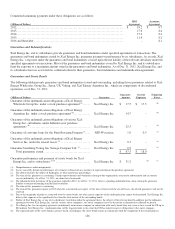

Xcel Energy 2011 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

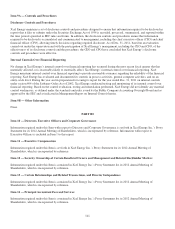

133

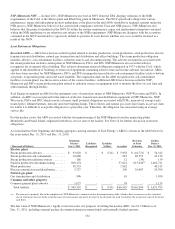

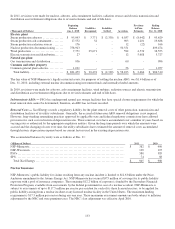

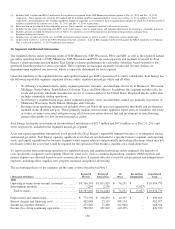

In 2011, revisions were made for nuclear, asbestos, ash-containment facilities, radiation sources and electric transmission and

distribution asset retirement obligations due to revised estimates and end of life dates.

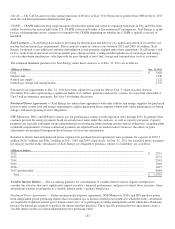

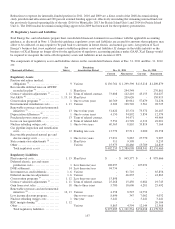

(Thousands of Dollars)

Beginning

Balance

Jan. 1, 2010

Liabilities

Recognized

Liabilities

Settled Accretion

Revisions

to Prior

Estimates

Ending

Balance

Dec. 31, 2010

Electric plant

Steam production asbestos

................

$

95,093 $

3,771

$ (2,330) $ 6,037 $ (8,942

) $ 93,629

Steam production ash containment

.........

17,552

32

- 903 1,201

19,688

Steam production radiation sources

........

176

-

- 12 (22

) 166

Nuclear production decommissioning

......

758,923

-

- 50,551 -

809,474

Wind production

.........................

7,751

25,671

- 592 4,539

38,553

Electric transmission and distribution

.......

27

-

- 12 5,688

5,727

Natural gas plant

Gas transmission and distribution

..........

936

-

- 60 -

996

Common and other property

Common general plant asbestos

............

1,021

-

- 56 -

1,077

Total liability

...........................

$

881,479 $

29,474

$ (2,330) $ 58,223 $ 2,464

$ 969,310

The fair value of NSP-Minnesota’s legally restricted assets, for purposes of settling the nuclear ARO, was $1.4 billion as of

Dec. 31, 2010, including external nuclear decommissioning investment funds and internally funded amounts.

In 2010, revisions were made for asbestos, ash-containment facilities, wind turbines, radiation sources and electric transmission

and distribution asset retirement obligations due to revised estimates and end of life dates.

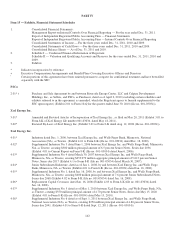

Indeterminate AROs — PSCo has underground natural gas storage facilities that have special closure requirements for which the

final removal date cannot be determined; therefore, an ARO has not been recorded.

Removal Costs — Xcel Energy records a regulatory liability for the plant removal costs of other generation, transmission and

distribution facilities of its utility subsidiaries. Generally, the accrual of future non-ARO removal obligations is not required.

However, long-standing ratemaking practices approved by applicable state and federal regulatory commissions have allowed

provisions for such costs in historical depreciation rates. These removal costs have accumulated over a number of years based on

varying rates as authorized by the appropriate regulatory entities. Given the long time periods over which the amounts were

accrued and the changing of rates over time, the utility subsidiaries have estimated the amount of removal costs accumulated

through historic depreciation expense based on current factors used in the existing depreciation rates.

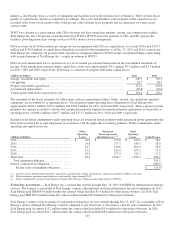

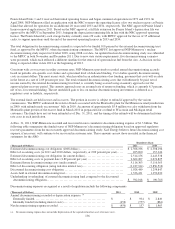

The accumulated balances by entity were as follows at Dec. 31:

(Millions of Dollars) 2011 2010

NSP-Minnesota .......................................................................... $

382 $

400

NSP-Wisconsin .......................................................................... 109 107

PSCo .................................................................................... 380 385

SPS ..................................................................................... 74 88

Total Xcel Energy ...................................................................... $

945 $

980

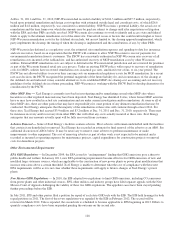

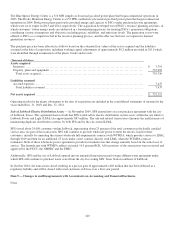

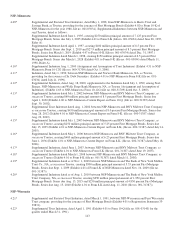

Nuclear Insurance

NSP-Minnesota’s public liability for claims resulting from any nuclear incident is limited to $12.6 billion under the Price-

Anderson amendment to the Atomic Energy Act. NSP-Minnesota has secured $375 million of coverage for its public liability

exposure with a pool of insurance companies. The remaining $12.2 billion of exposure is funded by the Secondary Financial

Protection Program, available from assessments by the federal government in case of a nuclear accident. NSP-Minnesota is

subject to assessments of up to $117.5 million per reactor per accident for each of its three licensed reactors, to be applied for

public liability arising from a nuclear incident at any licensed nuclear facility in the United States. The maximum funding

requirement is $17.5 million per reactor during any one year. These maximum assessment amounts are both subject to inflation

adjustment by the NRC and state premium taxes. The NRC’s last adjustment was effective April 2010.