Xerox 2005 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2005 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

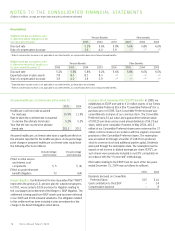

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

72

Cash Flow Hedges: As of December 31, 2005, cross-currency

swaps with a notional amount of $127 were used to hedge the

currency exposure for interest payments and principal on half

of our Japanese Yen denominated debt of ¥30 billion ($255).

In addition, forward currency contracts were used to hedge the

currency exposure for interest payments on the remaining debt.

These combined strategies converted the hedged cash flows

to U.S. dollar denominated payments and qualified for cash flow

hedge accounting.

During 2004, certain forward contracts were used to hedge the

interest payments on Euro denominated debt of $377. The deriva-

tives were designated and accounted for as cash flow hedges.

No amount of ineffectiveness was recorded in the Consolidated

Statements of Income during 2005 or 2004 for our designated

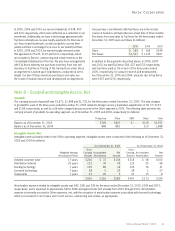

Fair Value of Financial Instruments: The estimated fair values of our financial instruments at December 31, 2005 and 2004 were as follows:

2005 2004

(in millions) Carrying Amount Fair Value Carrying Amount Fair Value

Cash and cash equivalents $1,322 $1,322 $3,218 $3,218

Short-term investments 244 244 – –

Accounts receivable, net 2,037 2,037 2,076 2,076

Short-term debt 1,139 1,134 3,074 3,093

Long-term debt 6,139 6,312 7,050 7,442

Short-term liabilities to trusts issuing

preferred securities(1) 98 96 – –

Long-term liabilities to trusts issuing

preferred securities 626 642 717 738

(1) Recognized as a component of Other current liabilities within the Consolidated Balance Sheets.

cash flow hedges and all components of each derivative’s gain

or loss was included in the assessment of hedge effectiveness.

Accumulated Other Comprehensive Loss (“AOCL”): During 2005,

a$32 after-tax decrease in the fair value of cash flow hedges was

recorded in AOCL while an after-tax amount of $30 was transferred

to earnings as a result of scheduled payments and receipts on our

cash flow hedges. This resulted in an ending gain position relating

to the cash flow hedges in AOCL of $1 as of December 31, 2005.

During 2004, a $16 after-tax increase in the fair value of cash

flow hedges was recorded in AOCL while an after-tax amount

of $(14) was transferred to earnings as a result of scheduled

payments and receipts on our cash flow hedges. This resulted in

an ending gain position relating to the cash flow hedges in AOCL

of $3 as of December 31, 2004.

Xerox Annual Report 2005

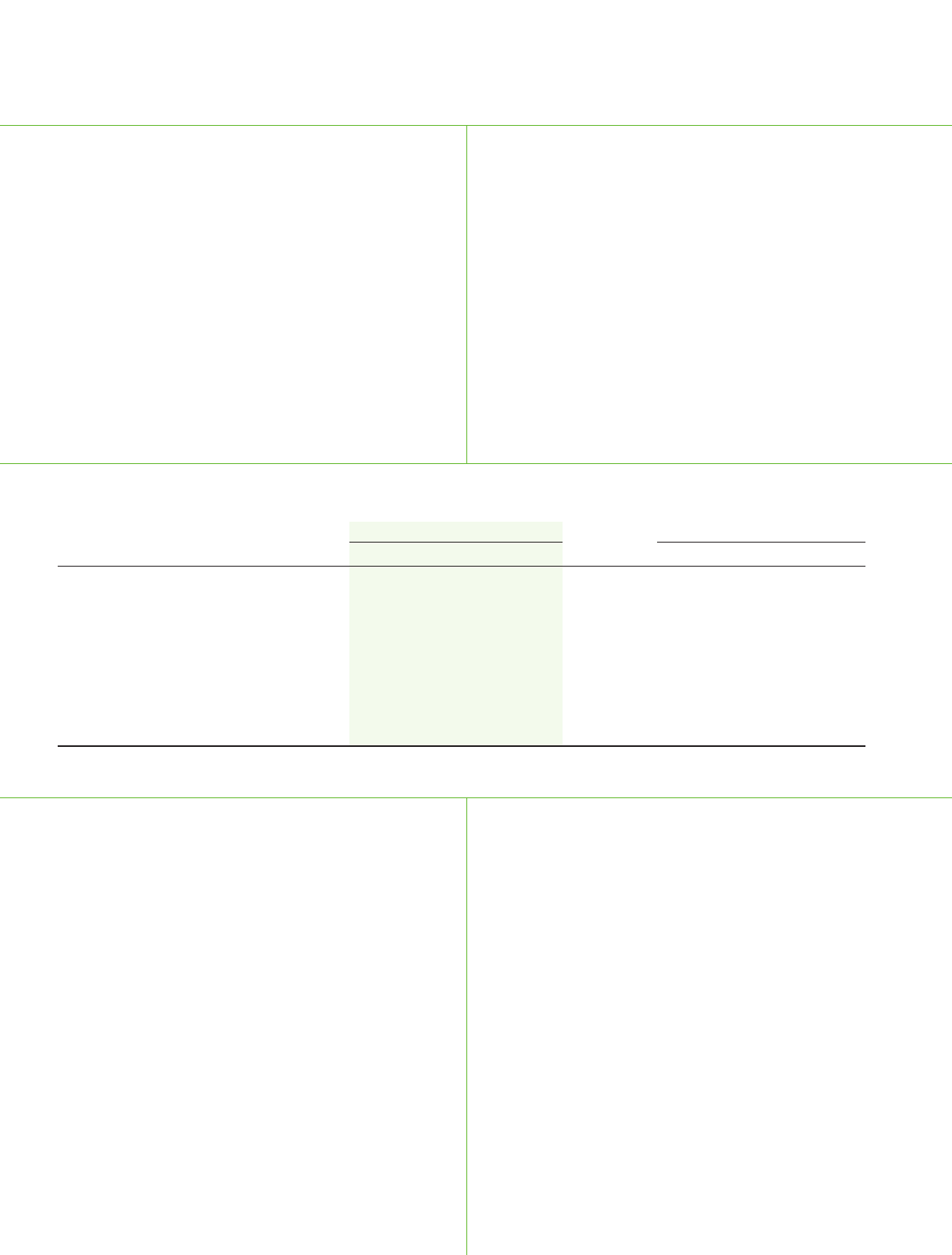

The fair value amounts for Cash and cash equivalents and

Accounts receivable, net approximate carrying amounts due

to the shortmaturities of these instruments. The fair value of

Short- and Long-term debt, as well as Liabilities to subsidiary

trusts issuing preferred securities, was estimated based on

quoted market prices for publicly traded securities or on

the current rates offered to us for debt of similar maturities.

The difference between the fair value and the carrying value

represents the theoretical net premium or discount we would

pay or receive to retire all debt at such date.