Xerox 2005 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2005 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Xerox Corporation

61

Note 5 – Inventories and Equipment on

Operating Leases, Net

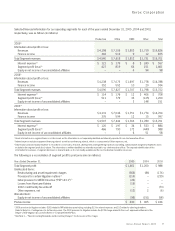

Inventories at December 31, 2005 and 2004 were as follows

(in millions):

2005 2004

Finished goods $ 956 $ 895

Work-in-process 99 65

Raw materials 146 183

Total Inventories $ 1,201 $ 1,143

Equipment on operating leases and similar arrangements

consists of our equipment rented to customers and depreciated

to estimated salvage value at the end of the lease term.

The transfer of equipment from our inventories to equipment

subject to an operating lease is presented in our Consolidated

Statements of Cash Flows in the operating activities section as a

non-cash adjustment. We recorded $56, $73 and $78 in inventory

write-down charges for the years ended December 31, 2005,

2004 and 2003, respectively. Equipment on operating leases

and the related accumulated depreciation at December 31, 2005

and 2004 were as follows (in millions):

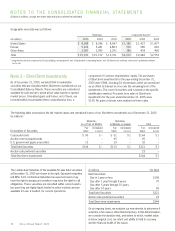

2005 2004

Equipment on operating leases $ 1,262 $ 1,649

Less: Accumulated depreciation (831) (1,251)

Equipment on operating leases, net $ 431 $ 398

Depreciable lives generally vary from three to four years consistent

with our planned and historical usage of the equipment subject to

operating leases. Depreciation and obsolescence expense was

$205, $210 and $271 for the years ended December 31, 2005,

2004 and 2003, respectively.Our equipment operating lease

terms vary, generally from 12 to 36 months. Scheduled minimum

futurerental revenues on operating leases with original terms of

one year or longer are(in millions):

2006 2007 2008 2009 2010 Thereafter

$386 $212 $130 $60 $27 $4

Total contingent rentals on operating leases, consisting principally

of usage charges in excess of minimum contracted amounts, for

the years ended December 31, 2005, 2004 and 2003 amounted

to $136, $137 and $235, respectively.

Note 6 – Land, Buildings and

Equipment, Net

Land, buildings and equipment, net at December 31, 2005 and

2004 were as follows (in millions):

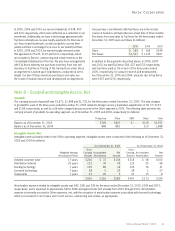

Estimated

Useful Lives

(Years) 2005 2004

Land $ 51 $ 53

Buildings and building

equipment 25 to 50 1,163 1,167

Leasehold improvements Varies 326 313

Plant machinery 5 to 12 1,637 1,667

Office furniture and equipment 3 to 15 967 1,072

Other 4 to 20 76 74

Construction in progress 83 96

Subtotal 4,303 4,442

Less: Accumulated depreciation (2,676) (2,683)

Land, buildings and equipment, net $ 1,627 $ 1,759

Depreciation expense was $280, $305 and $299 for the years

ended December 31, 2005, 2004 and 2003, respectively. We

lease certain land, buildings and equipment, substantially all of

which are accounted for as operating leases. Total rent expense

under operating leases for the years ended December 31, 2005,

2004 and 2003 amounted to $267, $316, and $287, respec-

tively. Future minimum operating lease commitments that have

remaining non-cancelable lease terms in excess of one year at

December 31, 2005 were as follows (in millions):

2006 2007 2008 2009 2010 Thereafter

$197 $165 $124 $102 $90 $197

In certain circumstances, we sublease space not currently

required in operations. Future minimum sublease income under

leases with non-cancelable terms in excess of one year amounted

to $14 at December 31, 2005.

We have an information technology contract with Electronic

Data Systems Corp. (“EDS”) through June 30, 2009. Services

to be provided under this contract include support of global

mainframe system processing, application maintenance, desktop

and helpdesk support, voice and data network management

and server management. Thereareno minimum payments due

EDS under the contract. Payments to EDS, which are primarily

recorded in selling, administrative and general expenses, were

$305, $328 and $340 for the years ended December 31, 2005,

2004 and 2003, respectively.

Xerox Annual Report 2005