Chevron 2004 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

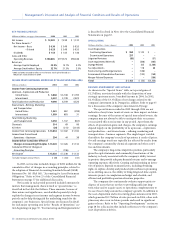

FINANCIAL TABLE OF CONTENTS

Key Financial Results

Income From Continuing Operations by

Major Operating Area

Special Items

Business Environment and Outlook

Operating Developments

Results of Operations

Consolidated Statement of Income

Selected Operating Data

Information Related to Investment in Dynegy Inc.

Liquidity and Capital Resources

Financial Ratios

Guarantees, Off-Balance-Sheet Arrangements

and Contractual Obligations, and

Other Contingencies

Financial and Derivative Instruments

Transactions With Related Parties

Litigation and Other Contingencies

Environmental Matters

Critical Accounting Estimates and Assumptions

New Accounting Standards

Note 1. Summary of Significant Accounting Policies

Note 2. Special Items and Other Financial Information

Note 3. Common Stock Split

Note 4. Information Relating to the Consolidated

Statement of Cash Flows

Note 5. Summarized Financial Data –

Chevron U.S.A. Inc.

Note 6. Summarized Financial Data –

Chevron Transport Corporation Ltd.

Note 7. Stockholders’ Equity

Note 8. Financial and Derivative Instruments

Note 9. Operating Segments and Geographic Data

Note 10. Litigation

Note 11. Lease Commitments

Note 12. Restructuring and Reorganization Costs

Note 13. Assets Held for Sale and

Discontinued Operations

Note 14. Investments and Advances

Note 15. Properties, Plant and Equipment

Note 16. Accounting for Buy/Sell Contracts

Note 17. Taxes

Note 18. Short-Term Debt

Note 19. Long-Term Debt

Note 20. New Accounting Standards

Note 21. Accounting for Suspended

Exploratory Wells

Note 22. Employee Benefit Plans

Note 23. Stock Options

Note 24. Other Contingencies and Commitments

Note 25. FAS 143 – Asset Retirement Obligations

Note 26. Earnings Per Share

The company has submitted to the New York Stock Exchange a certificate

of the Chief Executive Officer of the company certifying that he is not aware

of any violation by the company of New York Stock Exchange corporate

governance listing standards. The 302 certifications have been

filed in the Form 10-K.

This Annual Report of ChevronTexaco Corporation contains forward-looking statements relating to ChevronTexaco’s operations that are based on management’s current

expectations, estimates and projections about the petroleum, chemicals and other energy-related industries. Words such as “anticipates,” “expects,” “intends,”

“plans,” “targets,” “projects,” “believes,” “seeks,” ”schedules,” “estimates” and similar expressions are intended to identify such forward-looking statements.

These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control

and are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. You

should not place undue reliance on these forward-looking statements, which speak only as of the date of this report. Unless legally required, ChevronTexaco undertakes

no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Among the factors that could cause actual results to differ materially are crude oil and natural gas prices; refining margins and marketing margins; chemicals prices

and competitive conditions affecting supply and demand for aromatics, olefins and additives products; actions of competitors; the competitiveness of alternate energy

sources or product substitutes; technological developments; the results of operations and financial condition of equity affiliates; Dynegy Inc.’s ability to successfully

complete its recapitalization and restructuring plans; inability or failure of the company’s joint-venture partners to fund their share of operations and development

activities; potential failure to achieve expected production from existing and future oil and gas development projects; potential delays in the development, construction

or start-up of planned projects; potential disruption or interruption of the company’s production or manufacturing facilities due to war, accidents, political events, civil

unrest or severe weather; potential liability for remedial actions under existing or future environmental regulations and litigation; significant investment or product

changes under existing or future environmental regulations (including, particularly, regulations and litigation dealing with gasoline composition and characteristics);

potential liability resulting from pending or future litigation; the company’s ability to successfully implement the restructuring of its worldwide downstream organization

and other business units; the company’s ability to sell or dispose of assets or operations as expected; and the effects of changed accounting rules under generally

accepted accounting principles promulgated by rule-setting bodies. In addition, such statements could be affected by general domestic and international economic and

political conditions. Unpredictable or unknown factors not discussed herein also could have material adverse effects on forward-looking statements.