Chevron 2004 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 CHEVRONTEXACO CORPORATION 2004 ANNUAL REPORT

Management’s Discussion and Analysis of Financial Condition and Results of Operations

bediscussedagainatafutureEITFmeeting.Whilethisissueis

underdeliberation,theSECstaffdirectedChevronTexacoand

othercompaniesinitsJanuaryandFebruary2005commentletters

todiscloseonthefaceoftheincomestatementtheamountsasso-

ciatedwithbuy/sellcontractsandtodiscussinafootnotetothe

financialstatementsthebasisfortheunderlyingaccounting.

Withregardtothelatter,thecompany’saccountingtreat-

mentforbuy/sellcontractsisbasedontheviewthatsuch

transactionsaremonetaryinnature.Monetarytransactionsare

outsidethescopeofAPB29.Thecompanybelievesitsaccounting

isalsosupportedbytheindicatorsofgrossreportingofpurchases

andsalesinparagraph3ofEITFIssueNo.99-19,“Reporting

RevenueGrossasaPrincipalversusNetasanAgent.”Addition-

ally,FASBInterpretationNo.39,“OffsettingofAmountsRelated

toCertainContracts”(FIN39),prohibitsareceivablefrombeing

nettedagainstapayablewhenthereceivableissubjecttocredit

riskunlessarightofoffsetexiststhatisenforceablebylaw.The

companyalsoviewsnettingtheseparatecomponentsofbuy/sell

contractsintheincomestatementtobeinconsistentwiththe

grosspresentationthatFIN39requiresfortheresultingreceiv-

ableandpayableonthebalancesheet.

Thecompany’sbuy/selltransactionsarealsosimilarto

the“barrelback”exampleusedinotheraccountingliterature,

includingEITFIssueNo.03-11,“ReportingRealizedGainsand

LossesonDerivativeInstrumentsThatAreSubjecttoFASBState-

mentNo.133andNot‘HeldforTradingPurposes’asDefined

inIssueNo.02-3”(whichindicatesacompany’sdecisionto

showbuy/sell-typesoftransactionsgrossontheincomestate-

mentasbeingamatterofjudgmentoftherelevantfactsand

circumstancesofthecompany’sactivities)andDerivatives

ImplementationGroup(DIG)IssueNo.K1,“Miscellaneous:

DeterminingWhetherSeparateTransactionsShouldbeViewed

asaUnit.”

Thecompanyfurthernotesthattheaccountingforbuy/sell

contractsasseparatepurchasesandsalesisincontrasttothe

accountingforothertypesofcontractstypicallydescribedby

theindustryasexchangecontracts,whichareconsiderednon-

monetaryinnatureandappropriatelyshownnetontheincome

statement.Underanexchangecontract,forexample,onecom-

panyagreestoexchangerefinedproductsinonelocationfor

anothercompany’ssamequantityofrefinedproductsinanother

location.Upontransfer,theonlyamountsthatmaybeinvoiced

arefortransportationandqualitydifferentials.Amongother

things,unlikebuy/sellcontracts,theobligationsofeachparty

toperformunderthecontractarenotindependentandtherisks

andrewardsofownershiparenotseparatelytransferred.

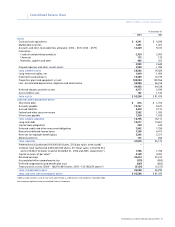

Asshownonthecompany’sConsolidatedStatementof

Income,“Salesandotheroperatingrevenues”forthethreeyears

endingDecember31,2004,included$18,650million,$14,246

millionand$7,963million,respectively,forbuy/sellcontracts.

Theserevenueamountsassociatedwithbuy/sellcontractsrepre-

sented12percentoftotal“Salesandotheroperatingrevenues”in

2004and2003and8percentin2002.Thecostsassociatedwith

thesebuy/sellrevenueamountsareincludedin“Purchasedcrude

oilandproducts”ontheConsolidatedStatementofIncomein

eachperiod.

OtherContingencies ChevronTexacoreceivesclaimsfrom,

andsubmitsclaimsto,customers,tradingpartners,U.S.federal,

stateandlocalregulatorybodies,hostgovernments,contractors,

insurers,andsuppliers.Theamountsoftheseclaims,indi-

viduallyandintheaggregate,maybesignificantandmaytake

lengthyperiodstoresolve.

Thecompanyanditsaffiliatesalsocontinuetoreviewand

analyzetheiroperationsandmayclose,abandon,sell,exchange,

acquireorrestructureassetstoachieveoperationalorstrategic

benefitsandtoimprovecompetitivenessandprofitability.These

activities,individuallyortogether,mayresultingainsorlossesin

futureperiods.

Virtuallyallaspectsofthebusinessesinwhichthecompany

engagesaresubjecttovariousfederal,stateandlocalenviron-

mental,healthandsafetylawsandregulations.Theseregulatory

requirementscontinuetoincreaseinbothnumberandcom-

plexityovertimeandgovernnotonlythemannerinwhichthe

companyconductsitsoperations,butalsotheproductsitsells.

Mostofthecostsofcomplyingwithlawsandregulationsper-

tainingtocompanyoperationsandproductsareembeddedin

thenormalcostsofdoingbusiness.

Accidentalleaksandspillsrequiringcleanupmayoccur

intheordinarycourseofbusiness.Inadditiontothecostsfor

environmentalprotectionassociatedwithitsongoingoperations

andproducts,thecompanymayincurexpensesforcorrective

actionsatvariousownedandpreviouslyownedfacilitiesandat

third-party-ownedwaste-disposalsitesusedbythecompany.

Anobligationmayarisewhenoperationsareclosedorsoldor

atnon-ChevronTexacositeswherecompanyproductshavebeen

handledordisposedof.Mostoftheexpenditurestofulfillthese

obligationsrelatetofacilitiesandsiteswherepastoperationsfol-

lowedpracticesandproceduresthatwereconsideredacceptable

atthetimebutnowrequireinvestigativeorremedialworkor

bothtomeetcurrentstandards.Usingdefinitionsandguidelines

establishedbytheAmericanPetroleumInstitute,ChevronTexaco

estimateditsworldwideenvironmentalspendingin2004at

approximately$1.1billionforitsconsolidatedcompanies.Included

intheseexpenditureswere$285millionofenvironmentalcapital

expendituresandapproximately$810millionofcostsassociated

withtheprevention,control,abatementoreliminationofhazard-

oussubstancesandpollutantsfromoperating,closedordivested

sitesandtheabandonmentandrestorationofsites.

For2005,totalworldwideenvironmentalcapitalexpenditures

areestimatedat$710million.Thesecapitalcostsareinaddition

totheongoingcostsofcomplyingwithenvironmentalregulations

andthecoststoremediatepreviouslycontaminatedsites.

Itisnotpossibletopredictwithcertaintytheamountof

additionalinvestmentsinneworexistingfacilitiesoramounts

ofincrementaloperatingcoststobeincurredinthefuture

to:prevent,control,reduceoreliminatereleasesofhazardous

materialsintotheenvironment;complywithexistingandnew

environmentallawsandregulations;orremediateandrestore

areasdamagedbypriorreleasesofhazardousmaterials.Although

thesecostsmaybesignificanttotheresultsofoperationsinany

singleperiod,thecompanydoesnotexpectthemtohaveamate-

rialeffectonthecompany’sliquidityorfinancialposition.