Xerox 2005 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2005 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Xerox Corporation

79

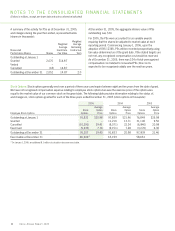

Indemnifications Provided as Part of Contracts and Agreements:

We are a party to the following types of agreements pursuant

to which we may be obligated to indemnify the other party with

respect to certain matters:

•Contracts that we entered into for the sale or purchase of

businesses or real estate assets, under which we customarily

agree to hold the other party harmless against losses arising

from a breach of representations and covenants, including

obligations to pay rent. Typically, these relate to such matters

as adequate title to assets sold, intellectual property rights,

specified environmental matters and certain income taxes

arising prior to the date of acquisition.

•Guarantees on behalf of our subsidiaries with respect to real

estate leases. These lease guarantees may remain in effect

subsequent to the sale of the subsidiary.

•Agreements to indemnify various service providers, trustees

and bank agents from any third-party claims related to their

performance on our behalf, with the exception of claims

that result from third party’s own willful misconduct or

gross negligence.

•Guarantees of our performance in certain sales contracts to our

customers and indirectly the performance of thirdparties with

whom we have subcontracted for their services. This includes

indemnifications to customers for losses that may be sustained

as a result of the use of our equipment at a customer’slocation.

In each of these circumstances, our payment is conditioned on the

other party making a claim pursuant to the procedures specified

in the particular contract, which procedures typically allow us to

challenge the other party’s claims. In the case of lease guarantees,

we may contest the liabilities asserted under the lease. Further,

our obligations under these agreements and guarantees may be

limited in terms of time and/or amount, and in some instances,

we may have recourse against third parties for certain payments

we made.

Patent Indemnifications: In most sales transactions to resellers

of our products, we indemnify against possible claims of

patent infringement caused by our products or solutions. These

indemnifications usually do not include limits on the claims,

provided the claim is made pursuant to the procedures required

in the sales contract.

Indemnification of Officers and Directors: Our corporate by-laws

require that, except to the extent expressly prohibited by law, we

must indemnify Xerox Corporation’s officers and directors against

judgments, fines, penalties and amounts paid in settlement, includ-

ing legal fees and all appeals, incurred in connection with civil or

criminal action or proceedings, as it relates to their services to

Xerox Corporation and our subsidiaries. Although the by-laws

provide no limit on the amount of indemnification, we may have

recourse against our insurance carriers for certain payments

made by us. However, certain indemnification payments may not

be covered under our directors’ and officers’ insurance coverage.

In addition, we indemnify certain fiduciaries of our employee

benefit plans for liabilities incurred in their service as fiduciary

whether or not they are officers of the Company.

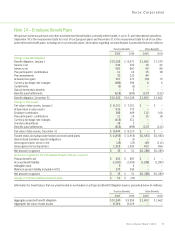

Product Warranty Liabilities: In connection with our normal

sales of equipment, including those under sales-type leases, we

generally do not issue product warranties. Our arrangements

typically involve a separate full-service maintenance agreement

with the customer. The agreements generally extend over a period

equivalent to the lease term or the expected useful life under a

cash sale. The service agreements involve the payment of fees

in return for our performance of repairs and maintenance. As a

consequence, we do not have any significant product warranty

obligations including any obligations under customer satisfaction

programs. In a few circumstances, particularly in certain cash

sales, we may issue a limited product warranty if negotiated by

the customer. We also issue warranties for certain of our lower-end

products in the Office segment, wherefull-service maintenance

agreements arenot available. In these instances, we record

warranty obligations at the time of the sale. Aggregate product

warranty liability expenses for the three years ended as of

December 31, 2005 were$45, $45 and $47, respectively.

Total product warranty liabilities as of December 31, 2005 and

2004 were $21 and $23, respectively.

Tax Related Contingencies

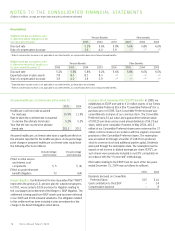

Brazil Tax and Labor Contingencies: At December 31, 2005, our

Brazilian operations were involved in various litigation matters

and have received or been levied with numerous governmental

assessments related to indirect and other taxes as well as

disputes associated with former employees and contract labor.

The total amounts related to these unreserved contingencies,

inclusive of any related interest, were approximately $900. The

tax matters, which comprise a significant portion of the total

contingencies, principally relate to claims for taxes on the internal

transfer of inventory, municipal service taxes on rentals and gross

revenue taxes. We are disputing these tax and labor matters and

intend to vigorously defend our position. Based on the opinion

of legal counsel, we do not believe that the ultimate resolution

of these matters will materially impact our results of operations,

financial position or cash flows. In connection with these

Xerox Annual Report 2005