properties,plantand

equipment,atcost.”Suchleasingarrangementsinvolvetanker

charters,crudeoilproductionandprocessingequipment,service

stations,andotherfacilities.Otherleasesareclassifiedasoperat-

ingleasesandarenotcapitalized.Thepaymentsonsuchleases

arerecordedasexpense.Detailsofthecapitalizedleasedassets

areasfollows:

At December 31

2003

Exploration and Production $ 246

Refining, Marketing and Transportation 842

Total 1,088

Less: Accumulated amortization 642

Net capitalized leased assets $ 446

Rentalexpensesincurredforoperatingleasesduring2004,

2003and2002wereasfollows:

Year ended December 31

2003 2002

Minimum rentals $ 1,567 $ 1,270

Contingent rentals 3 4

Total 1,570 1,274

Less: Sublease rental income 48 53

Net rental expense $ 1,522 $ 1,221

Contingentrentalsarebasedonfactorsotherthanthepas-

sageoftime,principallysalesvolumesatleasedservicestations.

Certainleasesincludeescalationclausesforadjustingrentalsto

reflectchangesinpriceindices,renewaloptionsrangingupto

25years,andoptionstopurchasetheleasedpropertyduringor

attheendoftheinitialorrenewalleaseperiodforthefairmarket

valueorotherspecifiedamountatthattime.

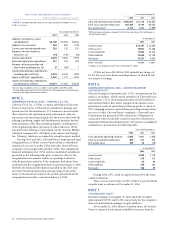

AtDecember31,2004,theestimatedfutureminimumlease

payments(netofnoncancelablesubleaserentals)underoperating

andcapitalleases,whichatinceptionhadanoncancelableterm

ofmorethanoneyear,wereasfollows:

At December 31

Operating Capital

Leases Leases

Year: 2005 $ 390 $ 83

2006 338 74

2007 280 62

2008 239 51

2009 236 52

Thereafter 749 562

Total $ 2,232 $ 884

Less: Amounts representing interest

and executory costs (292)

Net present values 592

Less: Capital lease obligations

included in short-term debt (353)

Long-term capital lease obligations $ 239

Notes to the Consolidated Financial Statements

Millionsofdollars,exceptper-shareamounts

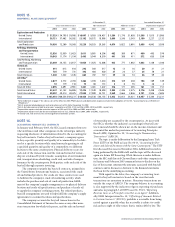

OPERATING SEGMENTS AND GEOGRAPHIC DATA – Continued