Chevron 2004 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

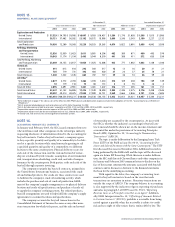

CHEVRONTEXACO CORPORATION 2004 ANNUAL REPORT 73

Pension Benefits Other

U.S. Int’l. Benefits

2005 $ 489 $ 144 $ 217

2006 $ 507 $ 150 $ 186

2007 $ 524 $ 160 $ 190

2008 $ 540 $ 171 $ 193

2009 $ 553 $ 180 $ 197

2010–2014 $ 2,912 $ 1,038 $ 1,028

EmployeeSavingsInvestmentPlan Eligibleemployeesof

ChevronTexacoandcertainofitssubsidiariesparticipateinthe

ChevronTexacoEmployeeSavingsInvestmentPlan(ESIP).In

2002,theEmployeesThriftPlanofTexacoInc.,EmployeesSav-

ingsPlanofChevronTexacoGlobalEnergyInc.(formerlyCaltex

Corporation),StockPlanofChevronTexacoGlobalEnergy,Inc.,

andEmployeesThriftPlanofFuelandMarineMarketingLLC

weremergedintotheChevronTexacoESIP.

ChargestoexpensefortheESIPrepresentthecompany’s

contributionstotheplan,whicharefundedeitherthroughthepur-

chaseofsharesofcommonstockontheopenmarketorthrough

thereleaseofcommonstockheldintheleveragedemployeestock

ownershipplan(LESOP),whichisdiscussedbelow.Totalcompany

matchingcontributionstoemployeeaccountswithintheESIPwere

$139,$136and$136in2004,2003and2002,respectively.Thiscost

wasreducedbythevalueofsharesreleasedfromtheLESOPtotal-

ing$(138),$(23)and$(73)in2004,2003and2002,respectively.

Theremainingamounts,totaling$1,$113and$63in2004,2003

and2002,respectively,representopenmarketpurchases.

EmployeeStockOwnershipPlan WithintheChevronTexaco

EmployeeSavingsInvestmentPlan(ESIP)isanemployeestock

ownershipplan(ESOP).In1989,Chevronestablishedaleveraged

employeestockownershipplan(LESOP)asaconstituentpartof

theESOP.TheLESOPprovidespartialprefundingofthecompany’s

futurecommitmentstotheESIP.

AspermittedbyAmericanInstituteofCertifiedPublic

Accountants(AICPA)StatementofPosition93-6,“Employers’

AccountingforEmployeeStockOwnershipPlans,”thecompany

haselectedtocontinueitspractices,whicharebasedonAICPA

76-3,“AccountingPracticesforCertainEmployeeStockOwnership

Plans,”andsubsequentconsensusoftheEITFoftheFASB.The

debtoftheLESOPisrecordedasdebt,andsharespledgedascol-

lateralarereportedas“Deferredcompensationandbenefitplan

trust”intheConsolidatedBalanceSheetandtheConsolidated

StatementofStockholders’Equity.

Thecompanyreportscompensationexpenseequalto

LESOPdebtprincipalrepaymentslessdividendsreceivedand

usedbytheLESOPfordebtservice.Interestaccruedonthe

LESOPdebtisrecordedasinterestexpense.Dividendspaidon

LESOPsharesarereflectedasareductionofretainedearnings.

AllLESOPsharesareconsideredoutstandingforearnings-per-

sharecomputations.

Total(credits)expensesrecordedfortheLESOPwere$(29),

$24and$98in2004,2003and2002,respectively,including$23,

$28and$32ofinterestexpenserelatedtoLESOPdebtanda

(credit)chargetocompensationexpenseof$(52),$(4)and$66.

OfthedividendspaidontheLESOPshares,$52,$61and

$49wereusedin2004,2003and2002,respectively,toservice

LESOPdebt.Includedinthe2004amountwasarepaymentof

debtenteredintoin1999topayinterestontheESOPdebt.Inter-

estexpenseonthisdebtwasrecognizedandreportedasLESOP

interestexpensein1999.Inaddition,thecompanymadeno

contributionsin2004andcontributionsof$26and$102in2003

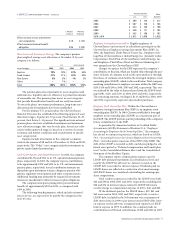

1 Percent 1 Percent

Increase Decrease

Effect on total service and interest

cost components $ 18 $ (15)

Effect on postretirement benefit

obligation $ 86 $ (98)

PlanAssetsandInvestmentStrategy Thecompany’spension

planweighted-averageassetallocationatDecember31byasset

categoryisasfollows:

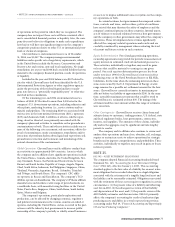

U.S. International

Asset Category 2003 2003

Equities 70% 55%

Fixed Income 21% 43%

Real Estate 8% 2%

Other 1% –

Total 100% 100%

Thepensionplansinvestprimarilyinassetcategorieswith

sufficientsize,liquidityandcostefficiencytopermitinvestments

ofreasonablesize.Thepensionplansinvestinassetcategories

thatprovidediversificationbenefitsandareeasilymeasured.

Toassesstheplans’investmentperformance,long-termasset

allocationpolicybenchmarkshavebeenestablished.

FortheprimaryU.S.pensionplan,theChevronTexaco

BoardofDirectorshasestablishedthefollowingapprovedasset

allocationranges:Equities40–70percent,FixedIncome20–65

percent,RealEstate0–15percent.Thesignificantinternational

pensionplansalsohaveestablishedmaximumandminimum

assetallocationrangesthatvarybyeachplan.Actualassetallo-

cationwithinapprovedrangesisbasedonavarietyofcurrent

economicandmarketconditionsandconsiderationofspecific

assetcategoryrisk.

Equitiesincludeinvestmentsinthecompany’scommon

stockintheamountof$8and$6atDecember31,2004and2003,

respectively.The“Other”assetcategoryincludesinvestmentsin

privateequitylimitedpartnerships.

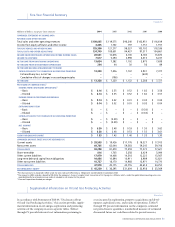

CashContributionsandBenefitPayments In2004,thecompany

contributed$1,332and$311toitsU.S.andinternationalpension

plans,respectively.In2005,thecompanyexpectscontributions

tobeapproximately$250and$150toitsU.S.andinternational

pensionplans,respectively.Actualcontributionamountsare

dependentuponinvestmentreturns,changesinpensionobli-

gations,regulatoryenvironmentsandothereconomicfactors.

Additionalfundingmayultimatelyberequiredifinvestment

returnsareinsufficienttooffsetincreasesinplanobligations.

Thecompanyanticipatespayingotherpostretirement

benefitsofapproximately$220in2005,ascomparedwith

$199in2004.

Thefollowingbenefitpayments,whichincludeestimated

futureservice,areexpectedtobepaidbythecompanyinthe

next10years:

EMPLOYEE BENEFIT PLANS – Continued