Chevron 2004 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

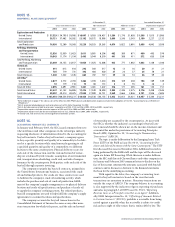

56 CHEVRONTEXACO CORPORATION 2004 ANNUAL REPORT

morefullyinNote22beginningonpage70.Thecompany

accountsforthoseplansundertherecognitionandmeasurement

principlesofAccountingPrinciplesBoard(APB)OpinionNo.25,

“AccountingforStockIssuedtoEmployees,”andrelatedinterpreta-

tions.Thefollowingtableillustratestheeffectonnetincomeand

earningspershareifthecompanyhadappliedthefair-value-

recognitionprovisionsofFinancialAccountingStandardsBoard

(FASB)StatementNo.123,“AccountingforStock-BasedCompen-

sation,”tostock-basedemployeecompensation:

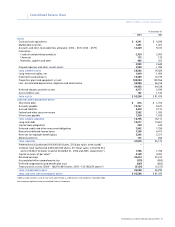

Year ended December 31

2003 2002

Net income, as reported $ 7,230 $ 1,132

Add: Stock-based employee

compensation expense included

in reported net income determined

under APB No. 25, net of related

tax effects1 1 (1)

Deduct: Total stock-based employee

compensation expense determined

under fair-value-based method for

all awards, net of related tax effects1,2 (26) (47)

Pro forma net income $ 7,205 $ 1,084

Earnings per share3,4

Basic – as reported $ 3.48 $ 0.53

Basic – pro forma $ 3.47 $ 0.51

Diluted – as reported $ 3.48 $ 0.53

Diluted – pro forma $ 3.47 $ 0.51

1 Costs of stock appreciation rights reported in net income and included in the

fair-value method for these rights were $10, $1 and $(1) for 2004, 2003 and 2002,

respectively.

2 The fair value is estimated using the Black-Scholes option-pricing model for stock

options. Stock appreciation rights are estimated based on the method outlined in

SFAS 123 for these instruments.

3 Per-share amounts in all periods reflect a two-for-one stock split effected as a

100 percent stock dividend in September 2004.

4 The amounts in 2003 include a benefit of $0.08 for the company’s share of a

capital stock transaction of its Dynegy Inc. affiliate, which under the applicable

accounting rules was recorded directly to the company’s retained earnings and not

included in net income for the period.

RefertoNote20beginningonpage68foradiscussionof

thecompany’splantoimplementFASBstatementNo.123R,

“Share-BasedPayment,”effectiveJuly1,2005.

Netincomeforeachperiodpresentedincludesamountscategorized

bythecompanyas“specialitems,”toassistintheexplanationof

thetrendofresults.

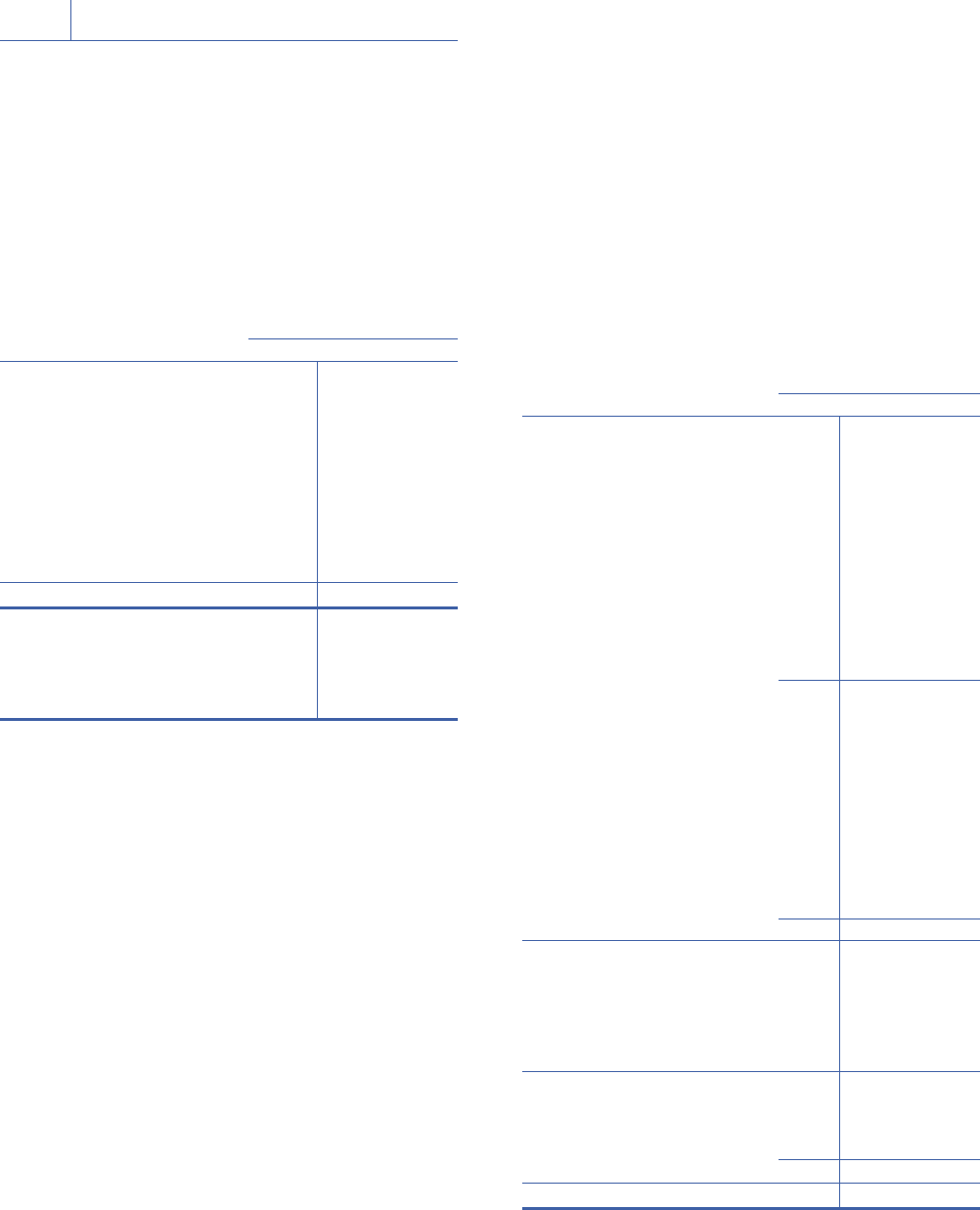

Listedinthefollowingtablearecategoriesoftheseitemsand

theirnetincrease(decrease)tonetincome,afterrelatedtaxeffects.

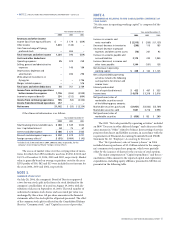

In2004,thecompanyrecordedspecialgainsof$1,217from

thesaleofnonstrategiccrudeoilandnaturalgasassets,primarily

intheUnitedStatesandCanada,andaspecialchargeof$55fora

litigationmatter.

In2003,impairmentsof$103and$30,respectively,were

recordedforvariousU.S.andinternationaloilandgaspro-

ducingproperties,reflectinglowerexpectedrecoveryofproved

reservesorawrite-downtomarketvalueforassetsinanticipa-

tionofsale.Impairmentsof$123ondownstreamassetswerefor

theconversionofarefinerytoaproductsterminalandawrite-

downtomarketvalueforassetsinanticipationofsale.Alsoin

2003,ChevronTexacoexchangeditsDynegySeriesBPreferred

Stockforcash,notesandSeriesCPreferredStock.The$365dif-

ferencebetweenthefairvalueoftheseitemsandthecompany’s

carryingvaluewasincludedinnetincome.

In2002,thecompanyrecordedwrite-downsof$1,626ofits

investmentinDynegycommonandpreferredstockand$136ofits

investmentinitspubliclytradedCaltexAustraliaaffiliatetotheir

respectiveestimatedfairvalues.Thewrite-downswererequired

becausethedeclinesinthefairvaluesoftheinvestmentsbelow

theircarryingvaluesweredeemedtobeotherthantemporary.

RefertoNote14beginningonpage63foradditionalinformation

onthecompany’sinvestmentinDynegyandCaltexAustralia.

Alsoin2002,impairmentsof$183wererecordedforvarious

U.S.explorationandproductionpropertiesand$100forinterna-

tionalprojects.

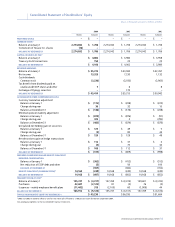

Year ended December 31

2003 2002

Asset dispositions

Exploration and Production

Continuing operations

United States $ 77 $ –

International 32 –

Discontinued operations

United States – –

International – –

Refining, Marketing and Transportation

United States 37 –

International (24) –

122 –

Asset impairments/write-offs

Exploration and Production

Continuing operations

United States (103) (183)

International (30) (100)

Refining, Marketing and Transportation

United States – (66)

International (123) (136)

All Other

Other asset write-offs (84) –

– (340) (485)

Tax adjustments – 118 60

Environmental remediation

provisions – (132) (160)

Restructuring and reorganizations (146) –

Merger-related expenses – (386)

Litigation provisions – (57)

Dynegy-related

Impairments – equity share (40) (531)

Asset dispositions – equity share – (149)

Other 365 (1,626)

325 (2,306)

$ (53) $ (3,334)

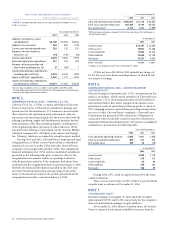

Theaggregateeffectsonincomestatementcategoriesfrom

specialitems,includingChevronTexaco’sproportionateshare

ofspecialitemsrelatedtoequityaffiliates,arereflectedinthe

followingtable.

Notes to the Consolidated Financial Statements

Millionsofdollars,exceptper-shareamounts

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – Continued