Xerox 2005 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2005 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

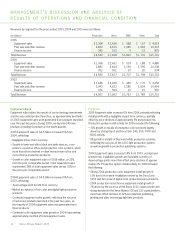

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

RESULTS OF OPERATIONS AND FINANCIAL CONDITION

42

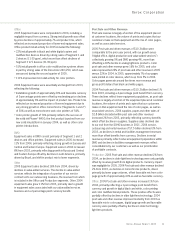

Liquidity: We manage our worldwide liquidity using internal cash

management practices, which are subject to (1) the statutes,

regulations and practices of each of the local jurisdictions in

which we operate, (2) the legal requirements of the agreements

to which we are a party and (3) the policies and cooperation of

the financial institutions we utilize to maintain and provide cash

management services.

With $1.6 billion of cash, cash equivalents and short-term

investments, as of December 31, 2005, borrowing capacity

under our 2003 Credit Facility of approximately $700 million

and funding available through our secured funding programs,

we believe our liquidity (including operating and other cash flows

that we expect to generate) will be sufficient to meet operating

cash flow requirements as they occur and to satisfy all scheduled

debt maturities for at least the next twelve months. Our ability

to maintain positive liquidity going forward depends on our ability

to continue to generate cash from operations and access the

financial markets, both of which are subject to general economic,

financial, competitive, legislative, regulatory and other market

factors that are beyond our control. As of December 31, 2005,

we had an active shelf registration statement with $1.75 billion of

capacity that enables us to access the market on an opportunistic

basis and offer both debt and equity securities.

Credit Facility: The 2003 Credit Facility consists of a $300 million

term loan and a $700 million revolving credit facility,which

includes a $200 million sub-facility for letters of credit. Xerox

Corporation is the only borrower of the term loan. The revolving

credit facility is available, without sub-limit, to Xerox Corporation

and certain of its foreign subsidiaries, including Xerox Canada

Capital Limited, Xerox Capital (Europe) plc and other qualified

foreign subsidiaries (excluding Xerox Corporation, the “Overseas

Borrowers”). The 2003 Credit Facility matures on September 30,

2008. As of December 31, 2005, the $300 million term loan

and $15 million of letters of credit were outstanding and there

were no outstanding borrowings under the revolving credit facility.

Since inception of the 2003 Credit Facility in June 2003, there

have been no borrowings under the revolving credit facility.

The term loan and the revolving loans each bear interest at

LIBOR plus a spread that varies between 1.75% and 3.00% or,

at our election, at a base rate plus a spread that depends on

the then-current leverage ratio, as defined, in the 2003 Credit

Facility.This rate was 6.22% at December 31, 2005.

The 2003 Credit Facility contains affirmative and negative

covenants as well as financial maintenance covenants. Subject to

certain exceptions, we cannot pay cash dividends on our common

stock during the facility term, although we can pay cash dividends

on our preferred stock provided there is then no event of default.

In addition to other defaults customary for facilities of this type,

defaults on other debt, or bankruptcy, of Xerox, or certain of our

subsidiaries, and a change in control of Xerox, would constitute

events of default. At December 31, 2005, we were in compliance

with the covenants of the 2003 Credit Facility and we expect to

remain in compliance for at least the next twelve months.

Share Repurchase Program: In October 2005, the Board of

Directors authorized the repurchase of up to $500 million of the

Company’s common stock during a period of up to one year. In

addition, during January 2006, the Board of Directors authorized

an additional repurchase of $500 million of the Company’s

common stock to also occur during a period of up to one year.

Refer to Note 18 – Common Stock in the Consolidated Financial

Statements for further information.

Other Financing Activity

Financing Business: We currently fund our customer financing

activity through third-party funding arrangements, cash generated

from operations, cash on hand, capital markets offerings and

secured loans. In the United States, Canada, the Netherlands,

the U.K. and France, we arecurrently funding a significant portion

of our customer financing activity through secured borrowing

arrangements with GE, De Lage Landen Bank (“DLL”) and Merrill

Lynch. At the end of the thirdquarter of 2005, we repaid $120

million of secured debt through a transaction with our DLL Joint

Venture to purchase DLL’s parent’s 51% ownership interest in

the Belgium and Spain leasing operations, which werepreviously

sold to the joint venture in the fourth quarter of 2003. In connec-

tion with the purchase, the secured borrowings to DLL’s parent in

these operations were repaid and the related finance receivables

are no longer encumbered. Other than the repayment of the

secured debt, the effects from this transaction were immaterial.

In October 2005, we renegotiated our Loan Agreement with

GE, resulting in a reduction in applicable interest rates and the

elimination of the monthly borrowing requirement. The interest

rate reduction is applicable to existing and new loans. Additionally,

in October 2005, we finalized renegotiation of our Loan

Agreements with Merrill Lynch in France, resulting in an increase

in the size of the facility from €350 million to €420 million

($414 million to $497 million), lower applicable interest rates

and an extension for an additional 2 years at our option from

the current expiration date of July 2007. Refer to Note 4 to the

Consolidated Financial Statements for a more detailed discussion

of our customer financing arrangements.

Xerox Annual Report 2005