Xerox 2005 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2005 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Xerox Corporation

63

Note 8 – Goodwill and Intangible Assets, Net

Goodwill:

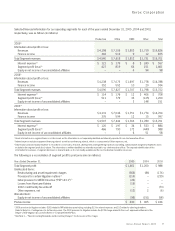

The carrying amount of goodwill was $1,671, $1,848 and $1,722, for the three years ended December 31, 2005. The only changes

in goodwill for each of the three years ended December 31, 2005 related to foreign currency translation adjustments of $(177), $132

and $158, respectively, as well as a $6 other charge that was incurred in the Other segment in 2004. The following table presents the

carrying amount of goodwill, by operating segment, as of December 31, 2005 and 2004, respectively (in millions):

Production Office DMO Other Total

Balance as of December 31, 2005 $745 $807 $ – $119 $1,671

Balance as of December 31, 2004 848 881 – 119 1,848

Intangible Assets, Net:

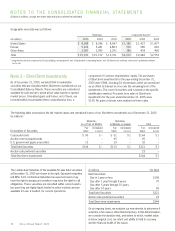

Intangible assets primarily relate to the Office operating segment. Intangible assets were comprised of the following as of December 31,

2005 and 2004 (in millions):

As of December 31, 2005 As of December 31, 2004

Gross Gross

Weighted Average Carrying Accumulated Net Carrying Accumulated Net

Amortization Period Amount Amortization Amount Amount Amortization Amount

Installed customer base 17 years $ 226 $ 72 $154 $ 218 $ 58 $ 160

Distribution network 25 years 123 30 93 123 25 98

Existing technology 7years 105 89 16 105 74 31

Licensed technology 7 years 28 5 23 28 1 27

Trademarks 7 years 23 20 3 23 15 8

$505 $216 $289 $497 $173 $324

Amortization expense related to intangible assets was $42, $38, and $36 for the years ended December 31, 2005, 2004 and 2003,

respectively, and is expected to approximate $40 in 2006 and approximate $22 annually from 2007 through 2010. Amortization

expense is primarily recorded in Other expenses, net, with the exception of amortization expense associated with licensed technology,

which is recorded in Cost of sales and Cost of service, outsourcing and rentals, as appropriate.

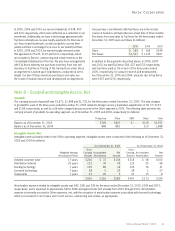

In 2005, 2004 and 2003, we received dividends of $38, $50

and $20, respectively, which were reflected as a reduction in our

investment. Additionally, we have a technology agreement with

Fuji Xerox whereby we receive royalty payments for their use of

our Xerox brand trademark, as well as rights to access their

patent portfolio in exchange for access to our patent portfolio.

In 2005, 2004 and 2003, we earned royalty revenues under

this agreement of $123, $119 and $110, respectively, which

are included in Service, outsourcing and rental revenues in the

Consolidated Statements of Income. We also have arrangements

with Fuji Xerox whereby we purchase inventory from and sell

inventory to Fuji Xerox. Pricing of the transactions under these

arrangements is based upon negotiations conducted at arm’s

length. Certain of these inventory purchases and sales are

the result of mutual research and development arrangements.

Our purchase commitments with Fuji Xerox are in the normal

course of business and typically have a lead time of three months.

Purchases from and sales to Fuji Xerox for the three years ended

December 31, 2005 were as follows (in millions):

2005 2004 2003

Sales $ 163 $ 166 $ 149

Purchases $ 1,517 $ 1,135 $ 871

In addition to the payments described above, in 2005, 2004

and 2003, we paid Fuji Xerox $28, $27 and $33, respectively,

and Fuji Xerox paid us $9 in each of the three years ended

2005, respectively, for unique research and development.

As of December 31, 2005 and 2004, amounts due to Fuji Xerox

were $157 and $155, respectively.

Xerox Annual Report 2005