Xerox 2005 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2005 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Xerox Corporation

55

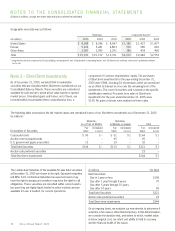

Other intangible assets primarily consist of assets obtained in con-

nection with business acquisitions, including installed customer

base and distribution network relationships, patents on existing

technology and trademarks. We apply an impairment evaluation

whenever events or changes in business circumstances indicate

that the carry value of our intangible assets may not be recover-

able. Other intangible assets are amortized on a straight-line basis

over their estimated economic lives. The straight-line method

of amortization reflects an appropriate allocation of the cost of

the intangible assets to earnings in proportion to the amount

of economic benefits obtained annually by the Company.

Impairment of Long-Lived Assets: We review the recoverability of

our long-lived assets, including buildings, equipment, internal-use

software and other intangible assets, when events or changes in

circumstances occur that indicate that the carrying value of the

asset may not be recoverable. The assessment of possible impair-

ment is based on our ability to recover the carrying value of the

asset from the expected future pre-tax cash flows (undiscounted

and without interest charges) of the related operations. If these

cash flows are less than the carrying value of such asset, an

impairment loss is recognized for the difference between estimated

fair value and carrying value. Our primary measureof fair value is

based on discounted cash flows. The measurement of impairment

requires management to make estimates of these cash flows related

to long-lived assets, as well as other fair value determinations.

Treasury Stock: We account for repurchased common stock

under the cost method and include such Treasury stock as a

component of our Common shareholders’ equity.Retirement

of Treasury stock is recorded as a reduction of Common stock

and Additional paid-in-capital.

Research and Development Expenses: Research and

development costs are expensed as incurred.

Restructuring Charges: Costs associated with exit or disposed

activities, including lease termination costs and certain employee

severance costs associated with restructuring, plant closing or

other activity,are recognized when they are incurred. In those

geographies where we have either a formal severance plan or a

history of consistently providing severance benefits representing

asubstantive plan, we recognize severance costs when they are

both probable and reasonably estimable.

Pension and Post-retirement Benefit Obligations: We sponsor

pension plans in various forms in several countries covering

substantially all employees who meet eligibility requirements.

Post-retirement benefit plans cover primarily U.S. employees for

retirement medical costs. As permitted by existing accounting

rules, we employ a delayed recognition feature in measuring

the costs and obligations of pension and post-retirement benefit

plans. This requires changes in the benefit obligations and

changes in the value of assets set aside to meet those obligations

to be recognized not as they occur, but systematically and

gradually over subsequent periods. All changes are ultimately

recognized, except to the extent they may be offset by sub-

sequent changes. At any point, changes that have been identified

and quantified await subsequent accounting recognition as net

cost components and as liabilities or assets.

Several statistical and other factors that attempt to anticipate

future events are used in calculating the expense, liability and

asset values related to our pension and post-retirement benefit

plans. These factors include assumptions we make about the

discount rate, expected return on plan assets, rate of increase

in healthcare costs, the rate of future compensation increases,

and mortality, among others. Actual returns on plan assets are

not immediately recognized in our income statement, due to the

delayed recognition requirement. In calculating the expected

return on the plan asset component of our net periodic pension

cost, we apply our estimate of the long-term rate of return to the

plan assets that support our pension obligations, after deducting

assets that are specifically allocated to Transitional Retirement

Accounts (which are accounted for based on specific plan terms).

For purposes of determining the expected return on plan assets,

we utilize a calculated value approach in determining the value

of the pension plan assets, as opposed to a fair market value

approach. The primary difference between the two methods

relates to systematic recognition of changes in fair value over

time (generally two years) versus immediate recognition of

changes in fair value. Our expected rate of return on plan assets

is then applied to the calculated asset value to determine the

amount of the expected return on plan assets to be used in the

determination of the net periodic pension cost. The calculated

value approach reduces the volatility in net periodic pension cost

that results from using the fair market value approach.

The difference between the actual return on plan assets and the

expected return on plan assets is added to, or subtracted from,

any cumulative differences that arose in prior years. This amount

is a component of the unrecognized net actuarial (gain) loss

and is subject to amortization to net periodic pension cost over

the remaining service lives of the employees participating in the

pension plan.

The discount rate is used to present-value our future anticipated

benefit obligations. In estimating our discount rate, we consider

rates of return on high-quality fixed-income investments included

in various published bond indexes, adjusted to eliminate the

effects of call provisions and differences in the timing and amounts

of cash outflows related to the bonds, as well as the expected

timing of pension and other benefit payments. In the U.S. and the

U.K., which comprise approximately 81% of our projected benefit

obligation, we consider the Moody’s Aa Corporate Bond Index

and the International Index Company’s iBoxx Sterling Corporates

AA Cash Bond Index, respectively, in the determination of the

appropriate discount rate assumptions.

Xerox Annual Report 2005