Xerox 2005 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2005 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

98

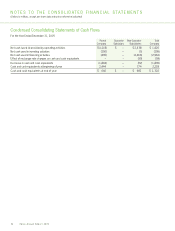

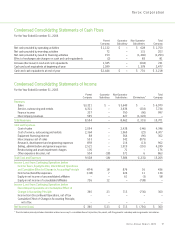

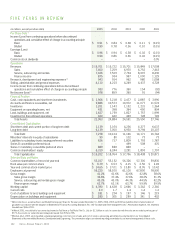

Condensed Consolidating Statements of Cash Flows

For the Year Ended December 31, 2003

Parent Guarantor Non-Guarantor Total

Company Subsidiary Subsidiaries Company

Net cash provided by (used in) operating activities $ 2,672 $ – $ (793) $ 1,879

Net cash (used in) provided by investing activities (475) – 524 49

Net cash (used in) provided by financing activities (2,769) – 299 (2,470)

Effect of exchange rate changes on cash and cash equivalents – – 132 132

(Decrease) increase in cash and cash equivalents (572) – 162 (410)

Cash and cash equivalents at beginning of year 1,671 – 1,216 2,887

Cash and cash equivalents at end of year $1,099 $ – $1,378 $ 2,477

Xerox Annual Report 2005

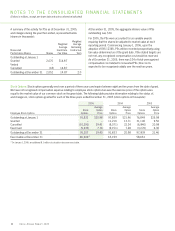

Note 23 – Subsequent Events

In January 2006, the Boardof Directors authorized an additional

repurchase of up to $500 of the Company’s common stock. The

Company expects the stock to be repurchased over the next 6-12

months, primarily through open-market purchases. Open-market

repurchases will be made in compliance with the Securities and

Exchange Commission’sRule 10b-18, and aresubject to market

conditions as well as applicable legal and other considerations.

Through February 16, 2006, we repurchased the following

through our authorized repurchase programs:

Common Stock Aggregate

Shares Costs

October 2005

Repurchase Program 35,213,032 $501*

January 2006

Repurchase Program 3,556,168 52**

Total 38,769,200 $553

*This amount included $1 of associated fees.

**This amount included an insignificant amount of associated fees.