Chevron 2004 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHEVRONTEXACO CORPORATION 2004 ANNUAL REPORT 65

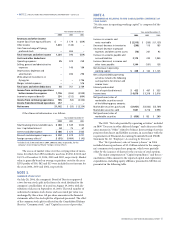

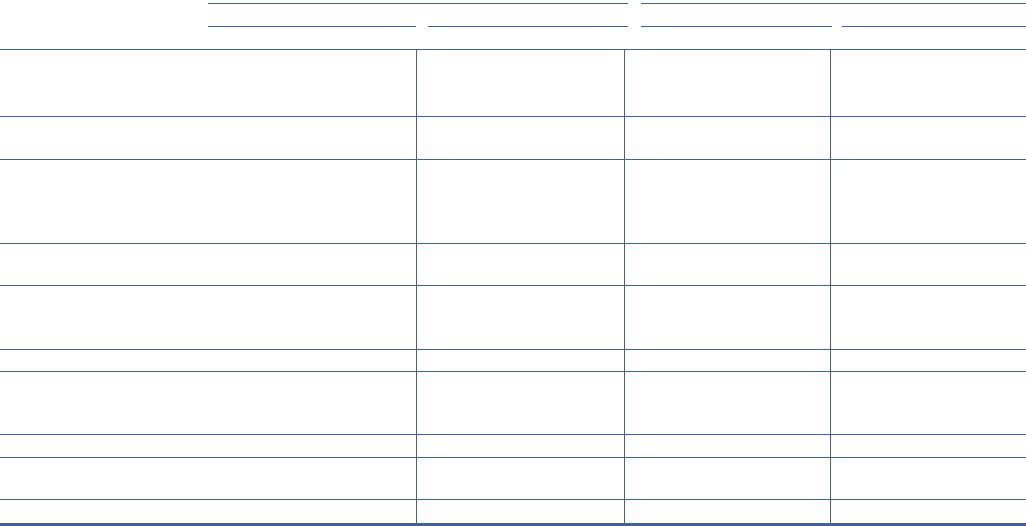

At December 31 Year ended December 31

Gross Investment at Cost Net Investment2 Additions at Cost3 Depreciation Expense4,5

2003 2002 2003 2002 2003 2002 2003 2002

United States $ 34,798 $ 39,986 $ 9,953 $ 10,457 $ 1,776 $ 1,658 $ 1,815 $ 1,806

International 37,402 36,382 20,572 18,908 3,246 3,343 2,227 2,132

Total Exploration

and Production 72,200 76,368 30,525 29,365 5,022 5,001 4,042 3,938

United States 12,959 13,423 5,881 6,296 389 671 493 570

International 11,174 11,194 5,944 6,310 388 411 655 530

Total Refining, Marketing

and Transportation 24,133 24,617 11,825 12,606 777 1,082 1,148 1,100

United States 613 614 303 317 12 16 21 21

International 719 731 404 420 24 37 38 21

Total Chemicals 1,332 1,345 707 737 36 53 59 42

United States 2,772 2,783 1,393 1,334 169 230 109 149

International 119 118 88 113 8 55 26 2

Total All Other 2,891 2,901 1,481 1,447 177 285 135 151

Total United States 51,142 56,806 17,530 18,404 2,346 2,575 2,438 2,546

Total International 49,414 48,425 27,008 25,751 3,666 3,846 2,946 2,685

Total $ 100,556 $ 105,231 $ 44,538 $ 44,155 $ 6,012 $ 6,421 $ 5,384 $ 5,231

1 Refer to Note 25 on page 77 for a discussion of the effect on 2003 PP&E balances and depreciation expenses related to the adoption of FAS 143, “Accounting for Asset Retirement

Obligations.”

2 Net of accumulated abandonment and restoration costs of $2,263 at December 31, 2002.

3 Net of dry hole expense related to prior years’ expenditures of $58, $124 and $36 in 2004, 2003 and 2002, respectively.

4 Depreciation expense includes accretion expense of $93 and $132 in 2004 and 2003, respectively.

5 Depreciation expense includes discontinued operations of $22, $58 and $62 in 2004, 2003 and 2002, respectively.

6 Primarily coal, real estate assets and management information systems.

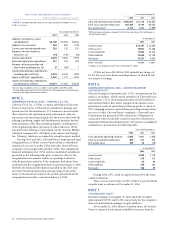

ofownershipareassumedbythecounterparties.Atissuewith

theSECiswhethertheindustry’saccountingforbuy/sellcon-

tractsinsteadshouldbeshownnetontheincomestatementand

accountedforundertheprovisionsofAccountingPrinciples

Board(APB)OpinionNo.29,“AccountingforNonmonetary

Transactions”(APB29).

ThetopicisunderdeliberationbytheEmergingIssuesTask

Force(EITF)oftheFASBasIssueNo.04-13,“AccountingforPur-

chasesandSalesofInventorywiththeSameCounterparty.”TheEITF

firstdiscussedthisissueinNovember2004.Additionalresearchis

beingperformedbytheFASBstaff,andthetopicwillbediscussed

againatafutureEITFmeeting.Whilethisissueisunderdelibera-

tion,theSECstaffdirectedChevronTexacoandothercompaniesin

itsJanuaryandFebruary2005commentletterstodiscloseonthe

faceoftheincomestatementtheamountsassociatedwithbuy/sell

contractsandtodiscussinafootnotetothefinancialstatements

thebasisfortheunderlyingaccounting.

Withregardtothelatter,thecompany’saccountingtreat-

mentforbuy/sellcontractsisbasedontheviewthatsuch

transactionsaremonetaryinnature.Monetarytransactionsare

outsidethescopeofAPB29.Thecompanybelievesitsaccounting

isalsosupportedbytheindicatorsofgrossreportingofpurchases

andsalesinparagraph3ofEITFIssueNo.99-19,“Reporting

RevenueGrossasaPrincipalversusNetasanAgent.”Addition-

ally,FASBInterpretationNo.39,“OffsettingofAmountsRelated

toCertainContracts”(FIN39),prohibitsareceivablefrombeing

nettedagainstapayablewhenthereceivableissubjecttocredit

riskunlessarightofoffsetexiststhatisenforceablebylaw.The

InJanuaryandFebruary2005,theSECissuedcommentlettersto

ChevronTexacoandothercompaniesintheoilandgasindustry

requestingdisclosureofinformationrelatedtotheaccountingfor

buy/sellcontracts.Underabuy/sellcontract,acompanyagrees

tobuyaspecificquantityandqualityofacommoditytobedeliv-

eredataspecificlocationwhilesimultaneouslyagreeingtosell

aspecifiedquantityandqualityofacommodityatadifferent

locationtothesamecounterparty.Physicaldeliveryoccursfor

eachsideofthetransaction,andtheriskandrewardofowner-

shipareevidencedbytitletransfer,assumptionofenvironmental

risk,transportationscheduling,creditrisk,andriskofnonper-

formancebythecounterparty.Bothpartiessettleeachsideofthe

buy/sellthroughseparateinvoicing.

Thecompanyroutinelyhasbuy/sellcontracts,primarilyin

theUnitedStatesdownstreambusiness,associatedwithcrude

oilandrefinedproducts.Forcrudeoil,thesecontractsareused

tofacilitatethecompany’scrudeoilmarketingactivity,which

includesthepurchaseandsaleofcrudeoilproduction,fulfill-

mentofthecompany’ssupplyarrangementsastophysicaldelivery

locationandcrudeoilspecifications,andpurchaseofcrudeoil

tosupplythecompany’srefiningsystem.Forrefinedproducts,

buy/sellarrangementsareusedtohelpfulfillthecompany’ssupply

agreementstocustomerlocationsandspecifications.

Thecompanyaccountsforbuy/selltransactionsinthe

ConsolidatedStatementofIncomethesameasanyothermon-

etarytransactionforwhichtitlepasses,andtheriskandreward