Xerox 2005 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2005 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Xerox Corporation

97

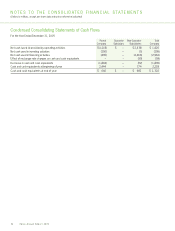

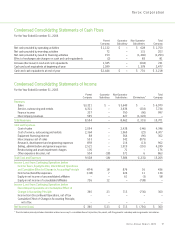

Condensed Consolidating Statements of Cash Flows

For the Year Ended December 31, 2004

Parent Guarantor Non-Guarantor Total

Company Subsidiary Subsidiaries Company

Net cash provided by operating activities $ 1,122 $ – $ 628 $ 1,750

Net cash provided by investing activities 72 – 131 203

Net cash provided by (used in) financing activities 153 – (1,446) (1,293)

Effect of exchange rate changes on cash and cash equivalents (2) – 83 81

Increase (decrease) in cash and cash equivalents 1,345 – (604) 741

Cash and cash equivalents at beginning of year 1,099 – 1,378 2,477

Cash and cash equivalents at end of year $2,444 $ – $ 774 $ 3,218

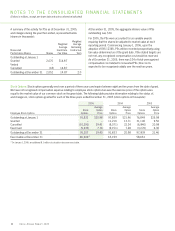

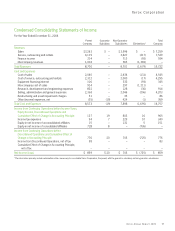

Condensed Consolidating Statements of Income

For the Year Ended December 31, 2003

Parent Guarantor Non-Guarantor Total

Company Subsidiary Subsidiaries Eliminations* Company

Revenues

Sales $3,321 $ – $ 3,649 $ – $ 6,970

Service, outsourcing and rentals 4,301 – 3,636 (203) 7,734

Finance income 337 – 750 (90) 997

Intercompany revenues 595 – 427 (1,022) –

Total Revenues 8,554 – 8,462 (1,315) 15,701

Cost and Expenses

Cost of sales 2,054 – 2,438 (146) 4,346

Cost of service, outsourcing and rentals 2,364 – 1,965 (22) 4,307

Equipment financing interest 88 – 364 (90) 362

Intercompany cost of sales 533 – 342 (875) –

Research, development and engineering expenses 859 – 116 (13) 962

Selling, administrative and general expenses 2,521 – 1,919 (191) 4,249

Restructuring and asset impairment charges 105 – 71 – 176

Other expenses (income), net 504 (18) 371 6 863

Total Cost and Expenses 9,028 (18) 7,586 (1,331) 15,265

Income (Loss) from Continuing Operations before

Income Taxes, Equity Income, Discontinued Operations

and Cumulative Effect of Change in Accounting Principle (474) 18 876 16 436

Income tax (benefits) expenses (108) 7 224 11 134

Equity in net income of unconsolidated affiliates – – 61 (3) 58

Equity in net income of consolidated affiliates 726 12 – (738) –

Income (Loss) from Continuing Operations before

Discontinued Operations and Cumulative Effect of

Change in Accounting Principle 360 23 713 (736) 360

Income from Discontinued Operations, net of tax – – – – –

Cumulative Effect of Change in Accounting Principle,

net of tax – – – – –

Net Income (Loss) $360 $ 23 $ 713 $ (736) $ 360

*The information primarily includes elimination entries necessary to consolidate Xerox Corporation, the parent, with the guarantor subsidiary and non-guarantor subsidiaries.

Xerox Annual Report 2005