Chevron 2004 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHEVRONTEXACO CORPORATION 2004 ANNUAL REPORT 85

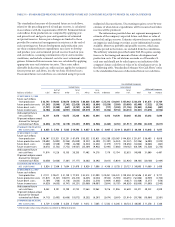

Thecompany’sresultsofoperationsfromoilandgasproduc-

ingactivitiesfortheyears2004,2003and2002areshownin

thefollowingtable.Netincomefromexplorationandproduc-

tionactivitiesasreportedonpage31reflectsincometaxes

computedonaneffectiveratebasis.InaccordancewithFAS69,

incometaxesinTableIIIarebasedonstatutorytaxrates,reflect-

ingallowabledeductionsandtaxcredits.Interestincomeand

expenseareexcludedfromtheresultsreportedinTableIIIand

fromthenetincomeamountsonpage31.

Consolidated Companies

United States International

Gulf of Total Asia- Total Affiliated Companies

Millionsofdollars Calif. Mexico Other U.S. Africa Pacific Indonesia Other Int’l. Total TCO Hamaca

Revenues from net

production

Sales

Transfers

Total

Production expenses

excluding taxes

Taxes other than on

income

Proved producing properties:

depreciation and depletion

Accretion expense2

Exploration expenses

Unproved properties

valuation

Other (expense) income3

Results before

income taxes

Income tax expense

Revenues from net

production

Sales $ 261 $ 2,197 $ 2,049 $ 4,507 $ 1,339 $ 1,442 $ 55 $ 2,556 $ 5,392 $ 9,899 $ 1,116 $ 104

Transfers 2,085 1,740 1,096 4,921 1,835 1,738 1,566 1,356 6,495 11,416 – –

Total 2,346 3,937 3,145 9,428 3,174 3,180 1,621 3,912 11,887 21,315 1,116 104

Production expenses

excluding taxes (631) (578) (750) (1,959) (505) (331) (616) (669) (2,121) (4,080) (117) (20)

Taxes other than on

income (28) (48) (280) (356) (22) (126) (1) (100) (249) (605) (29) –

Proved producing properties:

depreciation and depletion (224) (878) (430) (1,532) (327) (398) (314) (846) (1,885) (3,417) (97) (4)

Accretion expense2 (12) (37) (20) (69) (20) (5) (8) (26) (59) (128) (2) –

Exploration expenses (2) (168) (23) (193) (123) (130) (8) (117) (378) (571) – –

Unproved properties

valuation – (16) (4) (20) (20) (9) – (41) (70) (90) – –

Other (expense) income3 (18) (104) (51) (173) (173) (342) 2 (175) (688) (861) (4) (35)

Results before

income taxes 1,431 2,108 1,587 5,126 1,984 1,839 676 1,938 6,437 11,563 867 45

Income tax expense (528) (777) (585) (1,890) (1,410) (1,158) (289) (831) (3,688) (5,578) (260) –

$ 903 $ 1,331 $ 1,002 $ 3,236 $ 574 $ 681 $ 387 $ 1,107 $ 2,749 $ 5,985 $ 607 $ 45

1 The value of owned production consumed on lease as fuel has been eliminated from revenues and production expenses, and the related volumes have been deducted from net pro-

duction in calculating the unit average sales price and production cost. This has no effect on the results of producing operations.

2 See Note 25 on page 77, FAS 143, “Asset Retirement Obligations.”

3 Includes net sulfur income, foreign currency transaction gains and losses, certain significant impairment write-downs, miscellaneous expenses, etc. Also includes net income from

related oil and gas activities that do not have oil and gas reserves attributed to them (for example, net income from technical and operating service agreements) and items identi-

fied in the MD&A on pages 30 through 32.

4 2003 includes certain reclassifications to conform to 2004 presentation.