Xcel Energy 2011 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

8. Share-Based Compensation

Stock Options — Xcel Energy Inc. has incentive compensation plans under which stock options and other performance incentives

are awarded to key employees. Xcel Energy Inc. has not granted stock options since December 2001.

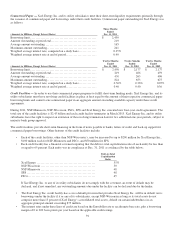

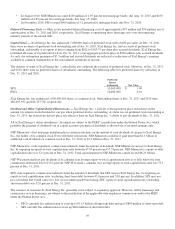

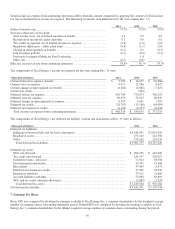

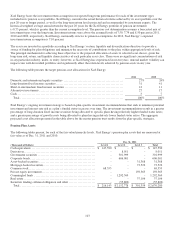

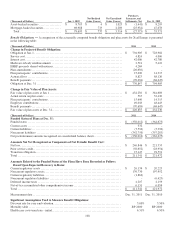

Activity in stock options was as follows:

2011 2010 2009

(Awards in Thousands) Awards

Average

Exercise

Price Awards

Average

Exercise

Price Awards

Average

Exercise

Price

Outstanding and exercisable at Jan. 1

.....

2,498

$

30.42 6,657

$ 28.17 8,460 $

27.05

Exercised

..............................

(1,173)

25.90 (51

) 19.31 (794)

19.84

Forfeited

...............................

-

- -

- (11)

20.04

Expired

................................

(1,325)

34.42 (4,108

) 26.91 (998)

25.40

Outstanding and exercisable at Dec. 31

...

-

- 2,498

30.42 6,657

28.17

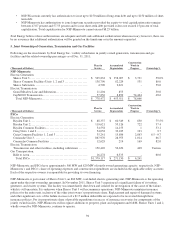

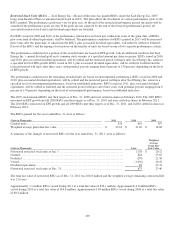

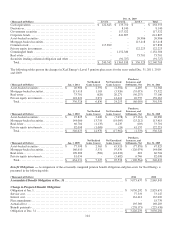

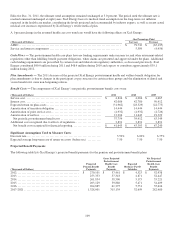

The total market value and the total intrinsic value of stock options exercised were as follows for the years ended Dec. 31:

(Thousands of Dollars) 2011 2010 2009

Market value of exercises ................................

....................

$

30,761 $

1,087 $

16,429

Intrinsic value of options exercised (a) ................................

........

380 93 670

(a) Intrinsic value is calculated as market price at exercise date less the option exercise price.

Cash received from stock options exercised and the actual tax benefit realized for the tax deductions from stock options exercised

during the years ended Dec. 31 were as follows:

(Thousands of Dollars) 2011 2010 2009

Cash received from stock options exercised ................................

....

$

30,381 $

1,033 $

15,759

Tax benefit realized for the tax deductions from stock options exercised

..........

157 40 277

Restricted Stock — Certain employees may elect to receive shares of common or restricted stock under the Xcel Energy Inc.

Executive Annual Incentive Award Plan. Restricted stock vests and settles in equal annual installments over a three-year period.

Xcel Energy Inc. reinvests dividends on the restricted stock it holds while restrictions are in place. Restrictions also apply to the

additional shares of restricted stock acquired through dividend reinvestment. If the restricted shares are forfeited, the employee is

not entitled to the dividends on those shares. Restricted stock has a fair value equal to the market trading price of Xcel Energy

Inc.’s stock at the grant date.

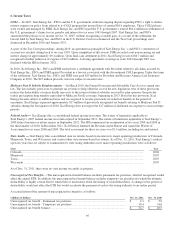

Xcel Energy Inc. granted shares of restricted stock for the years ended Dec. 31 as follows:

(Shares in Thousands) 2011 2010 2009

Granted shares ................................

..............................

15 44 -

Grant date fair value ................................

.........................

$

23.62 $

20.47 $

-

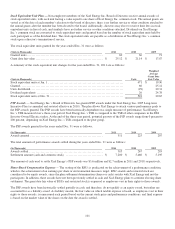

A summary of the changes of nonvested restricted stock for the year ended Dec. 31, 2011 were as follows:

(Shares in Thousands) Shares Weighted Average

Grant Date Fair Value

Nonvested restricted stock at Jan. 1 ................................

................

55 $ 20.28

Granted................................................................

..........

15 23.62

Vested................................................................

...........

(25) 20.53

Dividend equivalents ................................

.............................

2 24.37

Nonvested restricted stock at Dec. 31................................

...............

47 21.36