Xerox 2005 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2005 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

52

FAS 123(R) also requires that the benefits of tax deductions

in excess of recognized compensation cost be reported as a

financing cash flow, rather than as an operating cash flow as

required under current literature. This requirement will reduce net

operating cash flows and increase net financing cash flows in

periods after the effective date. While we can not estimate what

those amounts will be in the future (because they depend on,

among other things, when employees exercise stock options),

the amount of operating cash flows recognized in 2005 for such

excess tax deductions was $12.

Pending the effective date of FAS 123(R), we do not recognize

compensation expense relating to employee stock options

because the exercise price is equal to the market price at the

date of grant. If we had elected to recognize compensation

expense using a fair-value approach, and therefore determined

the compensation based on the value as determined by the

modified Black-Scholes option pricing model, our proforma

income and income per share would have been as follows:

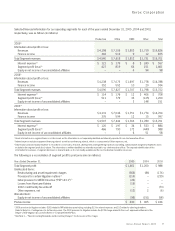

(in millions, except per-sharedata) 2005 2004 2003

Net income – as reported $ 978 $ 859 $ 360

Add: Stock-based employee

compensation expense

included in reported net

income, net of tax 25 13 10

Deduct: Total stock-based

employee compensation

expense determined under

fair value based method for

all awards, net of tax (113) (82) (95)

Net income – pro forma $ 890 $ 790 $ 275

Basic EPS – as reported $0.96 $0.94 $0.38

Basic EPS – pro forma 0.87 0.86 0.27

Diluted EPS – as reported $0.94 $0.86 $0.36

Diluted EPS – pro forma 0.85 0.80 0.25

The proforma periodic compensation expense amounts are not

representative of future amounts, as we began granting employees

restricted stock awards with time- and performance-based

restrictions in 2005 in lieu of stock options. As reflected in the

proforma amounts in the previous table, the weighted-average

fair value of options granted in 2004 and 2003 was $8.38 and

$5.39, respectively. The fair values were estimated on the date

of grant using the following weighted average assumptions:

2004 2003

Risk-free interest rate 3.2% 3.3%

Expected life in years(1) 5.7 7.2

Expected price volatility 66.5% 66.2%

Expected dividend yield ––

(1) Options granted in 2004 expireeight years from date of grant, resulting in an

expected life shorter than previous grants.

Refer to Note 18 – Common Stock for additional disclosures

regarding our stock compensation programs.

Summary of Accounting Policies

Revenue Recognition: We generate revenue through the sale and

rental of equipment, service and supplies and income associated

with the financing of our equipment sales. Revenue is recognized

when earned. More specifically, revenue related to sales of our

products and services is recognized as follows:

Equipment: Revenues from the sale of equipment, including those

from sales-type leases, are recognized at the time of sale or at the

inception of the lease, as appropriate. For equipment sales that

require us to install the product at the customer location, revenue is

recognized when the equipment has been delivered to and installed

at the customer location. Sales of customer-installable products are

recognized upon shipment or receipt by the customer according

to the customer’s shipping terms. Revenues from equipment under

other leases and similar arrangements areaccounted for by the

operating lease method and are recognized as earned over the

lease term, which is generally on a straight-line basis.

Service: Service revenues are derived primarily from maintenance

contracts on our equipment sold to customers and are recog-

nized over the term of the contracts. A substantial portion of

our products are sold with full-service maintenance agreements

for which the customer typically pays a base service fee plus a

variable amount based on usage. As a consequence, other than

the product warranty obligations associated with certain of our

low-end products in the Office segment, we do not have any

significant product warranty obligations, including any obligations

under customer satisfaction programs.

Revenues associated with outsourcing services as well as

professional and value-added services are generally recognized

as such services areperformed. In those service arrangements

where final acceptance of a system or solution by the customer

is required, revenue is deferred until all acceptance criteria have

been met. Costs associated with service arrangements are

generally recognized as incurred. Initial direct costs of an arrange-

ment are capitalized and amortized over the contractual service

period. Long-lived assets used in the fulfillment of the arrangements

are capitalized and depreciated over the shorter of their useful

life or the term of the contract. Losses on service arrangements

are recognized in the period that the contractual loss becomes

probable and estimable.

Sales to Distributors and Resellers: We utilize distributors and

resellers to sell certain of our products to end users. We refer

to our distributor and reseller network as our two-tier distribution

model. Sales to distributors and resellers are recognized as

revenue when products are sold to such distributors and

resellers, as long as all requirements for revenue recognition

have been met. Distributors and resellers participate in various

cooperative marketing and other programs, and we record

provisions for these programs as a reduction to revenue when

Xerox Annual Report 2005