Xerox 2005 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2005 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Xerox Corporation

33

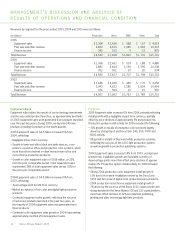

Office

2005 Equipment sales were comparable to 2004, including a

negligible impact from currency. Strong install growth was offset

by price declines of approximately 7% and product mix, which

reflected an increased proportion of lower-end equipment sales.

Office product install activity for 2005 included the following:

•22% install growth in black and white digital copiers and

multifunction devices driven by strong sales of Segment 1 and

2devices (11-30 ppm), which more than offset declines of

Segment 3 to 5 devices (31-90 ppm).

•51% install growth in office color multifunction systems driven

in part by strong sales of the DocuColor 240/250, which was

announced during the second quarter of 2005.

•111% improvement in install activity for color printers.

2004 Equipment sales wereessentially unchanged from 2003,

reflecting the following:

•Installation growth of approximately 20% and favorable currency

of 3-percentage points were offset by moderating price declines

of approximately 6% and the impact of product mix. Product mix

reflected an increased proportion of low-end equipment due to

very strong growth in office monochrome (“Segments 1 and 2”)

of 30% as well as monochrome and color printers of 54%.

•Color printer growth of 74% primarily reflects the success of

the solid ink Phaser®8400, the first product launched from our

new solid ink platform in January 2004, as well as other color

printer introductions.

DMO

Equipment sales in DMO consist primarily of Segment 1 and 2

devices and office printers. Equipment sales in 2005 increased

11% from 2004, primarily reflecting strong growth in Eurasia and

Central and Eastern Europe. Equipment sales in 2004 increased

8% from 2003, primarily reflecting growth in Russia and Central

and Eastern Europe offset by declines in Latin America, primarily

driven by Brazil, and shift in product mix to lower segments.

Other

2005 Equipment sales declined 16% from 2004, driven by

declines in value-added services. The decline in value-added

services reflects the integration of a portion of our service

contracts into our outsourcing business, the revenue from which

is included in the Office and Production segments. Other 2004

equipment sales grew 11% from 2003, primarily due to growth

in equipment sales associated with our value-added services

business and a 2-percentage point currency benefit.

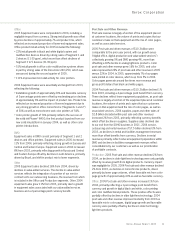

Post Sale and Other Revenue

Post sale revenue is largely a function of the equipment placed

at customer locations, the volume of prints and copies that our

customers make on that equipment and the mix of color pages,

as well as associated services.

2005 Post sale and other revenues of $10.3 billion were

comparable to the prior year period, with our growth areas

(“digital office, digital production and value-added services”)

collectively growing 5% and DMO growing 4%, more than

offsetting a 40% decline in analog light-lens products. Color

post sale and other revenue grew 16% for 2005, and color

sales represented 26% of post sale and other revenue in 2005

versus 22% in 2004. In 2005, approximately 7% of our pages

were printed on color devices, which is up from 5% in 2004.

Color pages generate around five times more revenue and

gross profit dollars than black and white pages.

2004 Post sale and other revenues of $10.3 billion declined 1%

from 2003, including a 4-percentage point benefit from currency.

These declines reflect lower equipment populations, as post sale

revenue is largely a function of the equipment placed at customer

locations, the volume of prints and copies that our customers

make on that equipment and the mix of color pages, as well as

associated services. 2004 supplies, paper and other sales of

$2.8 billion (included within post sale and other revenue)

increased 2% from 2003, primarily reflecting currency benefits

which offset declines in supplies. Supplies sales declined due

to our exit from the SOHO business in 2001. 2004 service,

outsourcing and rental revenue of $7.5 billion declined 3% from

2003, as declines in rental and facilities management revenues

morethan offset benefits from currency. Declines in rental

revenues primarily reflect reduced equipment populations within

DMO and declines in facilities management revenues reflect

consolidations by our customers as well as our prioritization

of profitable contracts.

Production: 2005 Post sale and other revenue declined 2% from

2004, as declines in older light-lens technology were only partially

offset by revenue growth from digital products. Currency impact

was negligible for 2005. 2004 Post sale and other revenue declined

2% from 2003, as declines in monochrome products, driven

primarily by lower page volumes, offset favorable mix from color

page growth of approximately 40% as well as favorable currency.

Office: 2005 Post sale and other revenue increased 1% from

2004, primarily reflecting a 1-percentage point benefit from

currency and growth in digital black and white, color printing

and color multifunctional products. These positive effects were

partially offset by declines in older light-lens technology. 2004

post sale and other revenue improved modestly from 2003 as

favorable mix to color pages, digital page growth and favorable

currency were partially offset by declines in older technology

light lens products.

Xerox Annual Report 2005