Chevron 2004 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHEVRONTEXACO CORPORATION 2004 ANNUAL REPORT 39

ChevronTexacoalsousesfinancialderivativecommodity

instrumentsfortradingpurposes,andtheresultsofthisactivity

werenotmaterialtothecompany’sfinancialposition,netincome

orcashflowsin2004.

Thecompany’spositionsaremonitoredandreportedona

dailybasisbyaninternalriskcontrolgrouptoensurecompliance

withthecompany’sriskmanagementpolicythathasbeenapproved

bytheAuditCommitteeofthecompany’sBoardofDirectors.

Thefinancialderivativeinstrumentsusedinthecompany’s

riskmanagementandtradingactivitiesconsistmainlyoffutures,

optionsandswapcontractstradedontheNewYorkMercantile

ExchangeandtheInternationalPetroleumExchange.Inaddi-

tion,crudeoil,naturalgasandrefinedproductswapcontracts

andoptionscontractsareenteredintoprincipallywithmajor

financialinstitutionsandotheroilandgascompaniesinthe

“over-the-counter”markets.

Virtuallyallderivativesbeyondthosedesignatedasnormal

purchaseandnormalsalecontractsarerecordedatfairvalueon

theConsolidatedBalanceSheetwithresultinggainsandlosses

reflectedinincome.Fairvaluesarederivedprincipallyfrommar-

ketquotesandotherindependentthird-partyquotes.

Eachhypothetical10percentincreaseinthepriceofnatural

gasandcrudeoilwouldincreasethefairvalueofthenaturalgas

derivativecontractsbyapproximately$40millionandreduce

thefairvalueofthecrudeoilderivativecontractsbyabout

$15million.Thesamehypotheticaldecreasesinthepricesof

thesecommoditieswouldresultinthesameoppositeeffectson

thefairvaluesofthecontracts.

Thehypotheticaleffectonthesecontractswasestimated

bycalculatingthecashvalueofthecontractsasthedifference

betweenthehypotheticalandcontractdeliverypricesmultiplied

bythecontractamounts.

ForeignCurrency Thecompanyentersintoforward

exchangecontracts,generallywithtermsof180daysorless,to

managesomeofitsforeigncurrencyexposures.Theseexposures

includerevenueandanticipatedpurchasetransactions,including

foreigncurrencycapitalexpendituresandleasecommitments

forecastedtooccurwithin180days.Theforwardexchange

contractsarerecordedatfairvalueonthebalancesheetwith

resultinggainsandlossesreflectedinincome.

Theaggregateeffectonforeignexchangecontractsofahypo-

thetical10percentchangetoyear-endexchangerateswouldbe

approximately$50million.

InterestRates Thecompanyentersintointerestrateswaps

aspartofitsoverallstrategytomanagetheinterestraterisk

onitsdebt.Underthetermsoftheswaps,netcashsettlements

arebasedonthedifferencebetweenfixed-rateandfloating-rate

interestamountscalculatedbyreferencetoagreednotional

principalamounts.Interestrateswapsrelatedtoaportionofthe

company’sfixed-ratedebtareaccountedforasfairvaluehedges,

whereasinterestrateswapsrelatingtoaportionofthecompany’s

floating-ratedebtarerecordedatfairvalueonthebalancesheet

withresultinggainsandlossesreflectedinincome.

During2004,fournewswapswereinitiatedtohedgea

portionofthecompany’sfixed-ratedebt.Atyear-end2004,the

weightedaveragematurityof“receivefixed”interestrateswaps

wasapproximatelythreeyears.Therewereno“receivefloating”

swapsoutstandingatyearend.

Ahypotheticalincreaseof10basispointsinmarket-fixed

interestrateswouldreducethefairvalueofthe“receivefixed”

swapsbyapproximately$4million.

Forthefinancialandderivativeinstrumentsdiscussed

above,therewasnotamaterialchangeinmarketriskfromthat

presentedin2003.

Thehypotheticalvariancesusedinthissectionwereselected

forillustrativepurposesonlyanddonotrepresentthecompany’s

estimationofmarketchanges.Theactualimpactoffuture

marketchangescoulddiffermateriallyduetofactorsdiscussed

elsewhereinthisreport.

ChevronTexacoentersintoanumberofbusinessarrange-

mentswithrelatedparties,principallyitsequityaffiliates.These

arrangementsincludelong-termsupplyandofftakeagreements.

Internationally,therearelong-termpurchaseagreementsinplace

withthecompany’srefiningaffiliateinThailand.Refertopage38

forfurtherdiscussion.Managementbelievestheforegoingagree-

mentsandothershavebeennegotiatedontermsconsistentwith

thosethatwouldhavebeennegotiatedwithanunrelatedparty.

MTBE Thecompanyandmanyothercompaniesinthepetro-

leumindustryhaveusedmethyltertiarybutylether(MTBE)asa

gasolineadditive.

Thecompanyisapartytomorethan70lawsuitsandclaims,

themajorityofwhichinvolvenumerousotherpetroleummarketers

andrefiners,relatedtotheuseofMTBEincertainoxygenated

gasolinesandtheallegedseepageofMTBEintogroundwater.

Resolutionoftheseactionsmayultimatelyrequirethecompany

tocorrectoramelioratetheallegedeffectsontheenvironment

ofpriorreleaseofMTBEbythecompanyorotherparties.Addi-

tionallawsuitsandclaimsrelatedtotheuseofMTBE,including

personal-injuryclaims,maybefiledinthefuture.

Thecompany’sultimateexposurerelatedtotheselawsuits

andclaimsisnotcurrentlydeterminable,butcouldbemate-

rialtonetincomeinanyoneperiod.Thecompanydoesnotuse

MTBEinthemanufactureofgasolineintheUnitedStatesand

therearenodetectablelevelsofMTBEinthatgasoline.

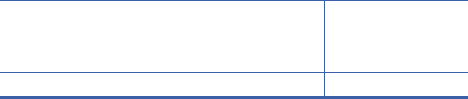

Environmental Thecompanyissubjecttolosscontingen-

ciespursuanttoenvironmentallawsandregulationsthatin

thefuturemayrequirethecompanytotakeactiontocorrect

oramelioratetheeffectsontheenvironmentofpriorreleaseof

chemicalsorpetroleumsubstances,includingMTBE,bythe

companyorotherparties.Suchcontingenciesmayexistforvari-

oussites,including,butnotlimitedto,federalSuperfundsites

andanalogoussitesunderstatelaws,refineries,oilfields,service

stations,terminals,andlanddevelopmentareas,whetheroper-

ating,closedorsold.Thefollowingtabledisplaystheannual

changestothecompany’sbefore-taxenvironmentalremediation

reserves,includingthoseforfederalSuperfundsitesandanalo-

goussitesunderstatelaws.In2004,thecompanyrecorded

additionalprovisionsforestimatedremediationcostsprimarily

atrefinedproductsmarketingsitesandvariousoperating,closed

ordivestedfacilitiesintheUnitedStates.

Millionsofdollars 2003 2002

Balance at January 1 $ 1,090 $ 1,160

Net Additions 296 229

Expenditures (237) (299)

$ 1,149 $ 1,090

Thecompanymanagesenvironmentalliabilitiesunderspe-

cificsetsofregulatoryrequirements,whichintheUnitedStates

includetheResourceConservationandRecoveryActandvarious

stateorlocalregulations.Nosingleremediationsiteatyear-end