Xcel Energy 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

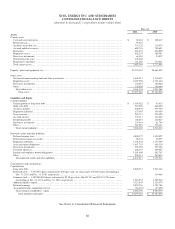

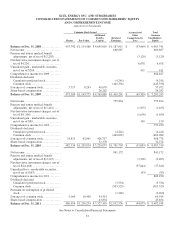

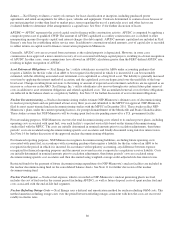

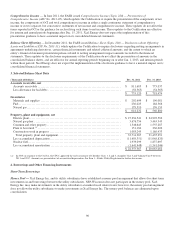

XCEL ENERGY INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CAPITALIZATION — (Continued)

(amounts in thousands, except share and per share data)

Dec. 31

2011 2010

Long-Term Debt — continued

NSP-Wisconsin

First Mortgage Bonds, Series due:

Oct. 1, 2018, 5.25% .................................................................... $

150,000 $

150,000

Sept. 1, 2038, 6.375%................................................................... 200,000 200,000

City of La Crosse Resource Recovery Bond, Series due Nov. 1, 2021, 6% (b)........................ 18,600 18,600

Fort McCoy System Acquisition, due Oct. 15, 2030, 7% ........................................ 625 659

Other .................................................................................. 1,892 1,954

Unamortized discount..................................................................... (1,748) (1,857)

Total ............................................................................... 369,369 369,356

Less current maturities .................................................................... 1,286 1,502

Total NSP-Wisconsin long-term debt .................................................. $

368,083 $

367,854

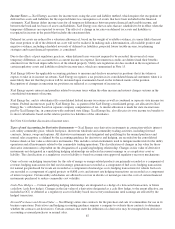

Other Subsidiaries

Various Eloigne Co Affordable Housing Project Notes, due 2012-2045, 0% — 9% .................. $

53,728 $

61,039

Total ............................................................................... 53,728 61,039

Less current maturities .................................................................... 4,974 5,088

Total other subsidiaries long-term debt ................................................. $

48,754 $

55,951

Xcel Energy Inc.

Unsecured Senior Notes, Series due:

April 1, 2017, 5.613%................................................................... $

253,979 $

253,979

May 15, 2020, 4.7% .................................................................... 550,000 550,000

July 1, 2036, 6.5%...................................................................... 300,000 300,000

Sept. 15, 2041, 4.8% .................................................................... 250,000 -

Junior Subordinated Notes, Series due:

Jan. 1, 2068, 7.6%...................................................................... 400,000 400,000

Elimination of PSCo capital lease obligation with affiliates ...................................... (76,329) (74,937)

Unamortized discount..................................................................... (10,798) (11,780)

Total ............................................................................... 1,666,852 1,417,262

Less current maturities (including elimination of PSCo capital lease obligation) ..................... (1,971) (2,664)

Total Xcel Energy Inc. long-term debt ................................................. $

1,668,823 $

1,419,926

Total long-term debt .............................................................. $

8,848,513 $

9,263,144

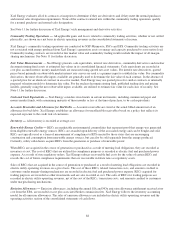

Preferred Stockholders’ Equity

Preferred stock — 7,000,000 shares authorized of $100 par value; no shares and 1,049,800 shares

outstanding at Dec. 31, 2011 and 2010, respectively

$3.60 series, 275,000 shares.............................................................. $

- $

27,500

$4.08 series, 150,000 shares.............................................................. - 15,000

$4.10 series, 175,000 shares.............................................................. - 17,500

$4.11 series, 200,000 shares.............................................................. - 20,000

$4.16 series, 99,800 shares............................................................... - 9,980

$4.56 series, 150,000 shares.............................................................. - 15,000

Total preferred stockholders’ equity ..................................................... $

- $

104,980

Common Stockholders’ Equity

Common stock — 1,000,000,000 shares authorized of $2.50 par value; 486,493,933 and 482,333,750

shares outstanding at Dec. 31, 2011 and 2010, respectively .................................... $

1,216,234 $

1,205,834

Additional paid in capital .................................................................. 5,327,443 5,229,075

Retained earnings ........................................................................ 2,032,556 1,701,703

Accumulated other comprehensive loss ...................................................... (94,035) (53,093)

Total common stockholders’ equity...................................................... $

8,482,198 $

8,083,519

(a) Pollution control financing

(b) Resource recovery financing

See Notes to Consolidated Financial Statements