Xerox 2005 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2005 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

66

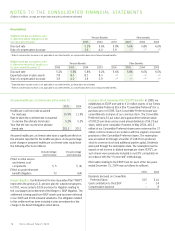

Note 10 – Supplementary Financial

Information

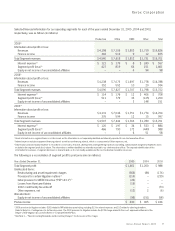

The components of other current assets and other current

liabilities at December 31, 2005 and 2004 were as follows

(in millions):

2005 2004

Other current assets

Deferred taxes $ 290 $ 289

Restricted cash 270 370

Prepaid expenses 133 142

Financial derivative instruments 28 125

Other 311 256

Total Other current assets $ 1,032 $ 1,182

Other current liabilities

Income taxes payable $ 84 $ 183

Other taxes payable 199 234

Interest payable 102 113

Restructuring reserves 212 93

Financial derivative instruments 12 46

Product warranties 20 22

Liability to Xerox Capital LLC 98 –

Other 625 618

Total Other current liabilities $ 1,352 $ 1,309

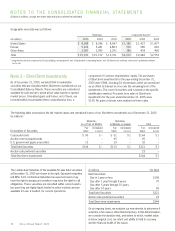

The components of other long-term assets and other long-

term liabilities at December 31, 2005 and 2004 were as follows

(in millions):

2005 2004

Other long-term assets

Prepaid pension costs $ 829 $ 891

Net investment in discontinued operations 420 440

Internal use software, net 198 255

Restricted cash 176 160

Financial derivative instruments – 19

Debt issuance costs, net 52 64

Other 246 244

Total Other long-term assets $ 1,921 $ 2,073

Other long-term liabilities

Deferred and other tax liabilities $ 771 $ 862

Minorities’ interests in equity of subsidiaries 90 80

Financial derivative instruments 45 43

Product warranties 1 1

Other 388 329

Total Other long-term liabilities $ 1,295 $ 1,315

Net Investment in Discontinued Operations: Our net investment in

discontinued operations is primarily related to the disengagement

from our former insurance holding company, Talegen Holdings, Inc.

(“Talegen”), and consists of our net investment in Ridge Reinsurance

Limited (“Ridge Re”) and a performance-based instrument relating

to the 1997 sale of The Resolution Group (“TRG”).

Ridge Re: Weprovide aggregate excess of loss reinsurance

coverage (the Reinsurance Agreement) to one of the former

Talegen units, TRG, through Ridge Re, a wholly owned subsidiary.

The coverage limit for this remaining Reinsurance Agreement is

$578. We have guaranteed that Ridge Re will meet all of its financial

obligations under the remaining Reinsurance Agreement. Ridge

Re maintains an investment portfolio in a trust that is required to

provide security with respect to aggregate excess of loss rein-

surance obligations under the remaining Reinsurance Agreement.

At December 31, 2005 and 2004, the balance of the investments

in the trust, consisting of U.S. government, government agency

and high-quality corporate bonds, was $504 and $544, respectively.

Our remaining net investment in Ridge Re was $83 and $82 at

December 31, 2005 and 2004, respectively. Based on Ridge Re’s

current projections of investment returns and reinsurance payment

obligations, we expect to fully recover our remaining investment.

The projected reinsurance payments are based on actuarial

estimates. Wecontinue to evaluate potential strategies to transfer

our obligations under the remaining Reinsurance Agreement,

as well as the investments in the trust, to another insurance

company in an effort to completely exit from this business.

Performance-Based Instrument: In connection with the 1997 sale

of TRG, we received a $462 performance-based instrument as

partial consideration. Cash distributions arepaid on the instrument,

based on 72.5% of TRG’savailable cash flow as defined in the

sale agreement. For the years ended December 31, 2005 and

2004, we received cash distributions of $20 and $22, respectively.

The recovery of this instrument is dependent upon the sufficiency

of TRG’s available cash flows. Such cash flows are supported by

TRG’s ultimate parent via a subscription agreement whereby the

parent has agreed to purchase from TRG an established number

of shares of this instrument each year through 2017. Based on

current cash flow projections, we expect to fully recover the $345

remaining balance of this instrument.

Liability to Xerox Capital LLC: Refer to Note 12 for further

information.

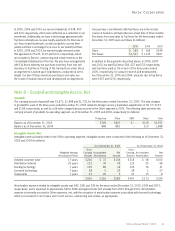

Internal Use Software: Capitalized direct costs associated with

developing, purchasing or otherwise acquiring software for internal

use are amortized on a straight-line basis over the expected useful

life of the software, beginning when the software is implemented.

Useful lives of the software generally vary from 3 to 5 years.

Amortization expense, including applicable impairment charges,

was $92, $107 and $116 for the years ended December 31,

2005, 2004 and 2003, respectively.

Xerox Annual Report 2005