Xerox 2005 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2005 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

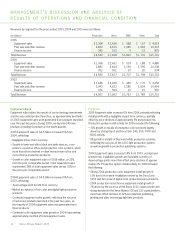

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

RESULTS OF OPERATIONS AND FINANCIAL CONDITION

40

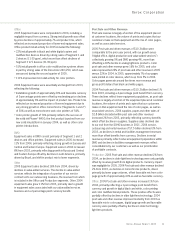

•Partially offsetting these items were lower tax payments of $96

million due to refunds from audit and other tax settlements, as

well as the timing of payments associated with restructuring.

•Partially offsetting lower pension contributions of $21 million.

For the year ended December 31, 2004, net cash provided by

operating activities decreased $129 million from 2003, primarily

as a result of the following:

•Lower finance receivable reductions of $159 million reflecting

the increase in equipment sale revenue in 2004.

•Higher cash usage related to inventory of $100 million to

support new products.

•Increased tax payments of $46 million due to increased income.

•Lower cash generation from the early termination of interest

rate swaps of $62 million.

•Lower pension plan contributions of $263 million, partially

offsetting the above cash outflows.

We expect 2006 operating cash flows to be at the high end of the

range of $1.2 billion to $1.5 billion, as compared to $1.4 billion in

2005. This expectation reflects cash generation from a decrease

in finance receivables that offsets cash usage from an increase

in equipment on operating leases, resulting in a neutral impact on

net operating cash flow.Since finance receivables and on-lease

equipment are expected to be leveraged at a 7:1 debt-to-equity

ratio, if these items collectively use or provide cash the overall

impact on our total cash flows should be minimal, since our debt

should also increase or decrease as appropriate to maintain our

current leverage.

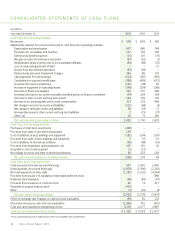

For the year ended December 31, 2005, net cash from investing

activities decreased $498 million from 2004 primarily as a result

of the following:

•$247 million from the net purchases of short-term investments

which were intended to increase our return on available cash.

•Decrease of $143 million due to a lower net reduction of escrow

and other restricted investments due to the 2004 renegotiation of

certain secured borrowing arrangements and scheduled releases

from an escrow account of supporting interest payments on our

prior liability to a trust issuing preferred securities.

•Decrease of $86 million due to lower proceeds from divestitures

and investments, net, reflecting:

–2005 proceeds of $105 million primarily consisting

of $96 million from the sale of our equity interest in

Integic Corporation.

–2004 proceeds of $191 million primarily consisting of

$66 million from the ContentGuardsale, $79 million from

the ScanSoft sale and $36 million from a preferred

stock investment.

•Decrease of $48 million due to lower proceeds from the sale

of excess land and buildings.

•Partially offsetting these items was a $15 million decrease in

capital and internal use software expenditures.

We expect 2006 capital expenditures including internal use

software to approximate $250 million.

For the year ended December 31, 2004, net cash from investing

activities increased $154 million from 2003, primarily as a result

of the following:

•An increase of $156 million in proceeds from the sale of busi-

nesses and investments, consisting of the $191 million referred

to above, as offset by $35 million of proceeds from the 2003

divestitures of investments in South Africa, France and Germany.

•An increase of $43 million of proceeds from the sale of certain

excess land and buildings.

•Partially offsetting these items was a $12 million decrease due

to the acquisition of an additional interest in Xerox India in 2004,

and a $31 million decrease due to a lower net reduction of

escrow and other restricted investments. 2003 investing cash

flows included $235 million related to our former reinsurance

obligations with our discontinued operations.

For the year ended December 31, 2005, net cash used in

financing activities increased $1.7 billion from 2004, primarily

as a result of the following:

•A$1.5 billion reduction in proceeds from new secured

financings, reflecting a rebalancing of our secured and

unsecured debt portfolio.

•$433 million cash usage for the acquisition of common stock

under the authorized October 2005 share repurchase program.

•Apartially offsetting $235 million decrease in net payments on

term and other debt reflecting lower debt maturity obligations.

For the year ended December 31, 2004, net cash used in

financing activities decreased $1.2 billion from 2003, primarily

as a result of the following:

•A$2.6 billion decrease in net payments of term and other debt.

•$889 million in proceeds received on the issuance of mandatory

redeemable preferred stock in 2003.

•Apartially offsetting decrease of $404 million in proceeds from

the issuance of common stock and a decrease of $114 million

in net proceeds from secured financing.

Xerox Annual Report 2005