Xerox 2005 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2005 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Xerox Corporation

89

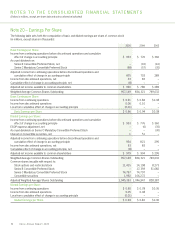

At December 31, 2005, the aggregate intrinsic value of stock

options outstanding and stock options exercisable was $247 and

$204, respectively.

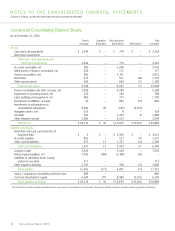

The following table provides information relating to stock option

exercises for the three years ended December 31, 2005:

(in millions) 2005 2004 2003

Total Intrinsic Value $36 $67 $14

Cash Received 41 67 21

Tax Benefit Realized for

Tax Deductions 12 23 5

Treasury Stock: In October 2005, the Boardof Directors authorized

the Company to repurchase up to $500 of common stock. The

stock is expected to be repurchased through the period ending

October 31, 2006, primarily through open-market purchases.

Repurchases aremade in compliance with the Securities and

Exchange Commission’s Rule 10b-18, and are subject to market

conditions as well as applicable legal and other considerations.

During the fourth quarter of 2005, we repurchased 30,502,200

shares at an aggregate cost of $433, including associated fees

of $1. These treasury stock shares may be cancelled upon the

Board of Directors’ approval. In 2005, 16,585,300 repurchased

shares were cancelled and were recorded as a reduction to both

common stock of $17 and additional paid-in-capital of $213.

Note 19 – Research, Development and

Engineering (“R,D&E”)

R,D&E was $943, $914 and $962 for the three years ended

December 31, 2005, respectively. Research and development

(“R&D”) costs were$755 in 2005, $760 in 2004 and $868 in

2003. Sustaining engineering costs are incurred with respect to

ongoing product improvements or environmental compliance

after initial product launch. Our sustaining engineering costs were

$188, $154 and $94 for the three years ended December 31,

2005, respectively.

Xerox Annual Report 2005

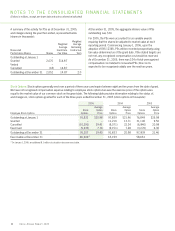

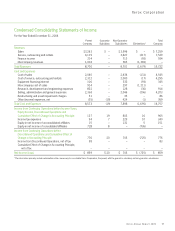

Options outstanding and exercisable at December 31, 2005 were as follows (stock options in thousands):

Options Outstanding Options Exercisable

Weighted Weighted

Average Weighted Average Weighted

Remaining Average Remaining Average

Number Contractual Exercise Number Contractual Exercise

Range of Exercise Prices Outstanding Life Price Exercisable Life Price

$4.75 to $6.98 6,487 4.96 $ 4.87 5,939 4.90 $ 4.85

7.13 to 10.69 31,078 6.35 9.12 25,789 6.27 9.29

10.70 to 15.27 11,119 5.97 13.66 7,577 5.96 13.65

16.91 to 22.88 12,188 4.00 21.77 12,188 4.00 21.77

25.38 to 32.16 3,826 3.89 26.37 3,826 3.89 26.37

42.83 to 60.95 11,609 2.38 55.79 11,609 2.38 55.79

76,307 5.08 19.40 66,928 4.89 20.70