Xerox 2005 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2005 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

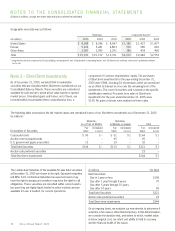

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

54

Revenues under bundled arrangements are allocated considering

the relative fair values of the lease and non-lease deliverables

included in the bundled arrangement based upon the estimated

relative fair values of each element. Lease deliverables include

maintenance and executory costs, equipment and financing,

while non-lease deliverables generally consist of the supplies and

non-maintenance services. Our revenue allocation for the lease

deliverables begins by allocating revenues to the maintenance

and executory costs plus profit thereon. The remaining amounts

are allocated to the equipment and financing elements. We perform

extensive analyses of available verifiable objective evidence of

equipment fair value based on cash selling prices during the

applicable period. The cash selling prices are compared to the

range of values included in our lease accounting systems. The

range of cash selling prices must be reasonably consistent with the

lease selling prices, taking into account residual values that accrue

to our benefit, in order for us to determine that such lease prices

areindicative of fair value. Our pricing interest rates, which areused

to determine customer lease payments, are developed based upon

avariety of factors including local prevailing rates in the market-

place and the customer’s credit history,industry and credit class.

Effective in 2004, our pricing rates are reassessed quarterly based

on changes in local prevailing rates in the marketplace and are

adjusted to the extent such rates vary by twenty-five basis points

or more, cumulatively, from the last rate in effect. The pricing

interest rates generally equal the implicit rates within the leases, as

corroborated by our comparisons of cash to lease selling prices.

Cash and Cash Equivalents: Cash and cash equivalents consist

of cash on hand, including money-market funds, and investments

with original maturities of three months or less.

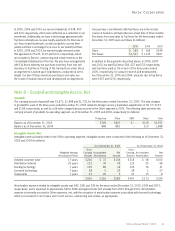

Restricted Cash and Investments: Several of our secured

financing arrangements and derivative contracts, as well as other

material contracts, require us to post cash collateral or maintain

minimum cash balances in escrow. These cash amounts are

reported in our Consolidated Balance Sheets, depending on

when the cash will be contractually released. At December 31,

2005 and 2004, such restricted cash amounts were as follows

(in millions):

December 31, 2005 2004

Escrow and cash collections related

to secured borrowing arrangements $ 254 $ 372

Collateral related to risk management

arrangements 43 61

Other restricted cash 149 97

Total $ 446 $ 530

Of these amounts, $270 and $370 wereincluded in Other current

assets and $176 and $160 wereincluded in Other long-term

assets, as of December 31, 2005 and 2004, respectively.

Provisions for Losses on Uncollectible Receivables: The provi-

sions for losses on uncollectible trade and finance receivables

are determined principally on the basis of past collection

experience applied to ongoing evaluations of our receivables

and evaluations of the default risks of repayment. Allowances for

doubtful accounts on accounts receivable balances were $136

and $183, as of December 31, 2005 and 2004, respectively.

Allowances for doubtful accounts on finance receivables were

$229 and $276 at December 31, 2005 and 2004, respectively.

Inventories: Inventories are carried at the lower of average cost

or market. Inventories also include equipment that is returned at

the end of the lease term. Returned equipment is recorded at the

lower of remaining net book value or salvage value. Salvage value

consists of the estimated market value (generally determined

based on replacement cost) of the salvageable component parts,

which are expected to be used in the remanufacturing process.

We regularly review inventory quantities and record a provision for

excess and/or obsolete inventory based primarily on our estimated

forecast of product demand, production requirements and servic-

ing commitments. Several factors may influence the realizability

of our inventories, including our decision to exit a product line,

technological changes and new product development. The provision

for excess and/or obsolete raw materials and equipment

inventories is based primarily on near-term forecasts of product

demand and include consideration of new product introductions

as well as changes in remanufacturing strategies. The provision

for excess and/or obsolete service parts inventory is based

primarily on projected servicing requirements over the life of the

related equipment populations.

Land, Buildings and Equipment and Equipment on Operating

Leases: Land, buildings and equipment are recorded at cost.

Buildings and equipment are depreciated over their estimated

useful lives. Leasehold improvements aredepreciated over the

shorter of the lease term or the estimated useful life. Equipment

on operating leases is depreciated to estimated residual value

over the lease term. Depreciation is computed using the

straight-line method. Significant improvements are capitalized

and maintenance and repairs are expensed. Refer to Notes

5and 6 for further discussion.

Goodwill and Other Intangible Assets: Goodwill is tested for impair-

ment annually or more frequently if an event or circumstance

indicates that an impairment loss may have been incurred.

Application of the goodwill impairment test requires judgment,

including the identification of reporting units, assignment of

assets and liabilities to reporting units, assignment of goodwill

to reporting units, and determination of the fair value of each

reporting unit. We estimate the fair value of each reporting unit

using a discounted cash flow methodology. This requires us

to use significant judgment including estimation of future cash

flows, which is dependent on internal forecasts, estimation of

the long-term rate of growth for our business, the useful life

over which cash flows will occur, determination of our weighted

average cost of capital, and relevant market data.

Xerox Annual Report 2005