Xerox 2005 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2005 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Xerox Corporation

37

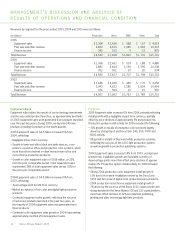

Other Expenses, Net: Other expenses, net, for the three years ended December 31, 2005 consisted of the following:

Year Ended December 31, Amount Change

(in millions) 2005 2004 2003 2005 2004

Non-financing interest expense $ 231 $363 $522 $(132) $(159)

Interest income (138) (75) (65) (63) (10)

(Gain) loss on sales of businesses and assets (97) (61) 13 (36) (74)

Currency losses, net 5 73 11 (68) 62

Amortization of intangible assets 38 37 36 1 1

Legal matters 115 9 242 106 (233)

Minorities’ interests in earnings of subsidiaries 15 8 6 7 2

All other expenses, net 55 15 111 40 (96)

$ 224 $369 $876 $(145) $(507)

Currency Gains and Losses: Currency gains and losses primarily

result from the mark-to-market of foreign exchange contracts utilized

to hedge foreign currency-denominated assets and liabilities, the

re-measurement of foreign currency-denominated assets and

liabilities and the mark-to-market impact of hedges of anticipated

transactions, primarily future inventory purchases, for which we

do not generally apply cash flow hedge accounting treatment.

In 2005, 2004 and 2003, currency losses totaled $5 million,

$73 million and $11 million, respectively. The decrease in 2005

from 2004 was primarily due to the strengthening of the U.S.

and Canadian Dollars against the Euroand the Yen in 2005, as

compared to the weakening U.S. Dollar in 2004, and decreased

costs of hedging foreign currency-denominated assets and

liabilities due to lower spot/forward premiums in 2005. The

increase in currency losses in 2004 from 2003 was primarily

due to the weakening U.S. Dollar in 2004 and increased costs

of hedging foreign currency-denominated assets and liabilities

due to higher spot/forwardpremiums in 2004.

Legal Matters: In 2005, legal matters costs consisted of

the following:

•$102 million, including $13 million for interest expense,

related to the MPI arbitration panel ruling (refer to Note 16 –

Contingencies in the Consolidated Financial Statements).

•$13 million related to other legal matters, primarily reflecting

charges for probable losses on cases that have not yet

been resolved.

In 2004, legal matters costs consist of expenses associated

with the resolution of legal and regulatory matters, none

of which was individually material, partially offset by the

adjustment of an estimate associated with a previously

recorded litigation accrual.

Non-financing Interest Expense: In 2005, non-financing interest

expense decreased due to lower average debt balances as a

result of scheduled term debt repayments and medium-term

note redemptions, as well as the full-year effect of the December

2004 Capital Trust II liability conversion. 2004 non-financing

interest expense was $159 million lower than in 2003, primarily

due to lower average debt balances as a result of the full-year

effect of the June 2003 recapitalization and other scheduled

term debt repayments.

Interest Income: Interest income is derived primarily from our

invested cash and cash equivalent balances and interest resulting

from periodic tax settlements. In 2005, interest income increased

primarily due to:

•A$57 million increase associated with the previously

disclosed settlement of the 1996-1998 IRS audit (refer

to Note 15 – Income and Other Taxes in the Consolidated

Financial Statements).

•A$23 million increase primarily reflecting higher rates of

return from our money market funds.

•Partially offset by the absence of $26 million of interest

income related to a 2004 domestic tax refund.

In 2004, interest income increased primarily as a result of $26

million related to a domestic tax refund claim in 2004, partially

offset by the absence of $13 million of interest income related

to Brazilian tax credits in 2003.

(Gain) Loss on Sales of Businesses and Assets: In 2005, gain on

sales of businesses and assets primarily relate to the $93 million

gain in the first quarter on the sale of Integic. In 2004, gains on

the sale of businesses and assets primarily reflect the $38 million

pre-tax gain from the sale of our ownership interest in ScanSoft,

as well as gains totaling $14 million related to the sale of certain

excess land and buildings in Europe and Mexico. The 2003

amount primarily included losses related to the sale of Xerox

Engineering Systems subsidiaries in France and Germany, which

were partially offset by a gain on the sale of our investment in

Xerox South Africa.

Xerox Annual Report 2005