Xerox 2005 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2005 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Xerox Corporation

27

Our 2005 balance sheet strategy focused on reducing our total

debt, optimizing operating cash flows and matching our remaining

debt portfolio to support our customer financing operations. The

successful implementation of this strategy in 2005 enabled us to

significantly improve our liquidity and finish the year with a cash,

cash equivalents and short-term investments balance of $1.6

billion. Our prospective balance sheet strategy includes: returning

our credit rating to investment grade; optimizing operating cash

flows; achieving an optimal cost of capital; rebalancing secured

and unsecured debt; and effectively deploying cash to deliver and

maximize long-term shareholder value. In addition, our strategy

includes maintaining our current leverage of financing assets

(finance receivables and equipment on operating leases) and

maintenance of a minimal level of non-financing debt.

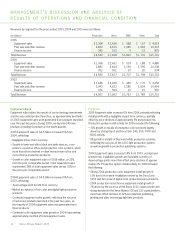

Revenues for the three years ended December 31, 2005 were as follows:

Year Ended December 31, Percent Change

(in millions) 2005 2004 2003 2005 2004

Equipment sales $ 4,519 $ 4,480 $ 4,250 1% 5%

Post sale and other revenue 10,307 10,308 10,454 – (1)%

Finance income 875 934 997 (6)% (6)%

Total Revenues $15,701 $15,722 $15,701 – –

Total Color revenue included in total revenues $ 4,634 $ 3,903 $ 3,267 19% 19%

•Comparable Post sale and other revenues, including a negligible

impact from currency, primarily reflecting revenue growth from

digital products and in DMO, which were partially offset by

declines in light lens.

•6% decline in Finance income including benefits from currency

of 1-percentage point, which reflects lower finance receivables.

Total 2004 revenues of $15.7 billion increased modestly as

compared to 2003 including a 3-percentage point benefit from

currency. Total 2004 revenues included the following:

•5% growth in Equipment sales, reflecting the success of our

color and digital light production products and a 3-percentage

point benefit from currency.

•1% decline in Post sale and other revenues due to declines in

older light-lens technology products and Developing Market

Operations (“DMO”), driven by Latin America, were partially

offset by growth in digital office and production color, as well

as a 3-percentage point benefit from currency. The light-lens

and DMO declines reflect a reduction of equipment at customer

locations and related page volume declines. As our equipment

sales continue to increase, we expect the effects of post sale

declines will moderate and ultimately reverse over time.

•6% decline in Finance income, including a 4-percentage point

benefit from currency, which reflects a decrease in equipment

lease originations over the past several years.

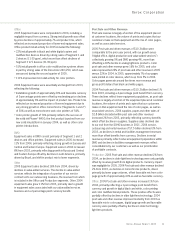

The following presentation reconciles the above information to the

revenue classifications included in our Consolidated Statements

of Income:

(in millions)

Year Ended December 31, 2005 2004 2003

Sales $ 7,400 $ 7,259 $ 6,970

Less: Supplies, paper

and other sales (2,881) (2,779) (2,720)

Equipment Sales $ 4,519 $ 4,480 $ 4,250

Service, outsourcing

and rentals $ 7,426 $ 7,529 $ 7,734

Add: Supplies, paper

and other sales 2,881 2,779 2,720

Post sale and other revenue $10,307 $10,308 $10,454

Total 2005 revenues of $15.7 billion were comparable to

the prior-year period. Currency impacts on total revenues

were negligible for the year. Total 2005 revenues included

the following:

•1% growth in Equipment sales, including a negligible impact

from currency, primarily reflecting revenue growth from color in

Office and Production, low-end black and white office products

as well as growth in DMO. These growth areas were partially

offset by revenue declines in higher-end office black and white

products, and black and white production products.

Xerox Annual Report 2005