Xerox 2005 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2005 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Xerox Corporation

93

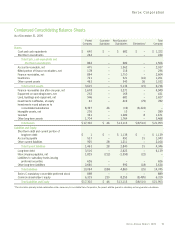

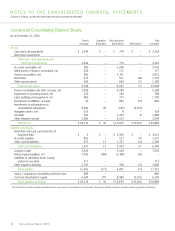

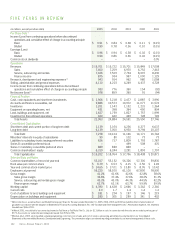

Condensed Consolidating Balance Sheets

As of December 31, 2005

Parent Guarantor Non-Guarantor Total

Company Subsidiary Subsidiaries Eliminations* Company

Assets

Cash and cash equivalents $ 640 $ – $ 682 $ – $ 1,322

Short-term investments 244 – – – 244

Total Cash, cash equivalents and

Short-term investments 884 – 682 – 1,566

Accounts receivable, net 475 – 1,562 – 2,037

Billed portion of finance receivables, net 178 – 118 – 296

Finance receivables, net 894 – 1,710 – 2,604

Inventories 721 – 521 (41) 1,201

Other current assets 463 – 543 26 1,032

Total Current assets 3,615 – 5,136 (15) 8,736

Finance receivables due after one year,net 1,678 – 3,271 – 4,949

Equipment on operating leases, net 263 – 168 – 431

Land, buildings and equipment, net 946 – 681 – 1,627

Investments in affiliates, at equity 42 – 819 (79) 782

Investments in and advances to

consolidated subsidiaries 8,397 46 (19) (8,424) –

Intangible assets, net 276 – 13 – 289

Goodwill 381 – 1,282 8 1,671

Other long-term assets 1,704 – 1,764 – 3,468

Total Assets $ 17,302 $ 46 $ 13,115 $ (8,510) $ 21,953

Liabilities and Equity

Short-term debt and current portion of

long-term debt $ 1 $ – $ 1,138 $ – $ 1,139

Accounts payable 537 – 491 15 1,043

Other current liabilities 925 28 1,211 – 2,164

Total Current liabilities 1,463 28 2,840 15 4,346

Long-term debt 3,516 – 2,623 – 6,139

Intercompany payables, net 1,829 (212) (1,595) (22) –

Liabilities to subsidiary trusts issuing

preferred securities 626 – – – 626

Other long-term liabilities 2,660 – 992 (18) 3,634

Total Liabilities 10,094 (184) 4,860 (25) 14,745

Series C mandatory convertible preferred stock 889 – – – 889

Common shareholders’ equity 6,319 230 8,255 (8,485) 6,319

Total Liabilities and Equity $17,302 $ 46 $13,115 $(8,510) $21,953

*The information primarily includes elimination entries necessary to consolidate Xerox Corporation, the parent, with the guarantor subsidiary and non-guarantor subsidiaries.

Xerox Annual Report 2005