Xcel Energy 2011 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2011 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108

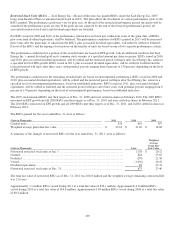

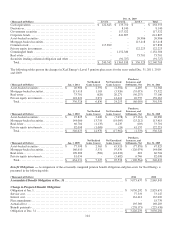

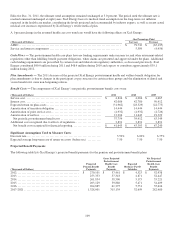

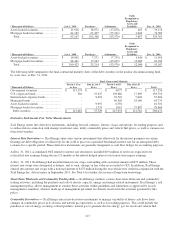

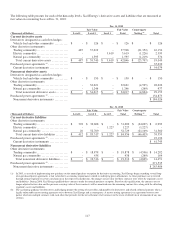

(Thousands of Dollars) Jan. 1, 2009

Net Realized

Gains (Losses)

Net Unrealized

Gains (Losses)

Purchases,

Issuances, and

Settlements, Net

Dec. 31, 2009

Asset-backed securities .................

$

8,705 $

4 $

1,025 $

(1,441) $

8,293

Mortgage-backed securities..............

69,988 733 2,289 (25,932) 47,078

Total ................................

$

78,693 $

737 $

3,314 $

(27,373) $

55,371

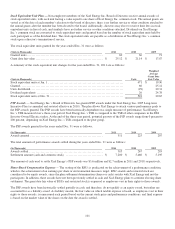

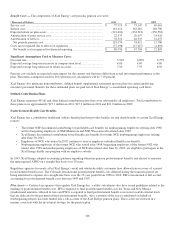

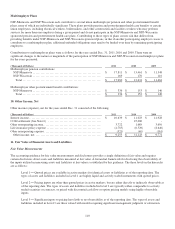

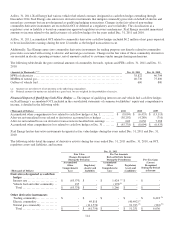

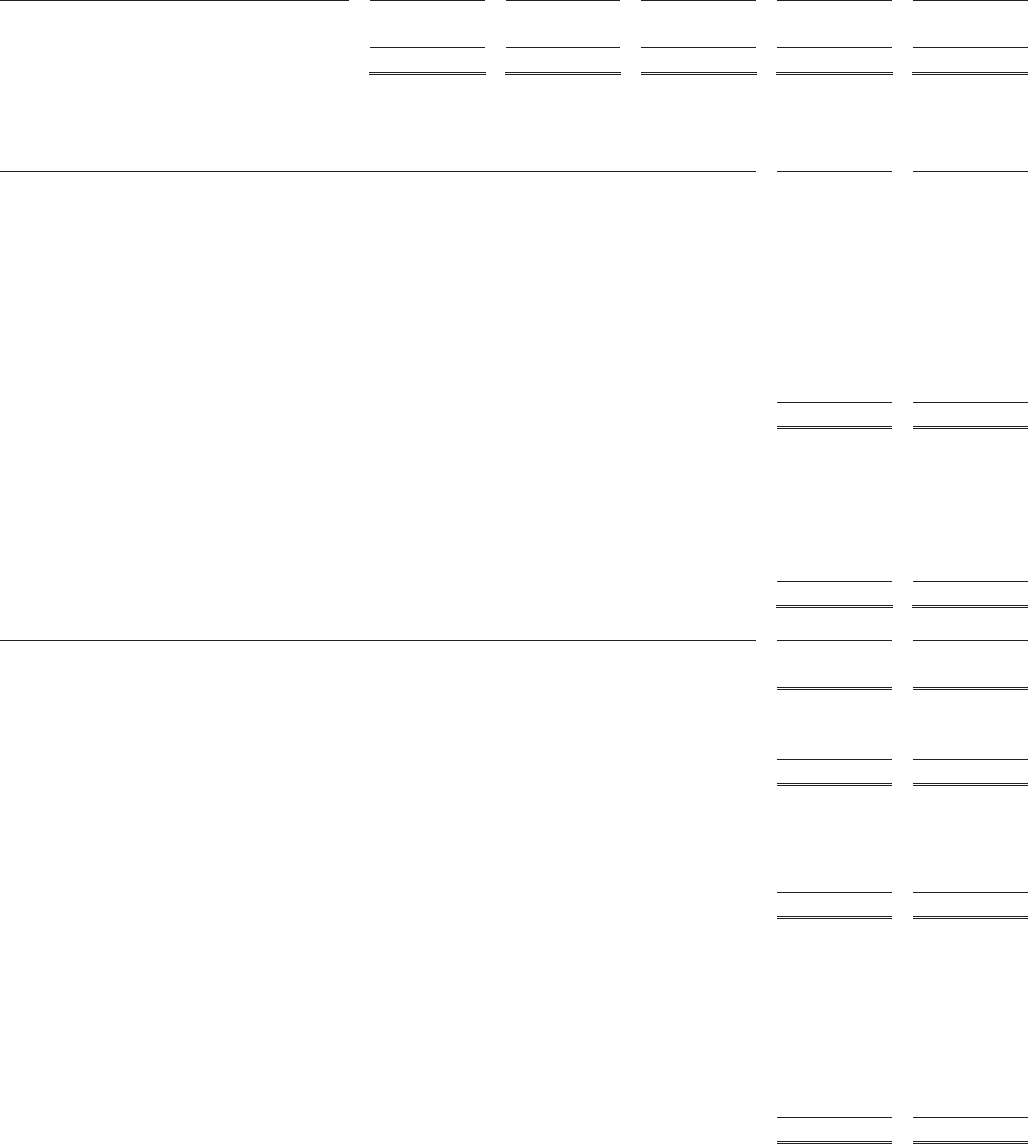

Benefit Obligations — A comparison of the actuarially computed benefit obligation and plan assets for Xcel Energy is presented

in the following table:

(Thousands of Dollars) 2011 2010

Change in Projected Benefit Obligation:

Obligation at Jan. 1 ................................................................

.....

$

794,905 $

728,902

Service cost ................................................................

............

4,824 4,006

Interest cost ................................................................

............

42,086 42,780

Medicare subsidy reimbursements ................................

.......................

3,518 5,423

ERRP proceeds shared with retirees ................................

......................

4,269 -

Plan amendments ................................................................

.......

(26,630) -

Plan participants’ contributions ................................

..........................

15,690 14,315

Actuarial loss ................................................................

..........

8,823 68,126

Benefit payments ................................................................

.......

(70,638) (68,647)

Obligation at Dec. 31 ................................................................

...

$

776,847 $

794,905

Change in Fair Value of Plan Assets:

Fair value of plan assets at Jan. 1................................

.........................

$

432,230 $

384,689

Actual return on plan assets ................................

.............................

535 53,430

Plan participants’ contributions ................................

..........................

15,690 14,315

Employer contributions ................................................................

.

49,018 48,443

Benefit payments ................................................................

.......

(70,638) (68,647)

Fair value of plan assets at Dec. 31 ................................

.......................

$

426,835 $

432,230

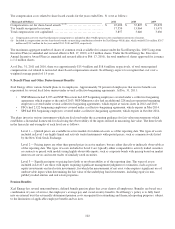

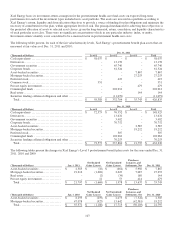

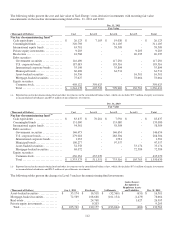

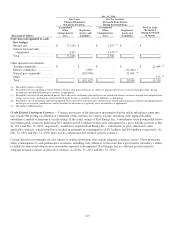

(Thousands of Dollars) 2011 2010

Funded Status of Plans at Dec. 31:

Funded status .........................................................................

$

(350,012) $

(362,675)

Current assets .........................................................................

332 -

Current liabilities ......................................................................

(7,594) (5,392)

Noncurrent liabilities ..................................................................

(342,750) (357,283)

Net postretirement amounts recognized on consolidated balance sheets.....................

$

(350,012) $

(362,675)

Amounts Not Yet Recognized as Components of Net Periodic Benefit Cost:

Net loss...............................................................................

$

246,846 $

221,335

Prior service credit.....................................................................

(50,652) (28,954)

Transition obligation...................................................................

15,147 29,591

Total .................................................................................

$

211,341 $

221,972

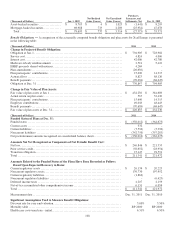

Amounts Related to the Funded Status of the Plans Have Been Recorded as Follows

Based Upon Expected Recovery in Rates:

Current regulatory assets ...............................................................

$

26,139 $

20,225

Noncurrent regulatory assets............................................................

176,730 197,952

Current regulatory liabilities ............................................................

(1,866) -

Noncurrent regulatory liabilities ........................................................

- (6,423)

Deferred income taxes .................................................................

4,207 4,159

Net-of-tax accumulated other comprehensive income .....................................

6,131 6,059

Total .................................................................................

$

211,341 $

221,972

Measurement date .....................................................................

Dec. 31, 2011

Dec. 31, 2010

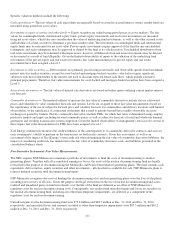

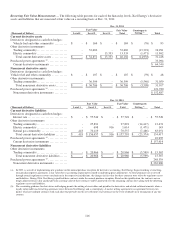

Significant Assumptions Used to Measure Benefit Obligations:

Discount rate for year-end valuation.....................................................

5.00%

5.50%

Mortality table ........................................................................

RP 2000 RP 2000

Health care costs trend rate - initial......................................................

6.31%

6.50%