Chevron 2004 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 CHEVRONTEXACO CORPORATION 2004 ANNUAL REPORT

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Inthethirdquarter2004,$300millionof6percentTexacoCapital

Inc.debt,dueJune2005,alsowasretired.

TexacoCapitalLLC,awhollyownedfinancesubsidiary,

issuedDeferredPreferredShares,SeriesC(SeriesC),inDecember

1995.InFebruary2005,thecompanyredeemedtheSeriesCand

accumulateddividendsatacostofapproximately$140million.

InJanuary2005,thecompanycontributed$98millionto

permittheESOPtomakea$144milliondebtservicepayment,

whichincludedaprincipalpaymentof$113million.

Inthesecondquarter2004,ChevronTexacoenteredinto

$1billionofinterestratefixed-to-floatingswaptransactions.

Underthetermsoftheswapagreements,ofwhich$250million

and$750millionterminateinSeptember2007andFebruary

2008,respectively,thenetcashsettlementwillbebasedonthe

differencebetweenfixed-rateandfloating-rateinterestamounts.

ChevronTexaco’sseniordebtisratedAAbyStandard

andPoor’sCorporationandAa2byMoody’sInvestorService,

exceptforseniordebtofTexacoCapitalInc.,whichisratedAa3.

ChevronTexaco’sU.S.commercialpaperisratedA-1+byStan-

dardandPoor’sandPrime1byMoody’s,andthecompany’s

CanadiancommercialpaperisratedR-1(middle)byDominion

BondRatingService.Alloftheseratingsdenotehigh-quality,

investment-gradesecurities.

Thecompany’sfuturedebtlevelisdependentprimarilyon

resultsofoperations,thecapital-spendingprogramandcashthat

maybegeneratedfromassetdispositions.Furtherreductions

fromdebtbalancesatDecember31,2004,aredependentupon

manyfactors,includingmanagement’scontinuousassessmentof

debtasanappropriatecomponentofthecompany’soverallcapi-

talstructure.Thecompanybelievesithassubstantialborrowing

capacitytomeetunanticipatedcashrequirements,andduring

periodsoflowpricesforcrudeoilandnaturalgasandnarrow

marginsforrefinedproductsandcommoditychemicals,the

companybelievesthatithastheflexibilitytoincreaseborrowings

ormodifycapital-spendingplansorbothtocontinuepayingthe

commonstockdividendandmaintainthecompany’shigh-quality

debtratings.

TengizchevroilFunding Aspartofthefundingoftheexpan-

sionofTengizchevroil’s(TCO)productionfacilities,inthefourth

quarter2004ChevronTexacopurchasedfromTCO$2.2billionof

6.124percentSeriesBNotes(SeriesB),due2014.Interestonthe

notesispayablesemiannually,andprincipalistoberepaidsemi-

annuallyinequalinstallmentsbeginninginFebruary2008.

ImmediatelyfollowingthepurchaseoftheSeriesB,Chevron-

TexacoreceivedfromTCOapproximately$1.8billion,representing

arepaymentofsubordinatedloansfromthecompany,interest

anddividends.The$2.2billioninvestmentintheSeriesBNotes,

whichthecompanyintendstoholduntilmaturity,andthe$1.8

billiondistributionwererecordedontheConsolidatedBalance

Sheetto“InvestmentsandAdvances.”

CommonStockRepurchaseProgram Thecompany

announcedastockrepurchaseprogramonMarch31,2004.

Acquisitionsofupto$5billionmaybemadefromtimeto

timeatprevailingprices,aspermittedbysecuritieslawsand

otherlegalrequirements,andsubjecttomarketconditionsand

otherfactors.Theprogramisforaperiodofuptothreeyears

andmaybediscontinuedatanytime.Thecompanypurchased

42,324,000sharesintheopenmarketfor$2.1billionthrough

December2004.PurchasesthroughFebruary2005increased

thetotalsharesacquiredto47,969,000for$2.4billion.

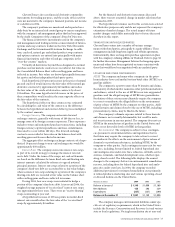

CapitalandExploratoryExpenditures Totalreported

expendituresfor2004were$8.3billion,including$1.56bil-

lionforthecompany’sshareofaffiliates’expenditures,which

didnotrequirecashoutlaysbythecompany.In2003and2002,

expenditureswere$7.4billionand$9.3billion,respectively,

includingthecompany’sshareofaffiliates’expendituresof

$1.1billionand$1.4billioninthecorrespondingperiods.Of

thetotal2004reportedexpenditures,$6.3billion,or76percent,

wasforupstreamactivities,comparedwith77percentin2003

and68percentin2002.Internationalupstreamaccountedfor

71percentoftheworldwideupstreamtotalin2004and2003and

70percentin2002,reflectingthecompany’scontinuingfocuson

internationalexplorationandproductionactivities.

Expendituresin2004increased13percentcompared

with2003,primarilydrivenbyhigherupstreamexpenditures.

Downstreamspendingincreased21percentfrom2003.Expen-

ditureswerehigherin2002thanin2003,dueinparttolarge

leaseacquisitionsintheNorthSeaandtheGulfofMexico,

spendingfortheAthabascaOilSandsProjectinwesternCanada,

andadditionalcommonstockinvestmentsinDynegy.

Includingitsshareofspendingbyaffiliates,thecompany

estimates2005capitalandexploratoryexpendituresat$10bil-

lion,whichisabout20percenthigherthan2004.About$7.4

billion,or74percentofthetotal,istargetedforexplorationand

productionactivities,with$4.9billionofthatamounttargeted

foroutsidetheUnitedStates.Theupstreamspendingistargeted

forthemostpromisingexploratoryprospectsinthedeepwater

GulfofMexicoandWestAfricaandmajordevelopmentprojects

inAngola,Nigeria,KazakhstanandthedeepwaterGulfofMexico.

Includedintheupstreamexpendituresisabout$400millionto

developthecompany’sinternationalnaturalgasresourcebase.

Worldwidedownstreamspendingin2005isestimatedat

$1.9billion,withabout$1.5billionforrefiningandmarketing

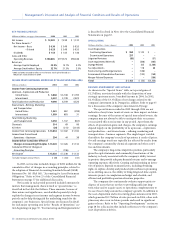

CapitalandExploratoryExpenditures

2003 2002

Millionsofdollars U.S. Int’l. Total U.S. Int’l. Total U.S. Int’l. Total

Exploration and Production $ 1,641 $ 4,034 $ 5,675 $ 1,888 $ 4,395 $ 6,283

Refining, Marketing and Transportation 403 697 1,100 750 882 1,632

Chemicals 173 24 197 272 37 309

All Other 371 20 391 855* 176* 1,031

Total $ 2,588 $ 4,775 $ 7,363 $ 3,765 $ 5,490 $ 9,255

Total, Excluding Equity in Affiliates $ 2,306 $ 3,920 $ 6,226 $ 3,312 $ 4,590 $ 7,902

*2002 conformed to 2004 presentation.