Xerox 2005 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2005 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Xerox Corporation

71

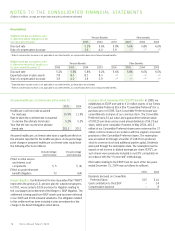

Cash Flow Hedges: During 2005, pay fixed/receive variable-

interest rate swaps with notional amounts of £200 million ($345)

and a net liability fair value of $(1), associated with the Xerox

Finance Limited GE Capital borrowing, were designated and

accounted for as cash flow hedges. The swaps were structured

to hedge the LIBOR interest rate of the debt by converting it from

avariable-rate instrument to a fixed-rate instrument. No ineffective

portion was recorded to earnings during 2005.

Terminated Swaps: During 2005, we terminated interest rate

swaps with a notional value of $1.3 billion and a net fair liability

value of $29 which had previously been designated as fair-value

hedges of certain indebtedness. The fair-value adjustment to

these debt instruments will be amortized to interest expense over

the remaining term of the notes. During 2004, we terminated

interest rate swaps with a notional value of $1.1 billion and a net

fair asset value of $68. Interest rate swaps with a notional value

of $600 and a net fair asset value of $55 had previously been

designated as fair-value hedges against the Senior Notes due

2009. In 2005 and 2004, the amortization of these fair-value

adjustments reduced interest expense by $11 and $9, respec-

tively.The remaining derivatives terminated in 2005 and 2004

had not been previously designated as hedges and accordingly

those terminations had no impact on earnings as they were being

marked to market through earnings each period.

Foreign Exchange Risk Management: Wemay use certain

derivative instruments to manage the exposures associated

with the foreign currency exchange risks discussed below.

Issuance of Foreign Currency Denominated Debt

•Weenter into cross-currency interest rate swap agreements

to swap the proceeds and related interest payments with a

counterparty. In return, we receive and effectively denominate

the debt in local functional currencies.

•We utilize forward exchange contracts to hedge the

currency exposure for interest payments on foreign currency

denominated debt.

•These derivatives may be designated as fair-value hedges

or cash flow hedges depending on the nature of the risk

being hedged.

Foreign Currency Denominated Assets and Liabilities

•Wegenerally utilize forwardforeign exchange contracts and

purchased option contracts to hedge these exposures.

•Changes in the value of these currency derivatives are recorded

in earnings together with the offsetting foreign exchange gains

and losses on the underlying assets and liabilities.

Purchases of Foreign-Sourced Inventory

•We generally utilize forward foreign exchange contracts

and purchased option contracts to hedge these anticipated

transactions. These contracts generally mature in six

months or less.

•Although these contracts are intended to economically hedge

foreign currency risks to the extent possible, the differences

between the contract terms of our derivatives and the

underlying forecasted exposures reduce our ability to obtain

hedge accounting. Accordingly, changes in value for these

derivatives are recorded directly through earnings.

During 2005, 2004 and 2003, we recorded net currency losses

of $5, $73 and $11, respectively. Net currency losses primarily

result from the mark-to-market of foreign exchange contracts

utilized to hedge foreign currency denominated assets and

liabilities, the re-measurement of foreign currency-denominated

assets and liabilities and the mark-to-market impact of economic

hedges of anticipated transactions for which we do not apply

cash flow hedge accounting treatment.

At December 31, 2005, we had outstanding forward exchange and

purchased option contracts with gross notional values of $2,927.

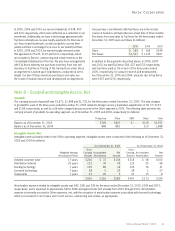

The following is a summary of the primary hedging positions and

corresponding fair values held as of December 31, 2005:

(in millions)

Gross Fair Value

Notional Asset

Currency Hedged (Buy/Sell) Value (Liability)

U.S. Dollar/Euro $ 634 $10

Japanese Yen/U.S. Dollar 467 2

Euro/U.S. Dollar 225 (2)

Canadian Dollar/Euro 205 (1)

Euro/U.K. Pound Sterling 199 2

Canadian Dollar/U.S. Dollar 166 –

Swedish Kronor/Euro 147 1

U.S. Dollar/U.K. Pound Sterling 129 3

U.S. Dollar/Canadian Dollar 118 –

Euro/Canadian Dollar 98 1

U.K. Pound Sterling/Euro 93 (1)

Swiss Franc/Euro 93 (1)

All Other 353 2

Total $2,927 $16

At December 31, 2005 and 2004, we had outstanding cross-

currency interest-rate swap agreements with aggregate notional

amounts of $127 and $597, respectively. The net (liability) asset

fair values at December 31, 2005 and 2004 were $(5) and

$44, respectively. There was only one contract outstanding at

December 31, 2005 and Japanese Yen was the currency hedged.

Xerox Annual Report 2005