Xerox 2005 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2005 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Xerox Corporation

67

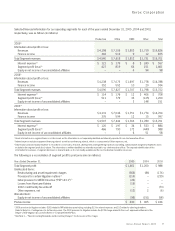

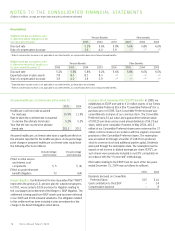

Note 11 – Debt

Short-term borrowings at December 31, 2005 and 2004 were as

follows (in millions):

2005 2004

Current maturities of long-term debt $ 1,099 $ 3,038

Notes payable 40 36

Total $ 1,139 $ 3,074

We classify our debt based on the contractual maturity dates

of the underlying debt instruments or as of the earliest put date

available to the debt holders. We defer costs associated with debt

issuance over the applicable term or to the first put date, in the

case of convertible debt or debt with a put feature. These costs

are amortized as interest expense in our Consolidated Statement

of Income.

Long-term debt, including debt secured by finance receivables

at December 31, 2005 and 2004 was as follows (in millions):

Weighted Average

Interest Rates at

U.S. Operations December 31, 2005 2005 2004

Xerox Corporation

Notes due 2006(1) –% $ – $ 15

Notes due 2007(1) – – 25

Notes due 2008 1.31 27 27

Senior Notes due 2009(2) 9.75 620 627

EuroSenior Notes due 2009 9.75 260 297

Senior Notes due 2010(2) 7.13 688 704

Notes due 2011 7.01 50 50

Senior Notes due 2011(2) 6.88 752 758

Senior Notes due 2013(2) 7.63 542 550

Convertible Notes due 2014 9.00 19 19

Notes due 2016 7.20 251 252

2003 Credit Facility due 2008 6.22 300 300

Subtotal 3,509 3,624

Xerox Credit Corporation

Yen notes due 2005 – – 970

Yen notes due 2007 2.00 255 292

Notes due 2008(1) ––25

Notes due 2012(1) 7.07 75 125

Notes due 2013 6.50 60 59

Notes due 2014 6.06 50 50

Notes due 2018 7.00 25 25

Subtotal $ 465 $1,546

Weighted Average

Interest Rates at

U.S. Operations December 31, 2005 2005 2004

Other U.S. Operations

Borrowings secured by

finance receivables(3) 4.78 $ 1,701 $ 2,486

Borrowings secured by

other assets 5.67 220 257

Subtotal 1,921 2,743

Total U.S. Operations 5,895 7,913

International Operations

Xerox Capital (Europe) plc:

Japanese yen due 2005 – – 97

U.S. dollars due 2008(1) ––25

Subtotal – 122

Other International Operations

Pound Sterling secured

borrowings due

2007-2008(3) 6.06 581 685

Euro secured borrowings

due 2005-2010(3) 3.73 526 839

Canadian dollars secured

borrowings due

2005-2007(3) 5.49 174 426

Other debt due 2005-2010 5.86 62 103

Subtotal 1,343 2,053

Total International Operations 1,343 2,175

Subtotal 7,238 10,088

Less current maturities (1,099) (3,038)

Total Long-term debt $ 6,139 $ 7,050

(1) Certain debt instruments, totaling $140, were redeemed in 2005 prior to their

scheduled maturities.

(2) As of December 31, 2005, these senior notes were guaranteed by our wholly

owned subsidiary Xerox International Joint Marketing, Inc.

(3) Refer to Note 4 – Receivables, Net, for further discussion of borrowings secured

by finance receivables, net.

Scheduled payments due on long-term debt for the next five years

and thereafter areas follows (in millions):

There-

2006 2007 2008 2009 2010 after Total

$1,099 $1,582 $978 $989 $727 $1,863 $7,238

Xerox Annual Report 2005