Xerox 2005 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2005 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

58

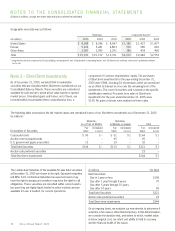

Geographic area data was as follows:

Revenues Long-Lived Assets(1)

(in millions) 2005 2004 2003 2005 2004 2003

United States $ 8,388 $ 8,346 $ 8,547 $ 1,386 $ 1,427 $ 1,477

Europe 5,226 5,281 4,863 500 585 616

Other Areas 2,087 2,095 2,291 386 434 460

Total $ 15,701 $ 15,722 $ 15,701 $2,272 $2,446 $2,553

(1) Long-lived assets are comprised of (i) land, buildings and equipment, net, (ii) equipment on operating leases, net, (iii) internal use software, net and (iv) capitalized software

costs, net.

component of Common shareholders’ equity. The purchases

of Short-term investments for the year-ending December 31,

2005 were $386, including $2 of premiums which are amortized

as an offset to Interest income over the remaining term of the

investments. The cost of securities sold is based on the specific

identification method. Proceeds from sales of Short-term

investments for the year ended December 31, 2005 were

$139. No gains or losses were realized on these sales.

Note 3 – Short-Term Investments

As of December 31, 2005, we held $244 in marketable

securities that are classified within Short-term investments in our

Consolidated Balance Sheets. These securities are considered

available-for-sale and are carried at fair value based on quoted

market prices. Unrealized gains and losses, net of taxes, are

recorded within Accumulated other comprehensive loss, a

The following table summarizes the fair market values and unrealized losses of our Short-term investments as of December 31, 2005

(in millions):

Maturities Maturities

Less Than 12 Months 12 Months or Greater Total

Fair Unrealized Fair Unrealized Fair Unrealized

Description of Securities Value Losses Value Losses Value Loses

Corporate bonds $ 93 $ – $ 51 $ 1 $144 $ 1

Auction rate municipal bonds ––45–45–

U.S. government agency securities 13 – 19 – 32 –

Total Debt Securities $106 $ – $115 $ 1 $221 $ 1

Auction rate preferred securities 23 –

Total Short-term investments $244 $ 1

Xerox Annual Report 2005

(in millions) Fair Value

Debt Securities:

Due in 1 year or less $106

Due after 1 year through 5 years 70

Due after 5 years through 10 years –

Due after 10 years 45

Total Debt Securities $221

Auction rate preferred securities 23

Total Short-term investments $244

On an ongoing basis, we evaluate our investments to determine if

adecline in fair value is other-than-temporary. In this determination,

we consider the duration that, and extent to which, market value

is below original cost, our intent and ability to hold to recovery

and the financial health of the issuer.

The contractual maturities of the available-for-sale debt securities

at December 31, 2005 are shown to the right. Expected maturities

will differ from contractual maturities because borrowers may

have the right to prepay and creditors may have the right to call

obligations. These securities are classified within current assets

because they are highly liquid, traded in active markets and are

available for use, if needed, for current operations.