Xcel Energy 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.51

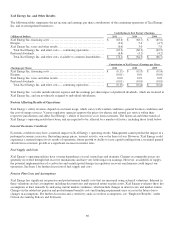

In 2010, Xcel Energy Inc., PSCo and PSRI entered into a settlement agreement with Provident Life & Accident Insurance

Company (Provident) related to all claims asserted by Xcel Energy Inc., PSCo and PSRI against Provident in a lawsuit associated

with the discontinued COLI program. Under the terms of the settlement, Xcel Energy Inc., PSCo and PSRI were paid $25 million

by Provident and Reassure America Life Insurance Company resulting in approximately $0.05 of non-recurring earnings per

share in 2010. The $25 million proceeds were not subject to income taxes.

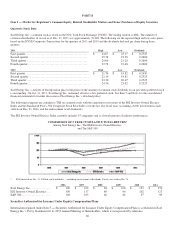

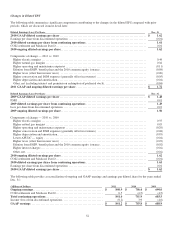

Earnings Adjusted for Certain Items (Ongoing Earnings)

2011 Comparison with 2010

Xcel Energy — Overall, ongoing earnings increased $0.10 per share for 2011. Ongoing earnings increased primarily due to

higher electric margins as a result of warmer than normal summer weather across Xcel Energy’s service territories and rate

increases in various states. The higher margins were partially offset by expected increases in O&M expenses, depreciation,

interest expense and property taxes. The increase in expenses was largely driven by capital investment in Xcel Energy’s utility

business.

PSCo — PSCo earnings decreased $0.04 per share for 2011. The decrease is due to the implementation of seasonal rates in June

2010 (seasonal rates are higher in the summer months and lower throughout the other months of the year), higher O&M expenses,

depreciation expense and property taxes, partially offset by the favorable impact of warmer temperatures in the summer.

NSP-Minnesota — NSP-Minnesota earnings increased $0.13 per share for 2011. The increase is primarily due to higher interim

electric rates effective in early 2011, subject to refund, in Minnesota and North Dakota, and conservation program incentives

partially offset by higher O&M expenses, depreciation expense (net of regulatory adjustments) and property taxes.

SPS — SPS earnings increased $0.01 per share for 2011. The increase is due to higher electric revenues, primarily due to the

Texas retail rate increase effective in the first quarter of 2011, and warmer summer weather, partially offset by higher O&M

expenses, depreciation expense and property taxes.

NSP-Wisconsin — NSP-Wisconsin earnings increased $0.01 per share for 2011. The increase is primarily due to higher electric

rates, partially offset by higher O&M expenses and depreciation expense.

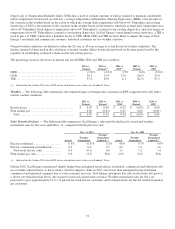

2010 Comparison with 2009

Xcel Energy — Overall, ongoing earnings increased $0.12 per share for 2010. Higher 2010 ongoing earnings were primarily due

to improved electric margins as a result of new rates in various jurisdictions and warmer summer temperatures, which were

partially offset by higher O&M expenses and property taxes.

PSCo — PSCo earnings increased $0.14 per share for 2010. The increase was due to higher electric margin resulting from the full

effect of two general rate increases, and warmer temperatures, which increased electric sales. The rate increases reflect the

significant capital investments that PSCo has made in its utility operations. In addition, PSCo’s electric operations substantially

under-earned its authorized return in 2009. The higher electric margin was partially offset by higher O&M expenses, higher

property tax expense and depreciation expense.

NSP-Minnesota — NSP-Minnesota earnings decreased $0.04 per share for 2010. The decrease was primarily due to higher O&M

expenses, property taxes and depreciation expense partially offset by the positive impact of warmer temperatures, higher earned

incentives on energy efficiency and conservation programs and modest normalized sales growth.

SPS — SPS earnings increased $0.02 per share in 2010. The increase was primarily due to electric sales growth, particularly in

the commercial and industrial customer class, the reversal of previously established fuel reserves following the regulatory

approval of certain settlement agreements and lower interest expense, which was partially offset by higher O&M expenses.

NSP-Wisconsin — NSP-Wisconsin earnings decreased $0.01 per share for 2010. The decrease was primarily due to fuel recovery

and higher O&M expenses, partially offset by warmer temperatures which increased electric sales, as well as new electric rates,

that were effective in January 2010.

Equity Earnings of Unconsolidated Subsidiaries — The increase was primarily related to increased earnings from the equity

investment in WYCO related to a natural gas storage facility that began operating in mid-2009.