Xerox 2005 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2005 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in millions, except per-share data and unless otherwise indicated)

60

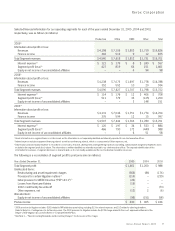

The following table shows finance receivables and related secured debt as of December 31, 2005 and 2004:

December 31, 2005 December 31, 2004

Maximum

Facility Facility Finance Secured Finance Secured

(in millions, unless otherwise indicated) Amount Amount(1) Receivables Debt Receivables Debt

Finance Receivables Encumbered by Loans:

GE secured loans:

GE Loans – U.S. $5 billion $8 billion $ 1,888 $ 1,701 $ 2,711 $ 2,486

GE Loans – U.K. £400 million £600 million 637 581 771 685

(U.S. $690) (U.S. $1.0 billion)

GE Loans – Canada Cdn. $850 million Cdn. $2 billion

(U.S. $730) (U.S. $1.7 billion) 258 174 486 426

Total GE Encumbered

finance receivables, net 2,783 2,456 3,968 3,597

Merrill Lynch Loan – France €420 million €420 million 430 342 368 287

(U.S. $497) (U.S. $497)

Asset-backed notes – France N/A N/A – – 225 148

DLL – Netherlands N/A N/A 216 184 436 404

Total Encumbered finance receivables, net 3,429 $ 2,982 4,997 $ 4,436

Unencumbered finance receivables, net 4,420 3,500

Total Finance receivables, net (2) $7,849 $8,497

(1) Subject to mutual agreement by the parties.

(2) Includes (i) billed portion of finance receivables, net (ii) finance receivables, net and (iii) finance receivables due after one year,net as included in the Consolidated Balance

Sheets as of December 31, 2005 and 2004.

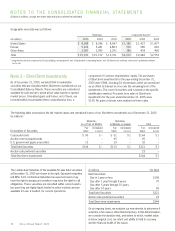

Accounts Receivable Funding Arrangement: In 2004, we

completed a transaction with GE for a three-year $400 revolving

credit facility secured by our U.S. accounts receivable. This

arrangement is being accounted for as a secured borrowing

within our Consolidated Balance Sheets. Secured accounts

receivables and related debt associated with this arrangement

as of December 31, 2005 and 2004 were as follows (in millions):

2005 2004

Secured accounts receivable, net $313 $354

Secured debt $178 $200

As of December 31, 2005, $3,429 of Finance receivables,

net are held as collateral in various entities, as security for the

borrowings noted above. Total outstanding debt secured by

these receivables at December 31, 2005 was $2,982. The

entities are consolidated in our financial statements. Although

the transferred assets areincluded in our total assets, the

assets of the entities are not available to satisfy any of our other

obligations. We also have arrangements in Germany, Italy, the

Nordic countries, Brazil and Mexico in which third-party financial

institutions originate lease contracts directly with our customers.

In these transactions, we sell and transfer title of the equipment

to these financial institutions and have no continuing ownership

rights in the leased equipment subsequent to its sale.

Xerox Annual Report 2005