Xerox 2005 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2005 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

76

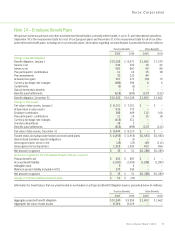

Assumptions

Weighted-average assumptions used Pension Benefits Other benefits

to determine benefit obligations at the

plan measurement dates 2005 2004 2003 2005 2004 2003

Discount rate 5.2% 5.6% 5.8% 5.6% 5.8% 6.0%

Rate of compensation increase 3.9 4.0 3.9 –(1) –(1) –(1)

(1) Rate of compensation increase is not applicable to our other benefits, as compensation levels do not impact earned benefits.

Weighted-average assumptions used Pension Benefits Other Benefits

to determine net periodic benefit cost

for years ended December 31 2006 2005 2004 2003 2006 2005 2004 2003

Discount rate 5.2% 5.6% 5.8% 6.2% 5.6% 5.8% 6.0% 6.5%

Expected return on plan assets 7.8 8.0 8.1 8.3 –(1) –(1) –(1) –(1)

Rate of compensation increase 3.9 4.0 3.9 3.9 –(2) –(2) –(2) –(2)

(1) Expected return on plan assets is not applicable to our other benefits, as these plans are unfunded.

(2) Rate of compensation increase is not applicable to our other benefits, as compensation levels do not impact earned benefits.

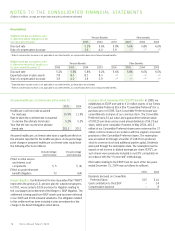

Employee Stock Ownership Plan (“ESOP”) Benefits: In 1989, we

established an ESOP and sold to it 10 million shares of our Series

BConvertible Preferred Stock (the “Convertible Preferred”) for a

purchase price of $785. Each Convertible Preferred share was

convertible into 6 shares of our common stock. The Convertible

Preferred had a $1 par value and a guaranteed minimum value

of $78.25 per share and accrued annual dividends of $6.25 per

share, which were cumulative if earned. In May 2004, all 6.2

million of our Convertible Preferred shares were redeemed for 37

million common shares in accordance with the original conversion

provisions of the Convertible Preferred shares. The redemption

was accounted for through a transfer of $483 from preferred

stock to common stock and additional paid-in-capital. Dividends

werepaid through the redemption date. The redemption had no

impact on net income or diluted earnings per share (“EPS”), as

such shares were previously included in our EPS computation in

accordance with the “if converted” methodology.

Information relating to the ESOP trust for each of the two years

ended December 31, 2004 was as follows (in millions):

2004 2003

Dividends declared on Convertible

Preferred Stock $15 $ 41

Cash contribution to the ESOP – 14

Compensation expense – 8

Assumed healthcare cost trend rates at December 31

2005 2004

Healthcare cost trend rate assumed

for next year 10.9% 11.9%

Rate to which the cost trend rate is assumed

to decline (the ultimate trend rate) 5.2% 5.2%

Year that the rate reaches the ultimate

trend rate 2011 2011

Assumed healthcarecost trend rates have a significant effect on

the amounts reported for the healthcare plans. A one-percentage

point change in assumed healthcarecost trend rates would have

the following effects (in millions):

One-percentage One-percentage

point increase point decrease

Effect on total service

and interest cost

components $ 5 $ (4)

Effect on post-retirement

benefit obligation 73 (64)

Berger Litigation: Our Retirement Income Guarantee Plan (“RIGP”)

represents the primary U.S. pension plan for salaried employees.

In 2003, we recorded a $239 provision for litigation relating to

the court-approved settlement of the Berger v. RIGP litigation. The

settlement is being paid from RIGP assets and has been reflected

in our 2005 and 2004 actuarial valuations. The obligation related

to this settlement has been included in plan amendments in the

change in the benefit obligation noted above.

Xerox Annual Report 2005