Chevron 2004 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

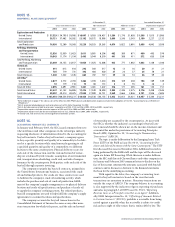

EMPLOYEE BENEFIT PLANS – Continued

TheaccumulatedbenefitobligationsforallU.S.andinter-

nationalpensionplanswere$6,117and$2,734,respectively,

atDecember31,2004,and$5,374and$2,372,respectively,at

December31,2003.

CHEVRONTEXACO CORPORATION 2004 ANNUAL REPORT 71

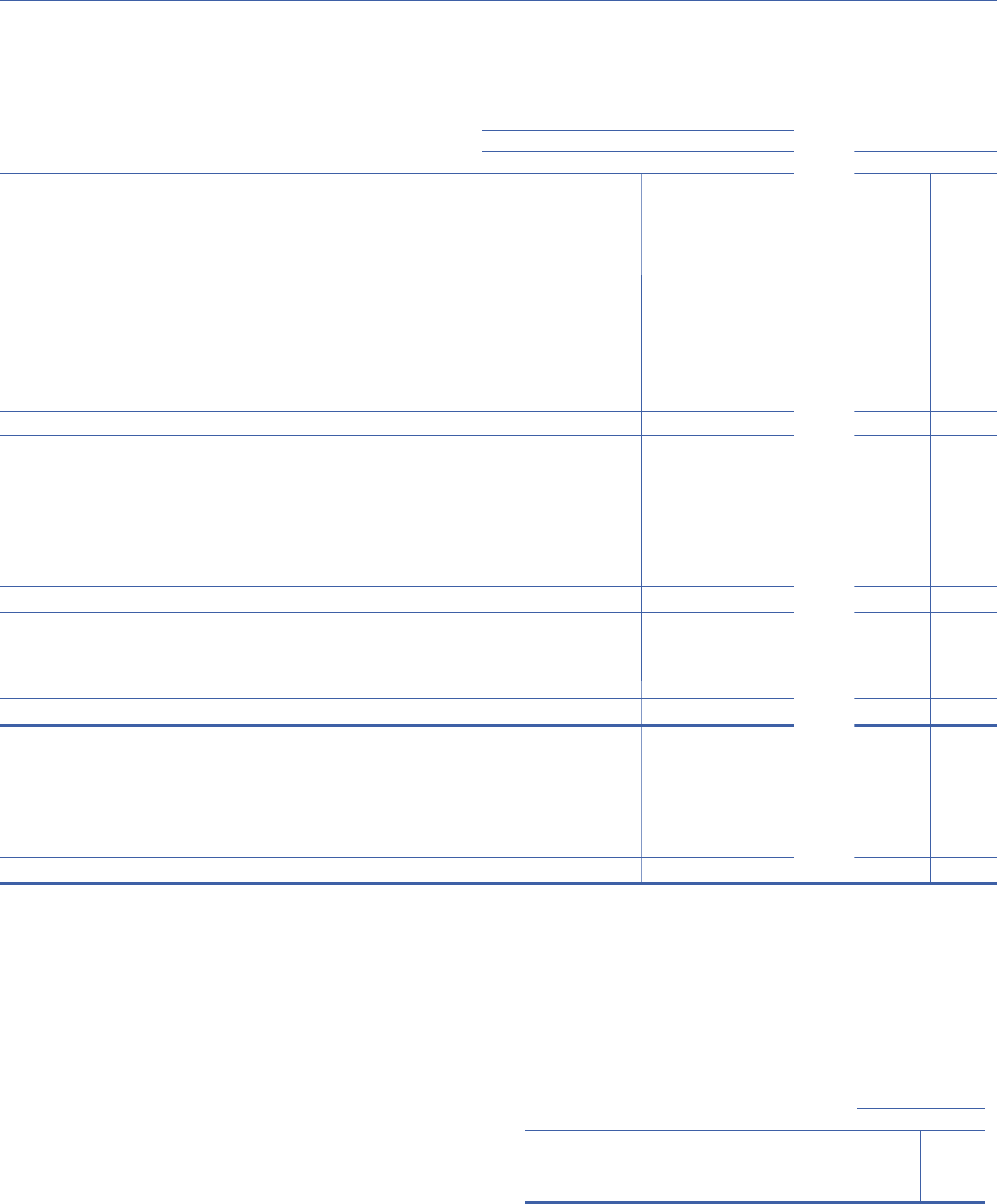

Thestatusofthecompany’spensionandotherpostretirementbenefitplansfor2004and2003isasfollows:

Pension Benefits

2003 Other Benefits

U.S. Int’l. U.S. Int’l. 2003

Benefit obligation at January 1 $ 5,308 $ 2,163 $ 2,865

Service cost 144 54 28

Interest cost 334 151 191

Plan participants’ contributions 1 1 –

Plan amendments – 25 –

Actuarial loss1 708 223 244

Foreign currency exchange rate changes – 257 7

Benefits paid (676) (162) (200)

Curtailment – (4) –

Special termination benefits – – –

Benefit obligation at December 31 5,819 2,708 3,135

Fair value of plan assets at January 1 3,190 1,645 –

Actual return on plan assets 726 203 –

Foreign currency exchange rate changes – 228 –

Employer contributions 1,203 214 200

Plan participants’ contributions 1 1 –

Benefits paid (676) (162) (200)

Fair value of plan assets at December 31 4,444 2,129 –

(1,375) (579) (3,135)

Unrecognized net actuarial loss1 1,598 918 646

Unrecognized prior-service cost 350 92 (19)

Unrecognized net transitional assets – 8 –

Total recognized at December 31 $ 573 $ 439 $ (2,508)

Prepaid benefit cost $ 10 $ 679 $ –

Accrued benefit liability2 (970) (392) (2,508)

Intangible asset 349 18 –

Accumulated other comprehensive income3 1,184 134 –

Net amount recognized $ 573 $ 439 $ (2,508)

1 Other Benefits in 2003 include a $10 gain for the Medicare Part D federal subsidy for a small subsidiary plan.

2 The company recorded additional minimum liabilities of $530 and $64 in 2004 for U.S. and international plans, respectively, and $1,533 and $152 in 2003 for U.S. and international

plans, respectively, to reflect the amount of unfunded accumulated benefit obligations. The long-term portion of accrued benefits liability is recorded in “Reserves for employee

benefit plans,” and the short-term portion is reflected in “Accrued liabilities.”

3 “Accumulated other comprehensive income” includes deferred income taxes of $181 and $21 in 2004 for U.S. and international plans, respectively, and $415 and $47 in 2003 for

U.S. and international plans, respectively. This item is presented net of these taxes in the Consolidated Statement of Stockholders’ Equity.

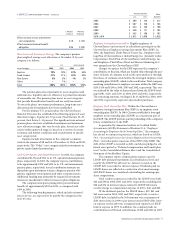

Informationforpensionplanswithanaccumulatedbenefit

obligationinexcessofplanassetsatDecember31,2004and

2003,was:

At December 31

2003

Projected benefit obligations $ 6,637

Accumulated benefit obligations 6,067

Fair value of plan assets 4,791