Chevron 2004 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 CHEVRONTEXACO CORPORATION 2004 ANNUAL REPORT

ofacustomerisnotconsideredsufficient,LettersofCreditare

theprincipalsecurityobtainedtosupportlinesofcredit.

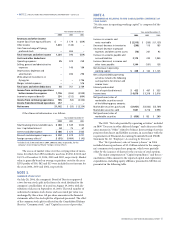

InvestmentinDynegyNotesandPreferredStock Atthebegin-

ningof2004,thecompanyheldinvestmentsin$223facevalue

ofDynegyJuniorUnsecuredSubordinatedNotesdue2016and

$400facevalueofDynegySeriesCConvertiblePreferredStock

withastatedmaturitydateof2033.

TheJuniorNoteswereredeemedatfacevalueduring2004,

andgainsof$54wererecordedforthedifferencebetweenthe

faceamountsandthecarryingvaluesatthetimeofredemp-

tion.Thefacevalueofthecompany’sinvestmentintheSeriesC

preferredstockatDecember31,2004,was$400.Thestockis

recordedatitsfairvalue,whichwasestimatedtobe$370at

December31,2004.Futuretemporarychangesintheestimated

fairvalueofthepreferredstockwillbereportedin“Othercom-

prehensiveincome.”However,ifanyfuturedeclineinfairvalue

isdeemedtobeotherthantemporary,achargeagainstincome

intheperiodwouldberecorded.Dividendspayableonthepre-

ferredstockarerecognizedinincomeeachperiod.

AlthougheachsubsidiaryofChevronTexacoisresponsiblefor

itsownaffairs,ChevronTexacoCorporationmanagesitsinvest-

mentsinthesesubsidiariesandtheiraffiliates.Forthispurpose,

theinvestmentsaregroupedasfollows:upstream–explora-

tionandproduction;downstream–refining,marketingand

transportation;chemicals;andallother.Thefirstthreeofthese

groupingsrepresentthecompany’s“reportablesegments”and

“operatingsegments”asdefinedinFAS131,“DisclosuresAbout

SegmentsofanEnterpriseandRelatedInformation.”

Thesegmentsareseparatelymanagedforinvestment

purposesunderastructurethatincludes“segmentmanagers”

whoreporttothecompany’s“chiefoperatingdecisionmaker”

(CODM)(termsasdefinedinFAS131).TheCODMisthecom-

pany’sExecutiveCommittee,acommitteeofseniorofficersthat

includestheChiefExecutiveOfficerandthatinturnreportsto

theBoardofDirectorsofChevronTexacoCorporation.

Theoperatingsegmentsrepresentcomponentsofthecom-

panyasdescribedinFAS131termsthatengageinactivities(a)

fromwhichrevenuesareearnedandexpensesareincurred;(b)

whoseoperatingresultsareregularlyreviewedbytheCODM,

whichmakesdecisionsaboutresourcestobeallocatedtothe

segments,andtoassesstheirperformance;and(c)forwhichdis-

cretefinancialinformationisavailable.

Segmentmanagersforthereportablesegmentsaredirectly

accountabletoandmaintainregularcontactwiththecompany’s

CODMtodiscussthesegment’soperatingactivitiesandfinancial

performance.TheCODMapprovesannualcapitalandexplor-

atorybudgetsatthereportablesegmentlevelandalsoapproves

capitalandexploratoryfundingformajorprojectsandmajor

changestotheannualcapitalandexploratorybudgets.However,

business-unitmanagerswithintheoperatingsegmentsaredirectly

responsiblefordecisionsrelatingtoprojectimplementationandall

othermattersconnectedwithdailyoperations.Companyofficers

whoaremembersoftheExecutiveCommitteealsohaveindividual

managementresponsibilitiesandparticipateinothercommittees

forpurposesotherthanactingastheCODM.

“AllOther”activitiesincludethecompany’sinterestin

Dynegy,coalminingoperations,powergenerationbusinesses,

worldwidecashmanagementanddebtfinancingactivities,cor-

porateadministrativefunctions,insuranceoperations,realestate

activitiesandtechnologycompanies.

Thecompany’sprimarycountryofoperationistheUnited

StatesofAmerica,itscountryofdomicile.Othercomponentsof

thecompany’soperationsarereportedas“International”(out-

sidetheUnitedStates).

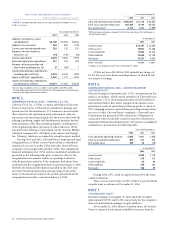

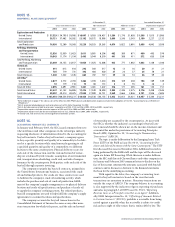

SegmentEarnings Thecompanyevaluatestheperformanceof

itsoperatingsegmentsonanafter-taxbasis,withoutconsidering

theeffectsofdebtfinancinginterestexpenseorinvestmentinterest

income,bothofwhicharemanagedbythecompanyonaworld-

widebasis.Corporateadministrativecostsandassetsarenot

allocatedtotheoperatingsegments.However,operatingsegments

arebilledforthedirectuseofcorporateservices.Nonbillable

costsremainatthecorporatelevelin“AllOther.”Merger-related

expensesin2002werealsoincludedin“AllOther.”After-tax

segmentincome(loss)fromcontinuingoperationsispresented

inthefollowingtable:

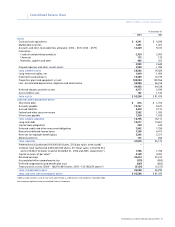

Year ended December 31

2003 2002

United States $ 3,160 $ 1,703

International 3,199 2,823

6,359 4,526

United States 482 (398)

International 685 31

1,167 (367)

United States 5 13

International 64 73

69 86

7,595 4,245

Interest expense (352) (406)

Interest income 75 72

Other 64 (2,423)

Merger-related expenses – (386)

7,382 1,102

44 30

Cumulative effect of changes in

accounting principles (196) –

$ 7,230 $ 1,132

Notes to the Consolidated Financial Statements

Millionsofdollars,exceptper-shareamounts

FINANCIAL AND DERIVATIVE INSTRUMENTS – Continued