Xerox 2005 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2005 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Xerox Corporation

41

Customer Financing Activities and Debt: We provide equipment

financing to the majority of our customers. Because the finance

leases allow our customers to pay for equipment over time rather

than at the date of installation, we maintain a certain level of debt

to support our investment in these customer finance leases.

During the last four years we had established a series of financing

arrangements with a number of major financial institutions to

provide secured funding for our customer leasing activities in

several of the major countries in which we operate, specifically in

Canada, France, the Netherlands, the U.K. and U.S. While terms

and conditions vary somewhat between countries, in general

these arrangements call for the financial counterparty to provide

loans secured by the sales-type lease originations in the country

for which it has been contracted to be the funding source. Most

arrangements are transacted through bankruptcy remote special

purpose entities and the transfers of receivables and equipment

to these entities aregenerally intended to be true sales at law.

Under these arrangements, secured debt matches the terms of

the underlying finance receivables it supports, which eliminates

certain significant refinancing, pricing and duration risks

associated with our financing.

At December 31, 2005 and 2004, all of the lease receivables

and related secured debt areconsolidated in our financial state-

ments because we are determined to be the primary beneficiary

of the arrangements and frequently the counterparties have

various types of recourse to us. The lease receivables sold

represent the collateral for the related secured debt and are

not available for general corporate purposes until the related

debt is paid off. Most of the secured financing arrangements

include over-collateralization of approximately 10% of the lease

amounts sold. All of these arrangements aresubject to usual and

customary conditions of default including cross-defaults. In the

remote circumstance that an event of default occurs and remains

uncured, in general, the counterparty can cease providing funding

for new lease originations.

Information on restricted cash that is the result of these third-

party secured funding arrangements is included in Note 1 –

Restricted Cash and Investments to the Consolidated Financial

Statements and disclosureof the amounts for new funding and

debt repayments areincluded in the accompanying Consolidated

Statement of Cash Flows.

We also have arrangements in certain countries – Germany, Italy,

the Nordic Countries, Brazil and Mexico – in which third-party

financial institutions originate lease contracts directly with our

customers. In these arrangements, we sell and transfer title to the

equipment to these financial institutions and generally have no

continuing ownership rights in the equipment subsequent to its sale.

In addition to these third-party arrangements, we also support

our customer finance leasing activities with cash generated from

operations and through capital markets offerings.

Refer to Note 4 – Receivables, Net in the Consolidated Financial

Statements for further information regarding our third-party

secured funding arrangements as well as a comparison of finance

receivables to our financing-related debt as of December 31,

2005 and 2004.

As of December 31, 2005 and 2004, debt secured by finance

receivables was approximately 41% and 44% of total debt,

respectively. Consistent with our objective to rebalance the ratio

of secured and unsecured debt, we expect payments on secured

loans will continue to exceed proceeds from new secured loans

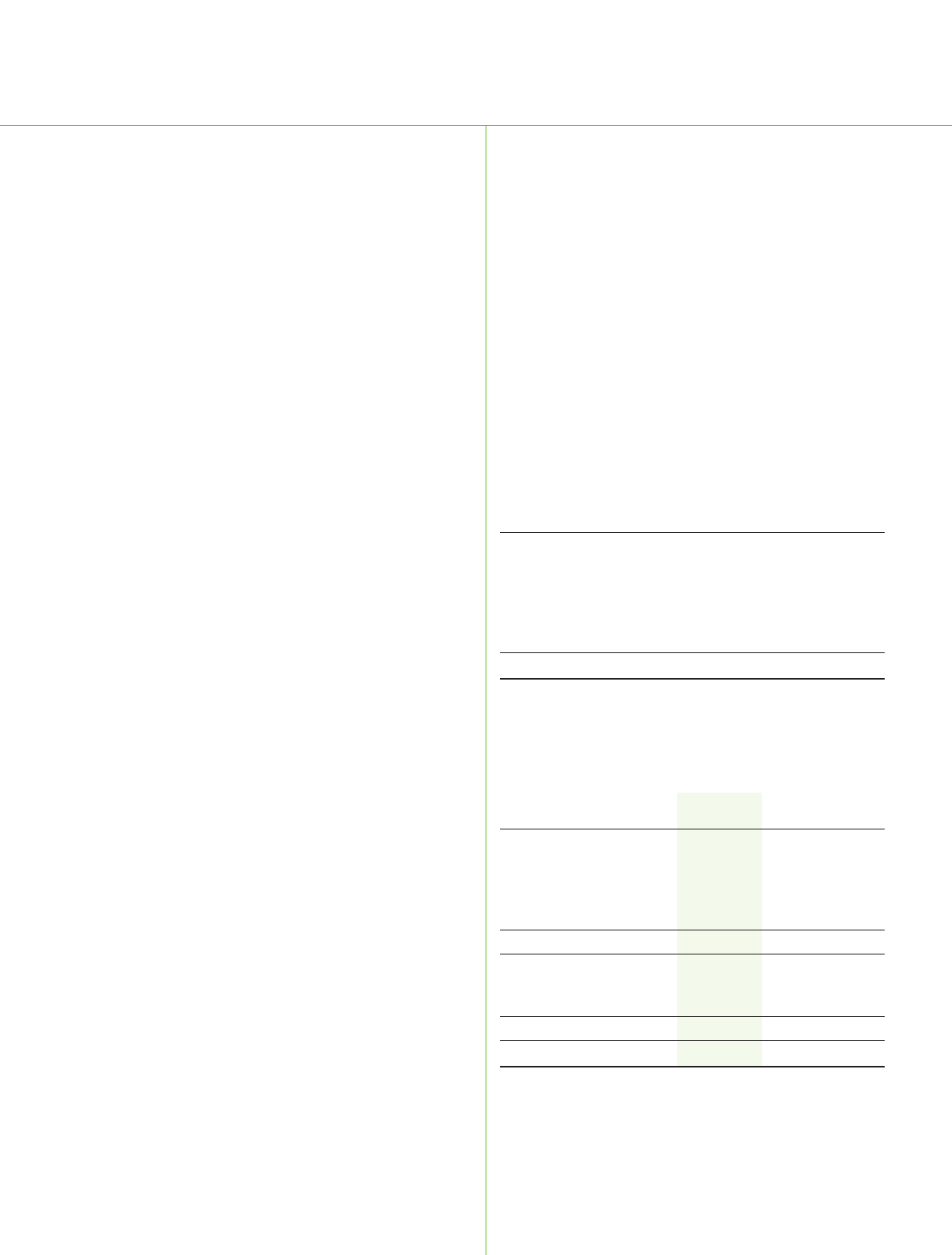

in 2006. The following represents our aggregate debt maturity

schedule as of December 31, 2005:

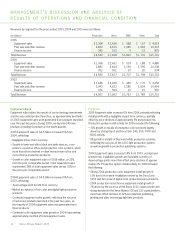

Debt

Secured Other

Unsecured by Finance Secured Total

(in millions) Debt Receivables Debt Debt

2006 $ 66 $1,058 $ 15 $1,139(1)

2007 258 1,139 185 1,582

2008 28 643 307 978

2009 879 103 7 989

2010 688 36 3 727

Thereafter 1,826 3 34 1,863

Total $3,745 $2,982 $551 $7,278

(1) Quarterly secured and unsecured total debt maturities (in millions) for 2006 are

$353, $307, $256 and $223 for the first, second, third and fourth quarters,

respectively.

The following table summarizes our secured and unsecured debt

as of December 31, 2005 and 2004:

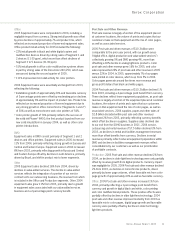

December 31, December 31,

(in millions) 2005 2004

Term Loan $ 300 $ 300

Debt secured by finance

receivables 2,982 4,436

Capital leases 38 58

Debt secured by other assets 213 235

Total Secured Debt 3,533 5,029

Senior Notes 2,862 2,936

Subordinated debt 19 19

Other Debt 864 2,140

Total Unsecured Debt 3,745 5,095

Total Debt $ 7,278 $10,124

Xerox Annual Report 2005