Chevron 2004 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHEVRONTEXACO CORPORATION 2004 ANNUAL REPORT 63

Includedinthe2004after-taxamountweregainstotaling

$257relatedtothesaleofaCanadiannatural-gasprocessing

business,awhollyownedsubsidiaryintheDemocraticRepublicof

theCongoandcertainproducingpropertiesintheGulfofMexico.

Notallassetssoldortobedisposedofareclassifiedasdiscon-

tinuedoperations,mainlybecausethecashflowsfromtheassets

werenot/willnotbeeliminatedfromtheongoingoperationsof

thecompany.

Equityinearnings,togetherwithinvestmentsinandadvances

tocompaniesaccountedforusingtheequitymethodandother

investmentsaccountedforatorbelowcost,areasfollows:

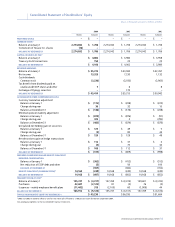

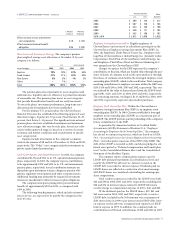

Investments and Advances Equity in Earnings

At December 31 Year ended December 31

2003 2003 2002

Tengizchevroil $ 3,363 $ 611 $ 490

Other 991 200 116

Total Exploration and

Production 4,354 811 606

LG-Caltex Oil Corporation 1,561 107 46

Caspian Pipeline Consortium 1,026 52 66

Star Petroleum Refining

Company Ltd. 457 8 (25)

Caltex Australia Ltd. 118 13 (156)

Other 1,069 100 110

Total Refining, Marketing

and Transportation 4,231 280 41

Chevron Phillips Chemical

Company LLC 1,747 24 2

Other 20 1 4

Total Chemicals 1,767 25 6

Dynegy Inc. 698 (56) (679)

Other 761 (31) 1

Total equity method $ 11,811 $ 1,029 $ (25)

Other at or below cost 508

Total investments and

advances $ 12,319

Total U.S. $ 3,905 $ 175 $ (559)

Total International $ 8,414 $ 854 $ 534

Descriptionsofmajoraffiliatesareasfollows:

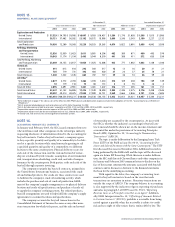

Tengizchevroil ChevronTexacohasa50percentequityownership

interestinTCO,ajointventureformedin1993todevelopthe

TengizandKorolevoilfieldsinKazakhstanovera40-yearperiod.

In2004,aspartofthefundingoftheexpansionofTCO’s

productionfacilities,ChevronTexacopurchasedfromTCO

$2,200of6.124percentSeriesBNotes,due2014,guaranteedby

TCO.

Interestonthenotesispayablesemiannually,

andprincipal

istoberepaidsemiannuallyinequalinstallmentsbeginningin

February2008.ImmediatelyfollowingthepurchaseoftheSeries

BNotes,ChevronTexacoreceivedfromTCOapproximately

$1,800representingarepaymentofsubordinatedloansfrom

thecompany,interestanddividends.The$2,200investmentin

theSeriesBNotes,whichthecompanyintendstoholdtotheir

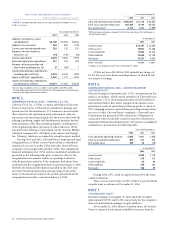

Inconnectionwithvariousreorganizationsandrestructurings

acrossseveralbusinessesandcorporatedepartments,thecom-

panyrecordedbefore-taxchargesof$258($146aftertax)during

2003forestimatedterminationbenefitsforapproximately4,500

employees.Nearlyhalfoftheliabilityrelatedtotheglobaldown-

streamsegment.Substantiallyalloftheemployeereductionsare

expectedtooccurbytheendof2005.

Atthebeginningof2004,a$100liabilityremainedfor

employeeseverancechargesrecordedin2002and2001associated

withthemergerbetweenChevronCorporationandTexacoInc.

Thebalancerelatedprimarilytodeferredpaymentoptionselected

bycertainemployeeswhowereterminatedbeforetheendof2003.

Approximately$80oftheliabilitywaspaidduring2004andthe

remainderinJanuary2005.

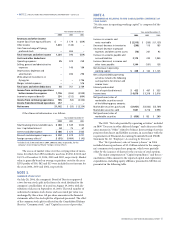

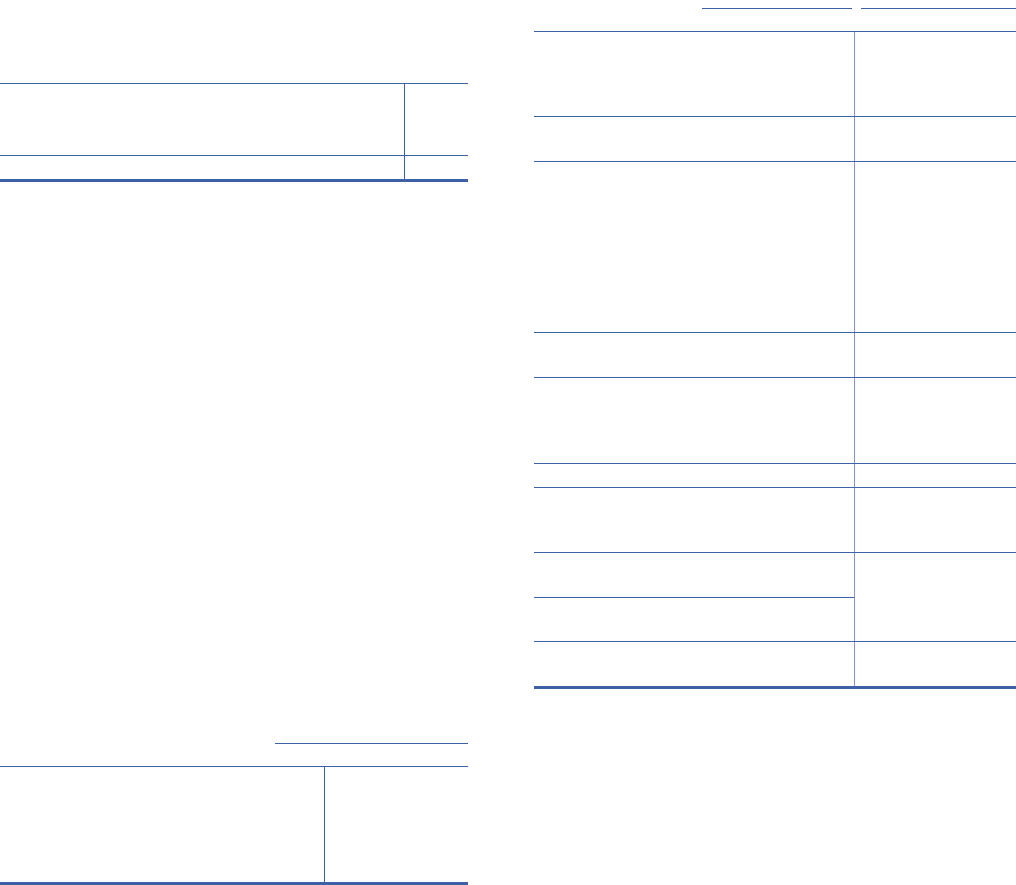

Activityforthecompany’sliabilityrelatedtoreorganizations

andrestructuringsin2004issummarizedinthefollowingtable:

Amountsbeforetax 2003

Balance at January 1 $ 6

Additions 258

Payments (24)

Balance at December 31 $ 240

SubstantiallyallofthebalanceatDecember31,2004,related

toemployeeseverancecoststhatwerepartofapresumedongoing

benefitarrangementunderapplicableaccountingrulesinFAS146,

“AccountingforCostsAssociatedwithExitorDisposalActivities,”

paragraph8,footnote7.Therefore,thecompanyaccountsfor

severancecostsinaccordancewithFAS88,“Employers’Accounting

forSettlementsandCurtailmentsofDefinedPensionPlansandfor

TerminationBenefits.”AtDecember31,2004,theamountwascat-

egorizedasacurrentaccruedliabilityontheConsolidatedBalance

Sheetandtheassociatedchargesduringtheperiodwerecategorized

as“Operatingexpenses”or“Selling,generalandadministrative

expenses”ontheConsolidatedStatementofIncome.

AtDecember31,2004,andDecember31,2003,thecompany

classified$162and$1,100,respectively,ofnetproperties,plant

andequipmentas“Assetsheldforsale”ontheConsolidatedBal-

anceSheet.Assetsinthiscategoryattheendof2004relatedto

agroupofservicestations.Theseassetsareexpectedtobedis-

posedofin2005.

Summarizedincomestatementinformationrelatingtodis-

continuedoperationsisasfollows:

Year ended December 31

2003 2002

Revenues and other income $ 485 $ 376

Income from discontinued operations

before income tax expense 94 56

Income from discontinued operations,

net of tax 44 30