Xerox 2005 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2005 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

RESULTS OF OPERATIONS AND FINANCIAL CONDITION

38

In 2003, legal matters costs primarily consisted of a $239

million provision for litigation relating to the court-approved

settlement of the Berger v. Retirement Income Guarantee Plan

(“RIGP”) litigation. RIGP represents the primary U.S. pension

plan for salaried employees. The settlement was paid from

RIGP assets and was reflected in our 2004 actuarial valuation.

The obligation related to this settlement was included in plan

amendments in the change in the benefit obligation.

Refer to Note 16 – Contingencies in the Consolidated Financial

Statements for additional information regarding litigation against

the Company.

All Other Expenses, Net: In 2005 all other expenses, net, included

the following individually significant items:

•$15 million for losses sustained from Hurricane Katrina

related to property damage and impaired receivables. We

continue to reassess the estimate of our losses from the

effects of Hurricane Katrina. Our current estimate as of

December 31, 2005, of total assets at risk in the affected

areas, primarily finance receivables from customers, was

approximately $20 million.

•$26 million charge related to the European Union Waste

Directive, including the associated adoption of FASB Staff

Position No. 143-1, “Accounting for Electronic Equipment

Waste Obligations,” which provided guidance on accounting

for the European Union (EU) Directive on the disposal of elec-

tronic equipment. Refer to Note 1 – Summary of Significant

Accounting Policies in the Consolidated Financial Statements.

In 2003, all other expenses, net, included a $73 million loss on

early extinguishment of debt reflecting the write-off of the remain-

ing unamortized fees associated with the 2002 Credit Facility.

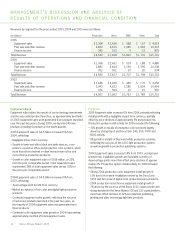

Income tax (benefits) expenses were as follows (in millions):

Year Ended December 31, 2005 2004 2003

Pre-tax income $ 830 $ 965 $ 436

Income tax (benefits) expenses (5) 340 134

Effective tax rate (0.6)% 35.2% 30.7%

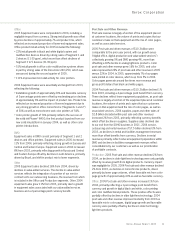

The 2005 effective tax rate of (0.6)% was lower than the U.S.

statutory tax rate primarily due to:

•Tax benefits of $253 million associated with the finalization of

the 1996-1998 IRS audit in the second quarter.

•Tax benefits of $42 million primarily from the realization of

foreign tax credits offset by the geographical mix of income

and the related tax rates in those jurisdictions.

•Tax benefits of $31 million from the reversal of a valuation

allowance on deferred tax assets associated with foreign

net operating loss carryforwards. This reversal followed

a re-evaluation of their future realization resulting from a

refinancing of a foreign operation.

•These impacts were partially offset by losses in certain

jurisdictions where we are not providing tax benefits and

continue to maintain deferred tax valuation allowances.

The 2004 effective tax rate of 35.2% was comparable to the

U.S. statutory tax rate, primarily reflecting:

•The impact of nondeductible expenses and $20 million of

unrecognized tax benefits primarily related to recurring

losses in certain jurisdictions where we maintained deferred

tax asset valuation allowances.

•Partially offset by tax benefits from other foreign adjustments,

including earnings taxed at different rates, tax law changes of

$14 million and other items that are individually insignificant.

The 2003 effective tax rate of 30.7% was lower than the U.S.

statutory tax rate, primarily reflecting:

•Tax benefits of $35 million resulting from the reversal of

valuation allowances on deferred tax assets following a

re-evaluation of their future realization due to improved financial

performance, other foreign adjustments, including earnings

taxed at different rates, the impact of Series B Convertible

Preferred Stock dividends and state tax benefits.

•Partially offset by tax expense for audit and other tax return

adjustments, as well as $19 million of unrecognized tax benefits

primarily related to recurring losses in certain jurisdictions

wherewe maintained deferred tax asset valuation allowances.

Our effective tax rate is based on recurring factors including the

geographical mix of income beforetaxes and the related tax

rates in those jurisdictions, as well as available foreign tax credits.

In addition, our effective tax rate will change based on discrete

or other nonrecurring events (such as audit settlements) that

may not be predictable. Weanticipate that our effective tax rate

for 2006 will approximate 34.0%, excluding the effects of any

discrete items.

Equity in Net Income of Unconsolidated Affiliates: Equity in net

income of unconsolidated affiliates of $98 million, principally

related to our 25% share of Fuji Xerox income, decreased $53

million in 2005 as compared to 2004, reflecting the following:

•A$44 million decrease in our 25% share of Fuji Xerox’s net

income. The lower net income related to the absence of the

$38 million pension settlement gain in 2004. Refer to Note 7 –

Investments in Affiliates, at Equity in the Consolidated Financial

Statements for condensed financial data of Fuji Xerox.

•The absence of $7 million of equity income from Integic

Corporation. In the first quarter of 2005, we sold our entire

equity interest in Integic Corporation.

Xerox Annual Report 2005