Chevron 2004 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2004 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

During the year, we continued to lower refinery operating and maintenance

costs. Our turnaround process for refinery maintenance is considered world

class by the industry’s leading external refining benchmarking firm. We also

are driving greater efficiencies through our refinery network. In 2004, our

refineries improved energy efficiency by 2.5 percent compared with 2003, an

important achievement in a high fuel-price environment.

MARKETING We made significant strides in our marketing initiatives in 2004.

In July, we resumed marketing fuels under the Texaco brand in the United

States. By the end of the year, we were supplying more than 1,000 Texaco retail

sites, primarily in the Southeast, and had plans to supply additional sites in the

Southeast and West in 2005. We also received important recognition of our

Chevron fuel brand. It was the first in the United States and Canada to be certi-

fied by four of the world’s top automakers as meeting “TOP TIER” criteria for

gasoline detergency levels. We also made progress in selling nonstrategic retail

sites. At the end of 2004, we had sold nearly 1,600 sites since a divestiture pro-

gram began in 2003. At the same time, we maintained sales volumes through

our network of approximately 25,700 retail outlets, including affiliates.

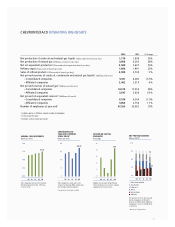

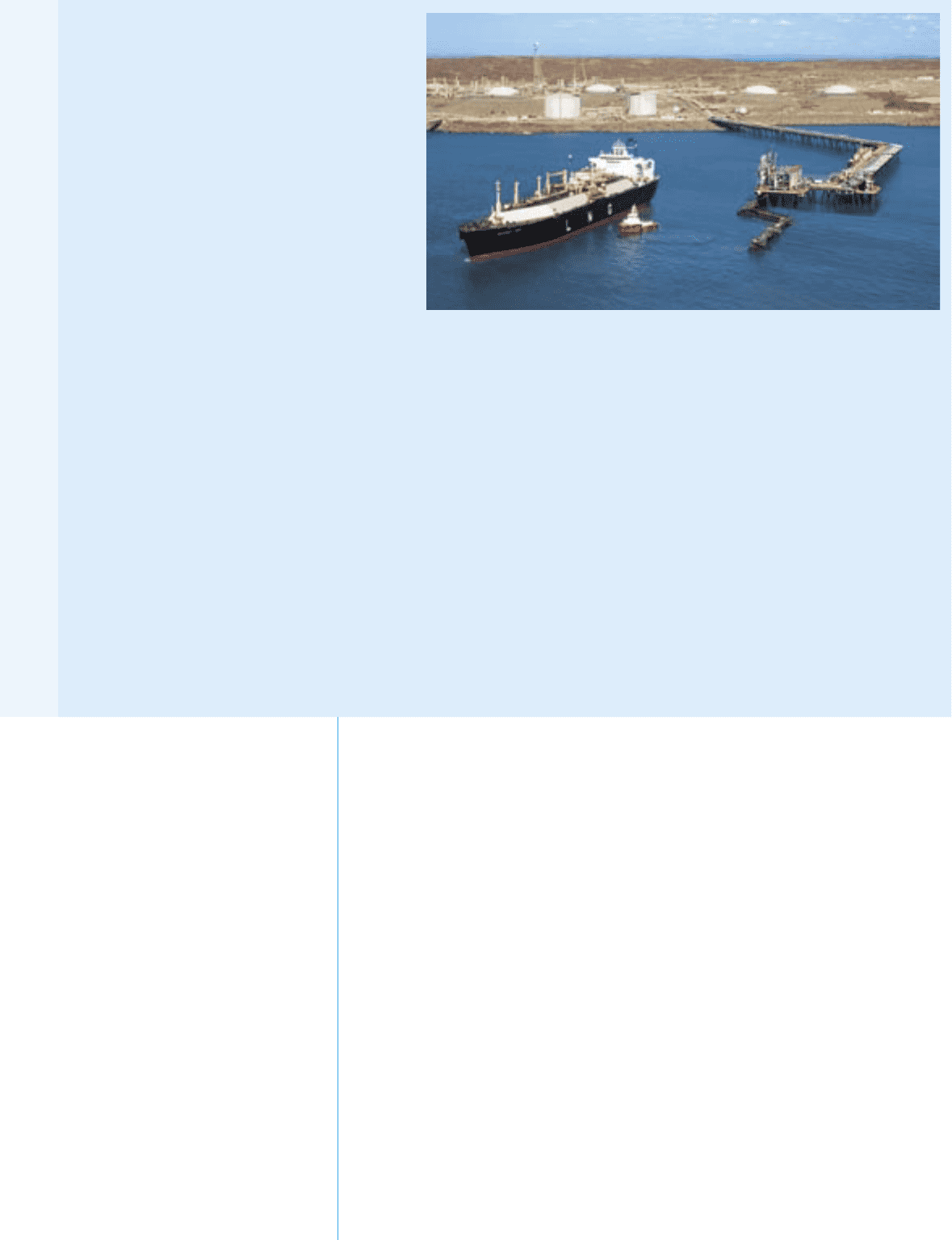

Over the next two decades, demand for natural gas

is expected to outpace demand for oil. The fastest-

growing markets will be Asia and the United States,

and ChevronTexaco is positioned to supply both.

We have large holdings of natural gas resources in

both the Pacific and Atlantic basins. Our strategy is

to commercialize them by targeting North American

and Asian markets.

In the Pacific Basin, our focus is on the Greater

Gorgon Area offshore Western Australia. We plan

to deliver liquefied natural gas (LNG) from Gorgon

to markets in Asia and on the West Coast of North

America. Also in Australia, we are part of the North

West Shelf Venture, which supplies LNG to Japan

and South Korea. In 2004, a fourth gas-processing

train was completed to expand LNG production,

and ChevronTexaco began operating the venture’s

> The Northwest

Swan is the

newest lique-

fied natural

gas carrier

in Australia’s

North West

Shelf Venture.

newest LNG carrier. In the Atlantic Basin, our strat-

egy is to deliver natural gas from West Africa and

Latin America to markets in North America. We

have received key permits for regasification termi-

nals on the West and Gulf coasts of North America

and have secured capacity in a planned regasifica-

tion terminal in Louisiana.

Gas-to-liquids (GTL) is the other important element

of our natural gas strategy. Through our Sasol

Chevron joint venture, we have a GTL project under

way in Nigeria and are evaluating projects in Qatar

and Australia.

Our LNG and GTL initiatives benefit from our experi-

ence across the natural gas value chain, including

our global shipping, power, and North America

marketing and pipeline operations.