Xerox 2005 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2005 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Xerox Corporation

91

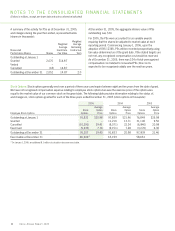

The 2005, 2004 and 2003 computation of diluted earnings per

share did not include the effects of 36 million, 38 million and

63 million stock options, respectively, because their respective

exercise prices were greater than the corresponding market value

per share of our common stock.

In 2003, the following potentially dilutive securities were not included

in the computation of diluted EPS because to do so would have been

anti-dilutive (in thousands of shares on weighted-average basis):

2003

Series C Mandatory Convertible Preferred Stock 43,656

Liability to subsidiary trust issuing

preferred securities – Trust II 113,426

Convertible subordinated debentures 1,992

Total 159,074

All such securities were dilutive or converted to common stock

in 2005 and 2004.

Note 21 – Divestitures and Other Sales

During the three years ended December 31, 2005, the following

significant divestitures occurred:

Integic: In March 2005, we completed the sale of our entire equity

interest in Integic Corporation (“Integic”) for $96 in cash, net of

transaction costs. The sale resulted in a pre-tax gain of $93

($58 after-tax). Prior to this transaction, our investment in Integic

was accounted for using the equity method and was included in

Investments in affiliates, at equity within our Consolidated Balance

Sheets. The pre-tax gain is classified within Other (income)

expenses, net in the accompanying Consolidated Statements

of Income.

ScanSoft: In April 2004, we completed the sale of our ownership

interest in ScanSoft, Inc. (“ScanSoft”) to affiliates of Warburg

Pincus for approximately $79 in cash, net of transaction costs.

Prior to the sale, we beneficially owned approximately 15% of

ScanSoft’s outstanding equity interests. The sale resulted in a

pre-tax gain of $38. Prior to this transaction, our investment in

ScanSoft was accounted for as an “available for sale” investment.

The gain is classified within Other (income) expenses, net in the

accompanying Consolidated Statements of Income.

ContentGuard: In March 2004, we sold all but 2% of our 75%

ownership interest in ContentGuard Inc, (“ContentGuard”) to

Microsoft Corporation and Time Warner Inc. for $66 in cash. The

sale resulted in a pre-tax gain of $109 as our investment reflected

the recognition of cumulative operating losses. The gain on

sale has been presented within the accompanying consolidated

statements of income considering the reporting requirements

related to discontinued operations of SFAS No. 144, “Accounting

for the Impairment or Disposal of Long-Lived Assets.” The

revenues, operating results and net assets of ContentGuard were

immaterial for all periods presented. ContentGuard, which was

originally created out of research developed at the Xerox Palo

Alto Research Center (“PARC”), licenses intellectual property and

technologies related to digital rights management. During 2005,

we sold our remaining interest in ContentGuard.

Xerox Engineering Systems: In the second quarter of 2003,

we sold our Xerox Engineering Systems (“XES”) subsidiaries

in France and Germany for a nominal amount and recognized

aloss of $12.

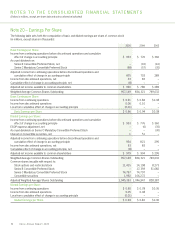

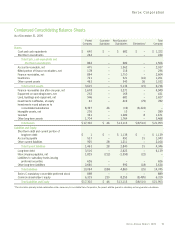

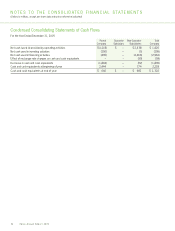

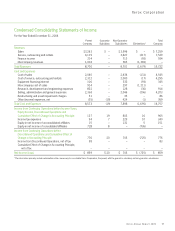

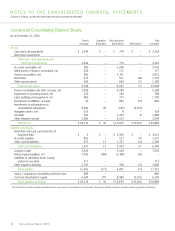

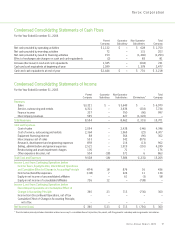

Note 22 – Financial Statements of

Subsidiary Guarantors

The Senior Notes due 2009, 2010, 2011 and 2013 are

guaranteed by Xerox International Joint Marketing, Inc. (“XIJM”)

(the “Guarantor Subsidiary”), which is wholly owned by Xerox

Corporation (the “Parent Company”). Effective December 31,

2005, one of the prior guarantors, Intelligent Electronics, Inc.,

was merged into the Parent Company based on an internal

reorganization. This resulted in a retroactive restatement of the

condensed consolidating financial information to reflect XIJM

as the sole guarantor subsidiary as of December 31, 2005. The

following supplemental financial information sets forth, on a con-

densed consolidating basis, statements of income, the balance

sheets and statements of cash flows for the Parent Company,

the Guarantor Subsidiary,the non-guarantor subsidiaries and

total consolidated Xerox Corporation and subsidiaries for the

years ended December 31, 2005, 2004 and 2003 and as of

December 31, 2005 and December 31, 2004.

Xerox Annual Report 2005