Xerox 2005 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2005 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Xerox Corporation

77

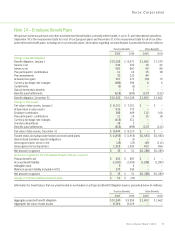

Note 15 – Income and Other Taxes

Income (loss) before income taxes for the three years ended

December 31, 2005 were as follows (in millions):

2005 2004 2003

Domestic income (loss) $386 $426 $(299)

Foreign income 444 539 735

Income before income taxes $830 $965 $ 436

Provisions (benefits) for income taxes for the three years ended

December 31, 2005 were as follows (in millions):

2005 2004 2003

Federal income taxes

Current $(94) $ 26 $ 77

Deferred (59) 114 (132)

Foreign income taxes

Current 95 178 144

Deferred 37 21 72

State income taxes

Current 9 (19) (17)

Deferred 7 20 (10)

Total $ (5) $ 340 $ 134

Areconciliation of the U.S. federal statutory income tax rate to

the consolidated effective income tax rate for the three years

ended December 31, 2005 was as follows:

2005 2004 2003

U.S. federal statutory

income tax rate 35.0% 35.0% 35.0%

Nondeductible expenses 3.4 3.4 5.0

Effect of tax law changes 0.3 (1.5) 1.0

Change in valuation allowance

for deferred tax assets (4.6) 1.3 (3.8)

State taxes, net of

federal benefit 1.6 1.3 (2.7)

Audit and other tax return

adjustments (25.5) 0.7 7.6

Tax-exempt income (0.7) (0.7) (1.0)

Dividends on Series B

convertible preferred stock – (0.6) (3.1)

Other foreign, including earnings

taxed at different rates (10.3) (2.4) (7.0)

Other 0.2 (1.3) (0.3)

Effective income tax rate (0.6)% 35.2% 30.7%

On a consolidated basis, we paid a total of $186, $253 and

$207 in income taxes to federal, foreign and state jurisdictions

in 2005, 2004 and 2003, respectively.

Total income tax expense (benefit) for the three years ended

December 31, 2005 was allocated as follows (in millions):

2005 2004 2003

Income taxes on income $ (5) $340 $134

Common shareholders’

equity(1) (43) (20) 123

Total $ (48) $320 $257

(1) For tax effects of items in accumulated other comprehensive loss and tax benefits

related to stock option and incentive plans.

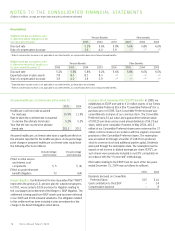

IRS Audit Resolution: In June 2005, the 1996-1998 IRS audit

was finalized. As a result, we recorded an aggregate second-

quarter 2005 net income benefit of $343. $260 of this benefit,

which includes an after-tax benefit of $33 for interest ($54 pre-tax

benefit), is the result of a change in tax law that allowed us to

recognize a benefit for $1.2 billion of capital losses associated

with the disposition of our insurance group operations in those

years. The claim of additional losses and related tax benefits

required review by the U.S. Joint Committee on Taxation, which

was completed in June 2005. The benefit did not result in a

significant cash refund, but increased tax credit carryforwards

and reduced taxes otherwise due. While these benefits originated

from our discontinued operations, tax accounting rules require

the classification of benefits resulting from a change in tax law

to be classified within the continuing operations tax provision.

The $343 benefit also includes after-tax benefits of $83 related

to the favorable resolution of certain other tax matters. Of this

amount, $53 is related to our discontinued operations and is

reported within Income from discontinued operations in the

Consolidated Statements of Income.

The following is a summary of the aggregate (benefit) recorded

and whereclassified in the Consolidated Statements of Income

for the year ended December 31, 2005 (in millions):

Resolution

Tax Law of Tax Aggregate

Change Matters Benefits

Other expenses, net $ (54) $ (3) $ (57)

Income tax (benefits) expenses (206) (27) (233)

Income from discontinued

operations, net of tax – (53) (53)

Net income $(260) $(83) $(343)

Xerox Annual Report 2005