Xerox 2005 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2005 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Xerox Corporation

21

Other

The Other segment primarily includes revenue from paper

sales, wide-format systems and value-added services.

We sell cut-sheet paper to our customers for use in their

document processing products. The market for cut-sheet

paper is highly competitive and revenues are significantly

affected by pricing. Our strategy is to charge a premium over

mill wholesale prices, which is adequate to cover our costs

and the value we add as a distributor.

We offer document processing products and devices in

our wide-format systems business designed to reproduce

large engineering and architectural drawings up to three

feet by four feet in size.

An increasingly important part of our offering is value-added

services, which leverage our document industry knowledge

and experience. Xerox value-added services deliver solutions,

which not only optimize enterprise output spend and infra-

structure, but also streamline, simplify and digitize our customers’

document-intensive business processes. Often the value-added

services solutions lead to larger Xerox managed services

contracts, which include Xerox equipment, supplies, service

and labor. The revenue from these contracts is reported within

the Production, Office or DMO segments. In 2005, value-added

services and managed services revenue, including equipment,

totaled $3.3 billion.

Revenue

Twenty-nine percent of our revenue comes from Equipment sales,

primarily from either lease arrangements that qualify as sales for

accounting purposes or outright cash sales. The remaining 71%

of our revenue, “Post sale and finance income,” includes annuity-

based revenue from maintenance, service, supplies and financing

as well as revenue from rentals or operating lease arrangements.

We sell most of our products and services under bundled lease

arrangements, in which our customers pay a monthly amount

for the related equipment, maintenance, services, supplies and

financing elements over the course of the lease agreement.

These arrangements are beneficial to our customers and us

since, in addition to customers receiving a bundled offering,

the arrangement allows us to maintain the customer relationship

for subsequent sales of equipment and services.

We are required for accounting purposes to analyze these

arrangements to determine whether the equipment component

meets certain accounting requirements such that the equipment

should be recorded as a sale at lease inception (i.e., sales-type

lease). Sales-type leases require allocation of a portion of the

monthly payment attributable to the fair value of the equipment

which we report as “equipment sales.” The remaining portion

of the monthly payment is allocated to the various remaining

elements based on fair value – service, maintenance, supplies

and financing – which are generally recognized over the term

of the lease agreement and reported as “post sale and other

revenue” and “finance income” revenue. In those arrangements

that do not qualify as sales-type leases, which has been starting

to occur morefrequently as a result of our services-led strategy,

the entiremonthly payment will be recognized over the term

of the lease agreement (i.e., rental or operating lease) and is

reported in “post sale and other revenue.” Our accounting

policies related to revenue recognition for leases and bundled

arrangements are included in Note 1 to the Consolidated Financial

Statements in our 2005 Annual Report.

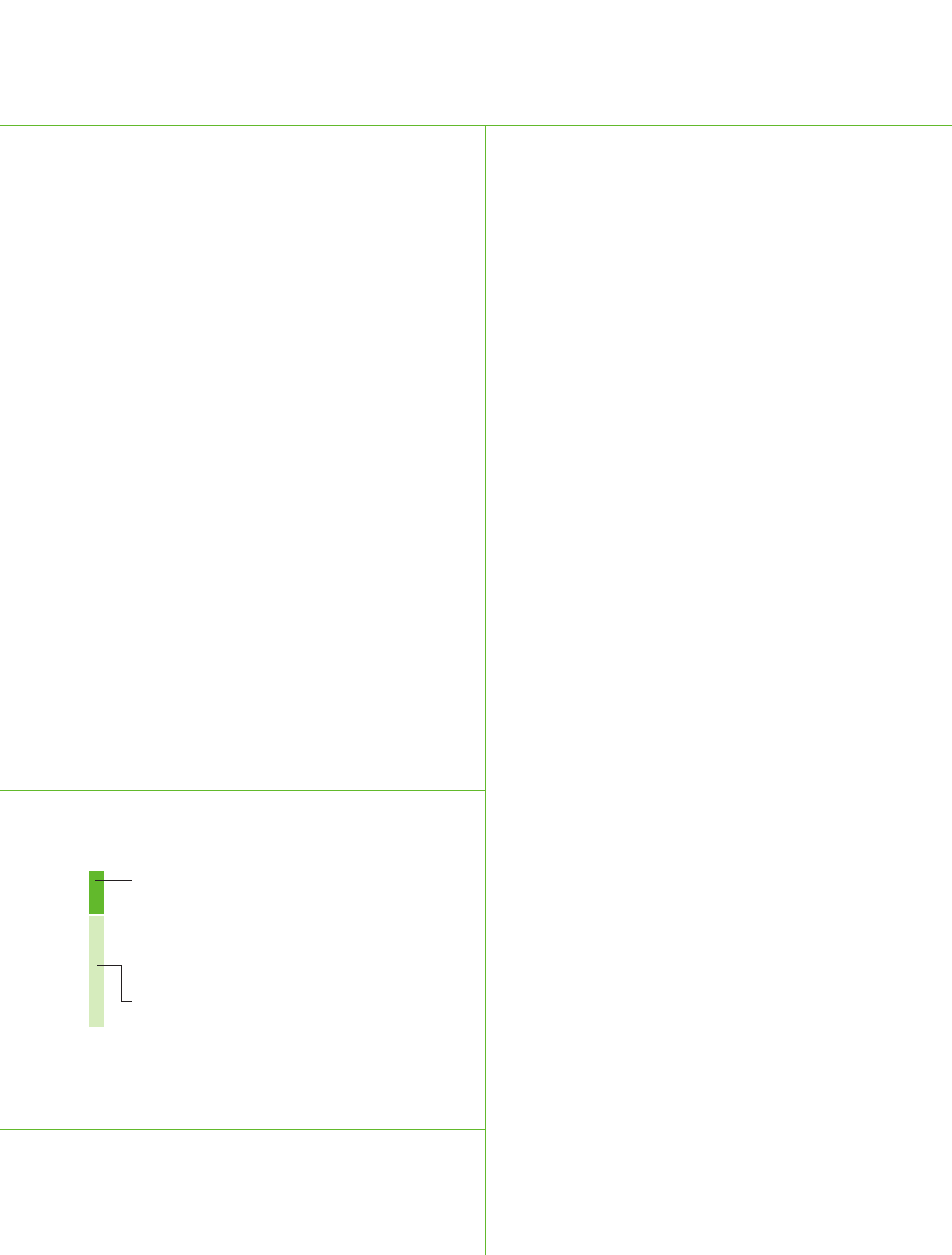

$100

20

40

60

80

29%

71%

Revenue Stream

Approximately 29% of our revenue

comes from Equipment sales, from

either lease arrangements that

qualify as sales for accounting

purposes or outright cash sales.

The remaining 71% of our

revenue, “Post sale and financing,”

includes annuity-based revenue

from maintenance, service, supplies

and financing, as well as revenue

from rentals or operating lease

arrangements.

Xerox Annual Report 2005